The S&P hit 6000. Should you be worried?

The Predictive Investor - 6/8/25

The S&P 500 closed at 6000, and that means we should be worried. At least according to Barron’s, which ran a headline advising buyers to beware.

It’s a natural reaction. There’s plenty of overhead resistance between 6000 and 6100.

But under the surface there are signs this rally has room to run, precisely because skepticism remains high.

Here’s what we’re watching, and why it matters.

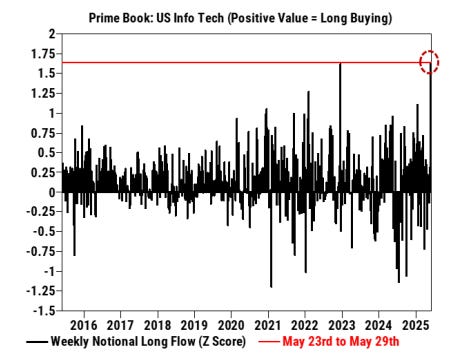

Hedge funds play catch-up

Institutional investors are repositioning their portfolios just as we said they would.

Goldman Sachs' Prime Brokerage data shows that hedge funds long buying in tech hit its highest level in over a decade at the end of last month. That's a massive reversal from the defensive positioning we saw earlier in the year.

Big money is moving fast back into stocks. Whether it’s AI optimism, resilient earnings, or a desire to chase performance, the institutional herd just turned bullish on innovation again.

This sharp move could drive short-term volatility, but history suggests these surges often signal the early phases of a sustained rotation rather than the top.

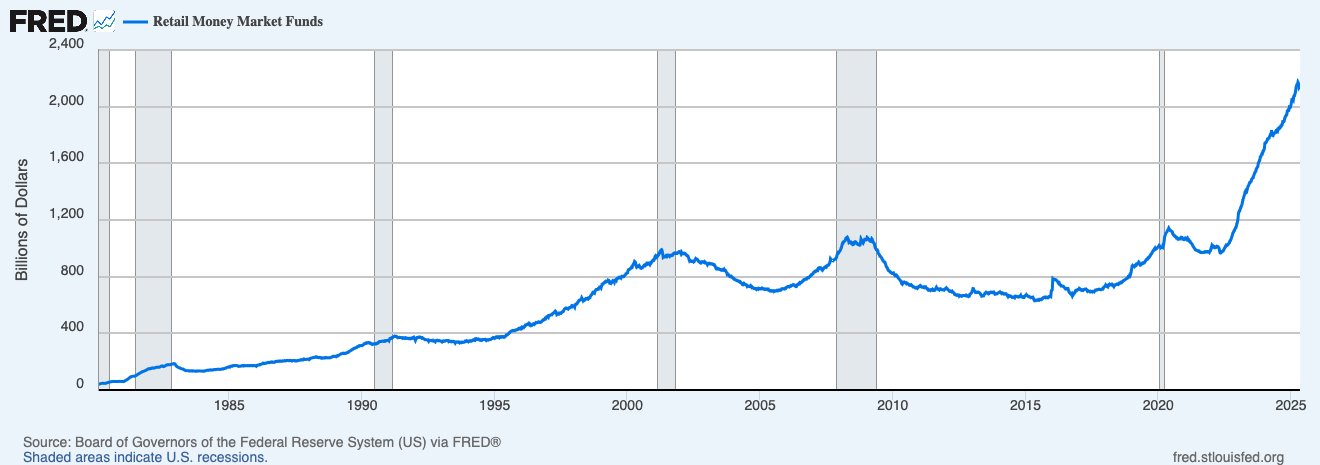

Retail investors sitting on record cash

There's over $2 trillion sitting in retail money market funds. The obvious takeaway is that there’s a lot of potential buying power waiting for "confirmation" that it's safe to re-enter risk assets.

But more importantly, high money market balances suggest that investors aren’t overconfident. If we were really in a bubble, more of this cash would already be deployed into speculative assets. Just think back to 2021, when SPACs, crypto, and high-growth tech absorbed a lot of liquidity, much of it from investors taking on more risk, not less.

There's still a deep layer of skepticism and fear beneath the surface rally. Classic “wall of worry” behavior, and an indicator that we’re not in a FOMO (fear of missing out) rally.

This is a market of reluctant believers. When sentiment shifts from caution to confidence, that money may rotate very fast into risk assets. Best to be positioned before that happens.

Labor market cool, not cracking

The economy added 139,000 jobs in May, slightly above expectations yet still below the 12-month average of 149,000. The unemployment rate held steady at 4.2%, which is low by historical standards. (Read)

The report continues to support the thesis that the labor market is cooling but still resilient. Job gains are slow but steady. Wage growth is decelerating but still outpacing inflation. And participation isn’t collapsing.

