The Predictive Investor - 2/9/25

Tariff whiplash

Welcome to The Predictive Investor weekly update for February 9th, 2025!

Stocks closed down for the week, mostly driven by uncertainty over U.S. trade and tariff policy.

And yet, there were some big moves in our portfolio including Palantir $PLTR, which broke $100 on the back of a phenomenal earnings call. The stock is now up 441% from our original buy point last March vs. 18% for the S&P over the same time period, proving once again the superiority of a rules-based approach.

Good companies will still be able to thrive regardless of tariffs. Our job is to find them.

Here’s my takeaways from the week.

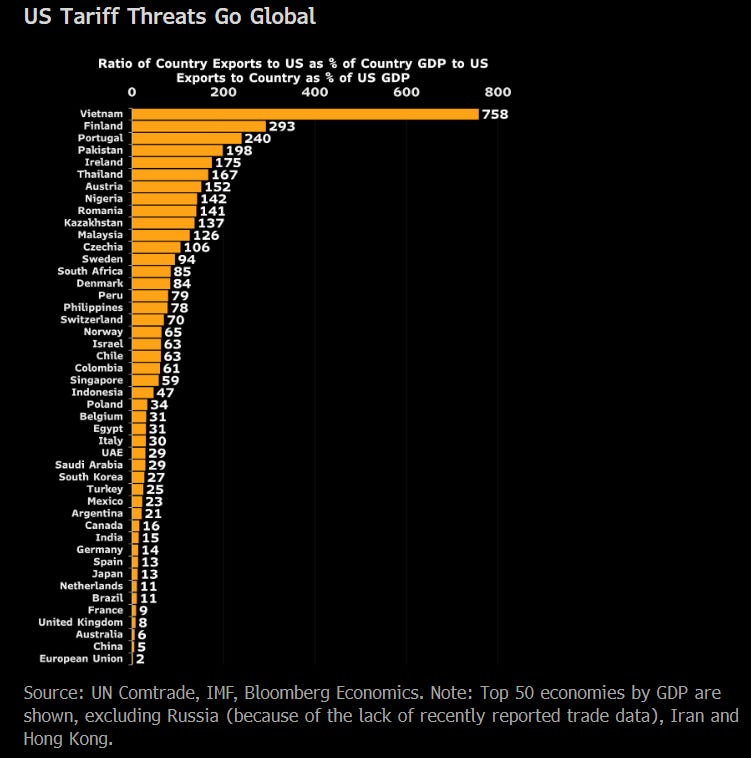

Everyone is vulnerable to tariffs

Most countries are far more dependent on exports to the U.S. than vice versa. Canada and Mexico are 16 and 23 times more dependent respectively on exports to the U.S. than the other way around.

While tariffs on both countries are on pause for now, a 10% tariff on China is in place, which is a far bigger trading partner.

There is still much uncertainty but we learned a few things from the whiplash this week:

The administration seems to favor using tariffs as a negotiating tactic, rather than starting a full blown trade war.

Trade as a percentage of GDP is much higher for other countries than it is for the U.S., which means the incentive is strong to negotiate with the Trump administration.

Tariffs do pose an upside risk to inflation and are a headwind for growth, but the administration’s efforts to reduce regulation and taxes could offset this.

Overall, given how sensitive Trump is to the stock market and economy, I continue to view any volatility around trade policy as a buying opportunity.

