Trump Tariff Plan 2025: Key details, reactions, and impact

The Predictive Investor - 4/6/25

Welcome to The Predictive Investor weekly update for April 6th, 2025!

Needless to say the Trump tariff plan was far more aggressive than expected. Yet with one shocking announcement, President Trump managed to achieve multiple policy goals in real time.

The yield on the 10 Year Treasury dropped, which will lower costs to refinance government debt and reduce mortgage rates.

The US dollar sold off against other currencies. The price of oil dropped nearly 10% last week, which will put downward pressure on inflation.

And the Fed is under increased pressure to lower rates, while congressional Republicans are under pressure to deliver tax cuts and deregulation.

However, I’m generally not a fan of tariffs, and neither is the market. While it’s hard for anyone to watch the value of their portfolio nosedive, it’s incredibly important not to overreact.

Times like this are the reason we have a rules-based strategy. Our strategy is based on trends in both momentum and earnings, and my plan is to let the dust settle before making any decisions.

The silver lining here is even after this decline our portfolio is still up 46% vs. 17% for the S&P 500 over the same time period.

Here’s my takeaways from the week.

What we know about the Trump tariff plan

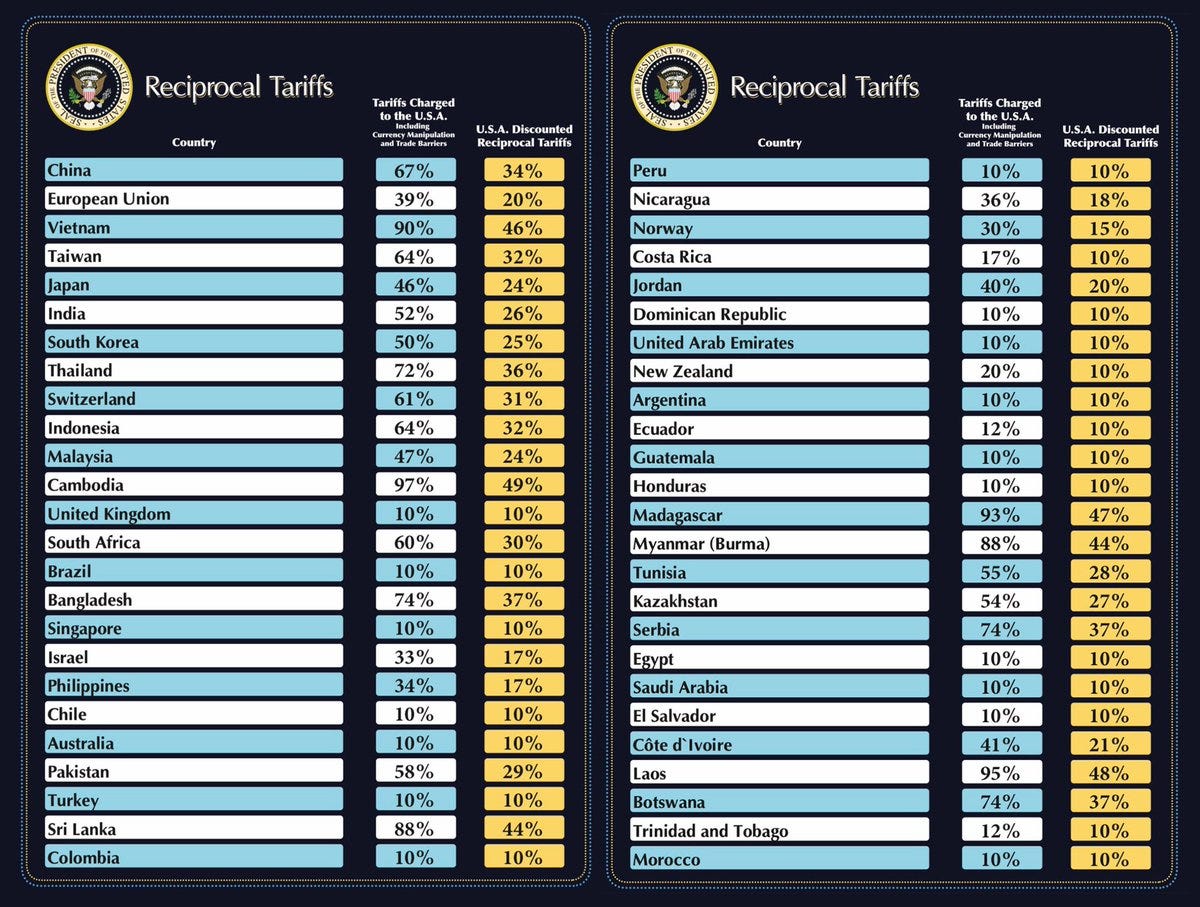

In addition to the previously announced auto and steel/aluminum tariffs, Trump is implementing a 10% baseline tariff on all imported goods worldwide, effective April 5th.

He also announced reciprocal tariffs ranging from 10% to 48%, effective April 9th. These are based on each country’s trade deficit with the United States.