Combined with recent BofA data showing most investors missed the rally in stocks, the labor market backdrop reinforces a contrarian but compelling case: this rally still has legs, and skepticism may be the strongest tailwind of all.

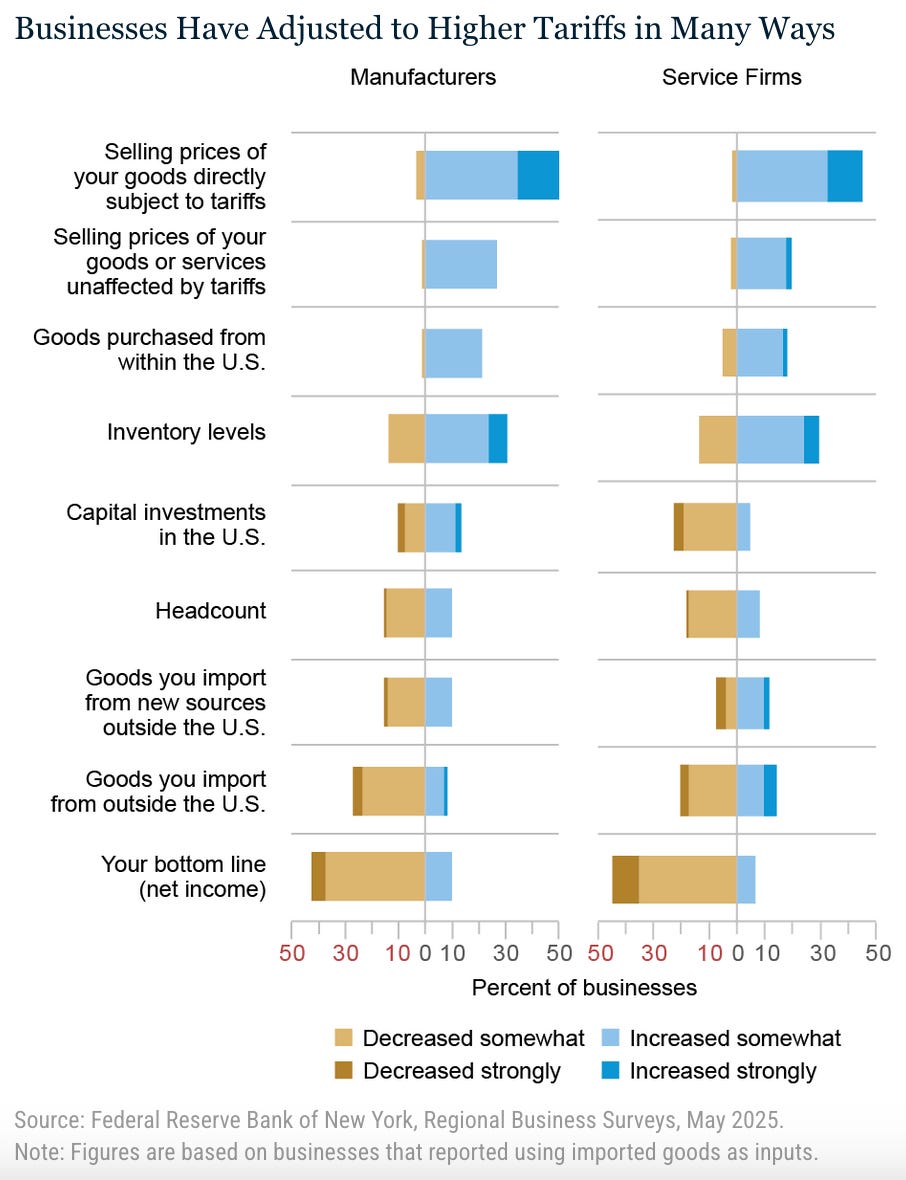

Businesses adjust to tariffs

Businesses are responding to tariffs in various ways, just as we said they would.

Both manufacturers and service firms are increasing prices on tariff-affected goods. Many firms are adjusting supply chains, sourcing more from the U.S. or switching to alternative foreign suppliers. Bottom lines are under pressure, and will remain so until this gets resolved.

The key here is resilience. Capital investment and headcount haven't cratered, which suggests companies are positioning themselves for the long term, not just hunkering down.

We're in a moment of cautious optimism. Retail investors have a lot of dry powder, institutions are getting more aggressive, and businesses are adapting to policy risk. This is a classic late-cycle environment, but with healthy fundamentals and sentiment that still has room to run.

If you're following a rules-based strategy, this is exactly the kind of noisy, emotionally charged environment where staying disciplined gives you an edge.

And if you’re not yet a predictive investor, consider upgrading to paid.