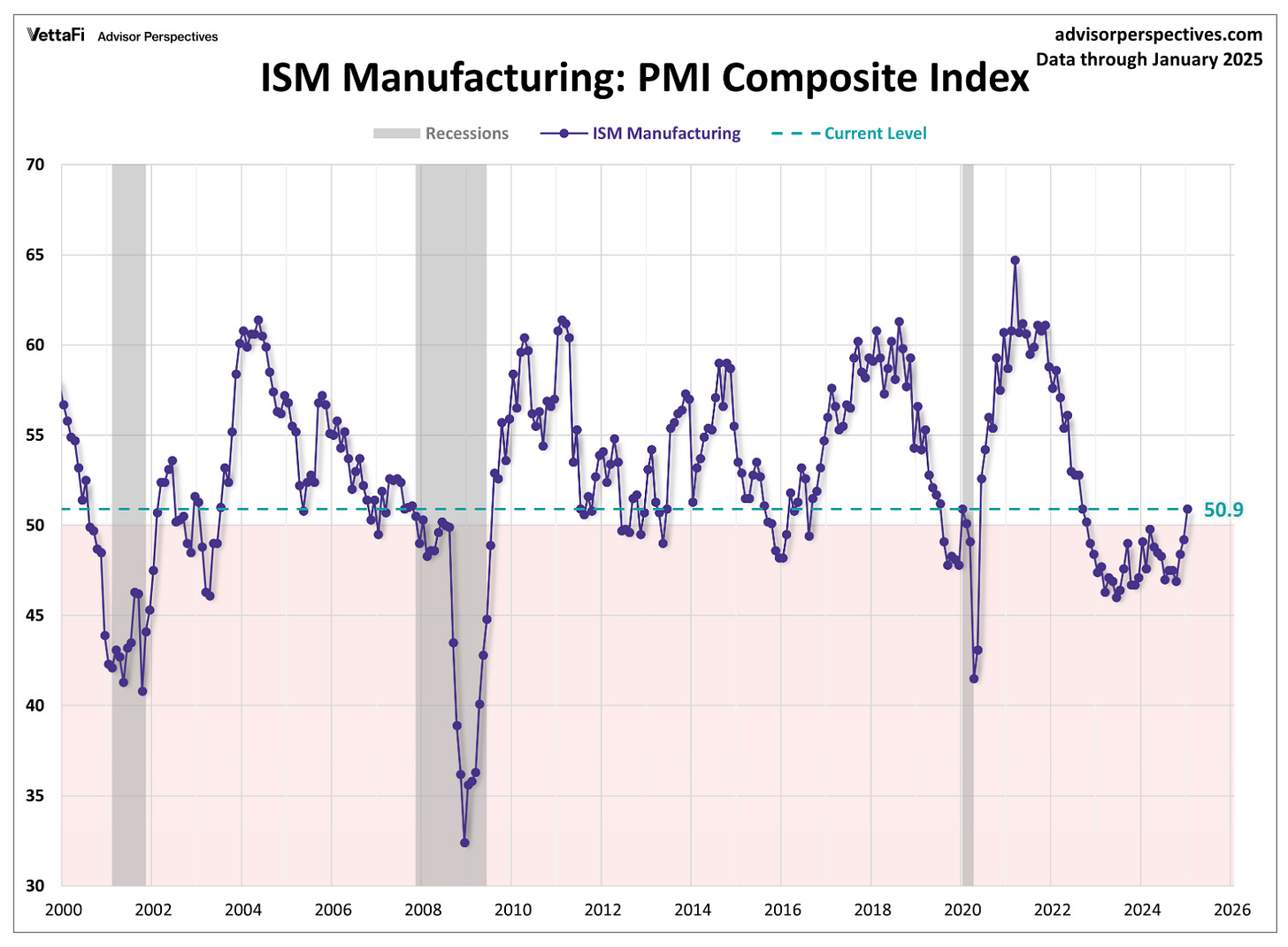

Manufacturing finally expands

U.S. manufacturing activity expanded for the first time since October 2022, with most PMI components growing in January. New orders increased for the third consecutive month, and Production and Employment both rebounded into positive territory.

The current PMI reading is consistent with continued economic expansion in 2025, and should benefit industrial stocks in the months ahead.

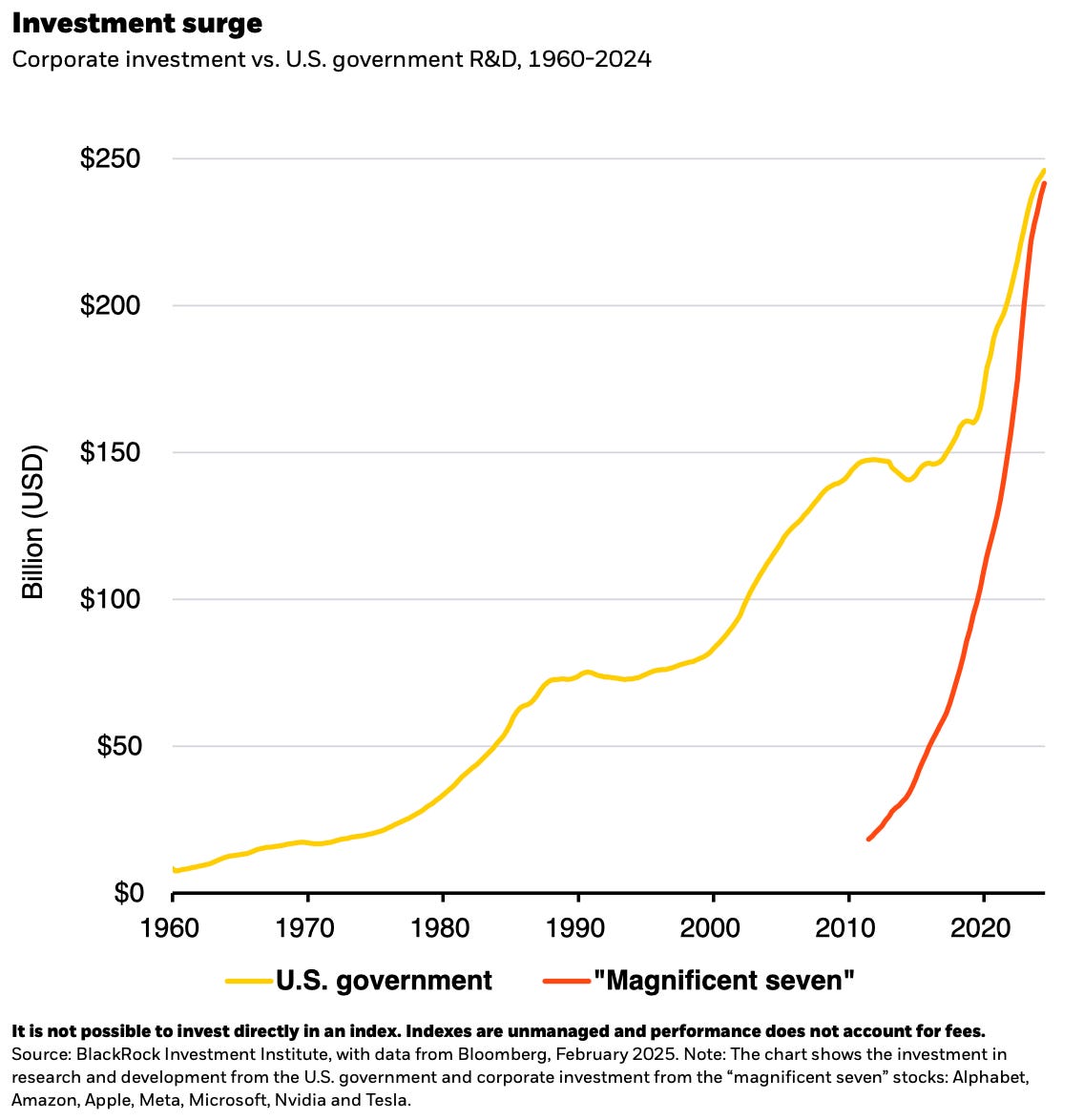

Mag 7 capex surges

Capex for the Mag 7 stocks is now on par with the U.S. government, driven by investment in artificial intelligence.

While the current environment is often compared to the dot com bubble, there are a couple of key differences.

First, valuations today are nowhere near dot com levels, because the Mag 7 are real businesses with growing revenue and earnings.

Second, the Mag 7 are nothing like the telecom companies of the 1990s, which used debt to build fiber optic networks to handle the growth of the internet, and then imploded because they ran out of money before capacity could be fully utilized. The Mag 7 all have very profitable core businesses, and have the capital to sustain AI investment through widespread adoption.

Only 6% of companies are using AI in production. We’re still in the very early innings of adoption and growth.

DOGE spending cuts

The Department of Government Efficiency (DOGE) announced that they’ve cut $1 billion per day of government spending. (Read)

This is against a more immediate goal of cutting $3 billion per day. While we don’t have a detailed breakdown of the spending cuts, if this trend continues the deficit will move significantly lower.

Government spending contributes to GDP, so the implications really depend on whether the private sector can compensate for this decrease in investment. But given that the country’s fiscal situation remains the biggest long term economic risk, more accountability is a good thing.

The spending cuts needed to bring the debt-to-GDP ratio under control will be painful no matter what. The key is balancing fiscal sustainability against disruption of essential services.

Labor market remains strong (for now)

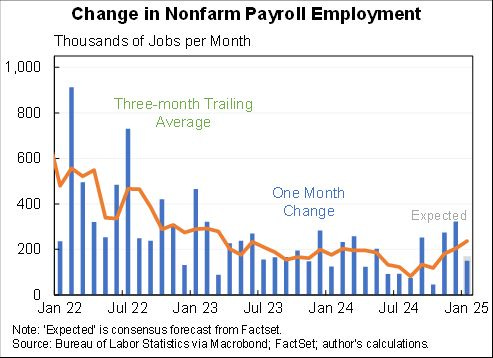

Job growth in January came in below expectations, but upward revisions to prior months pushed the three-month average to 241k. The unemployment rate dropped to 4%, far below the long term average of 5.7%.

Rising wages continue to outpace inflation, which should drive consumption in the months ahead.

However, more than 7.5 million people work in jobs connected to the federal government. We will need to keep a close eye on how spending cuts affect the labor market.

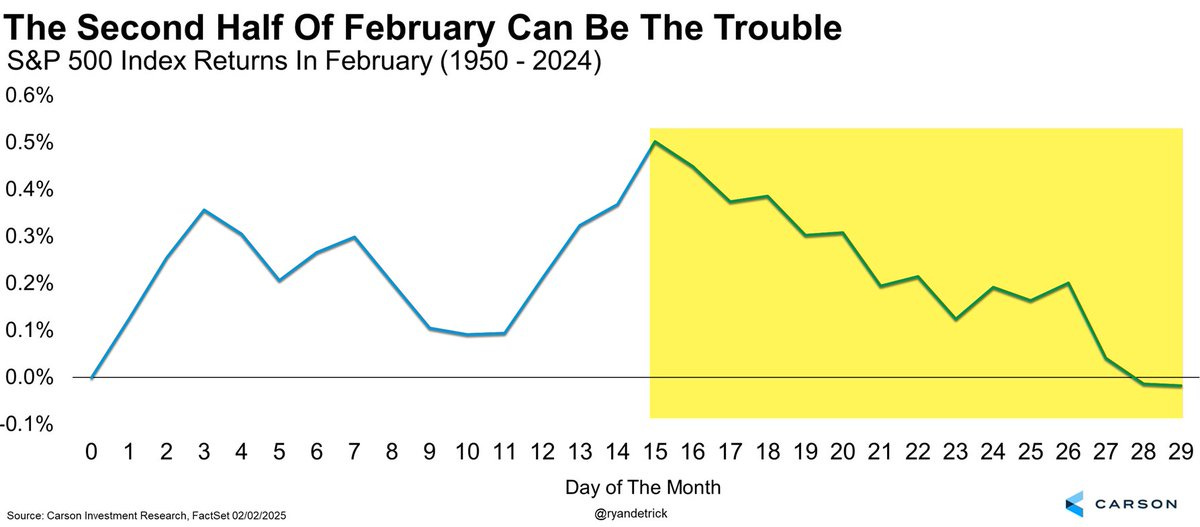

February seasonality

The S&P 500 has been bumping up against resistance at 6,100 as we enter a time period that has been historically weak for stocks.

Last year’s market activity did not fit the seasonality trends that well, as pullbacks were fast and short. If you missed out on any of our stocks, you might get another chance later this month. So get your buy list ready now!