The market had priced in baseline tariffs. The reciprocal tariffs are insane, and far more aggressive than most market participants, including myself, expected.

They were intentionally designed to cause panic, and if they go through as announced, they will no doubt lead to a recession.

Trump has a long history of advocating for tariffs, and therefore I believe the baseline tariffs are here to stay. That said, I think the delay in implementing the reciprocal tariffs is designed to bring people to the negotiating table.

Dozens of countries are already engaging with the White House. There will likely be retaliatory announcements next week, lawsuits seeking to block the tariffs, and deals made with certain companies and/or countries.

Unfortunately, an uncertain situation is now even more uncertain. Over the long term the market will be fine - it has been through far worse before. Over the short term, expect more volatility to the upside and downside.

China escalates - does it matter?

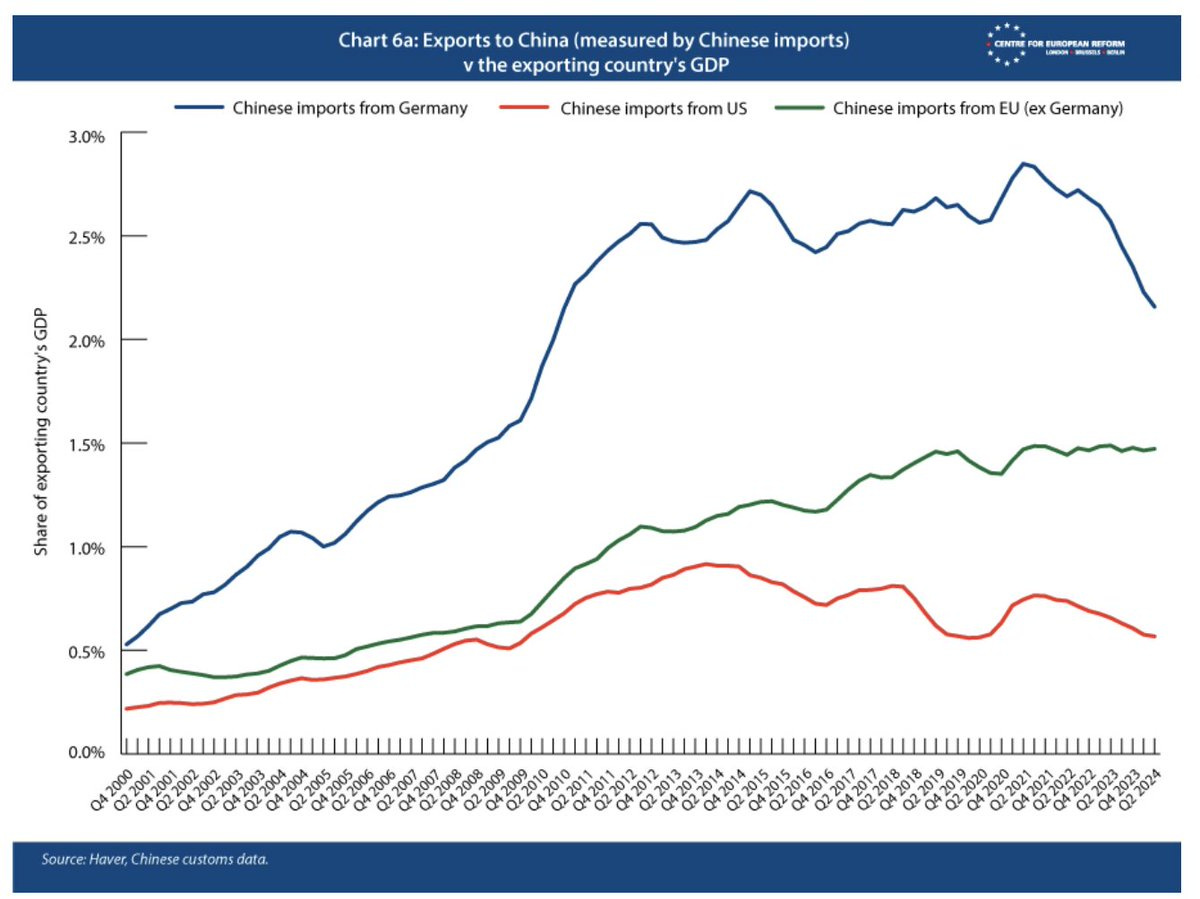

China retaliated against the Trump tariff plan with a 34% tariff on US goods as well export controls on rare earth minerals.

This news accelerated the selloff. But a prolonged trade war would deliver a far bigger blow to China than than the U.S.

China’s imports of US goods have been on a downtrend for 10 years, and represent a very small portion of both country’s GDP.

The bigger impact will come from any potential retaliation by Canada and the EU.

China has engaged in unfair trading practices for a very long time. I suspect the blanket tariff approach by the Trump administration was designed to force countries to negotiate deals that will isolate China.

Will it work? No one knows. It’s a huge gamble, and anyone who tells you they’re certain about how this all plays out is lying.

VIX finally aligns with sentiment

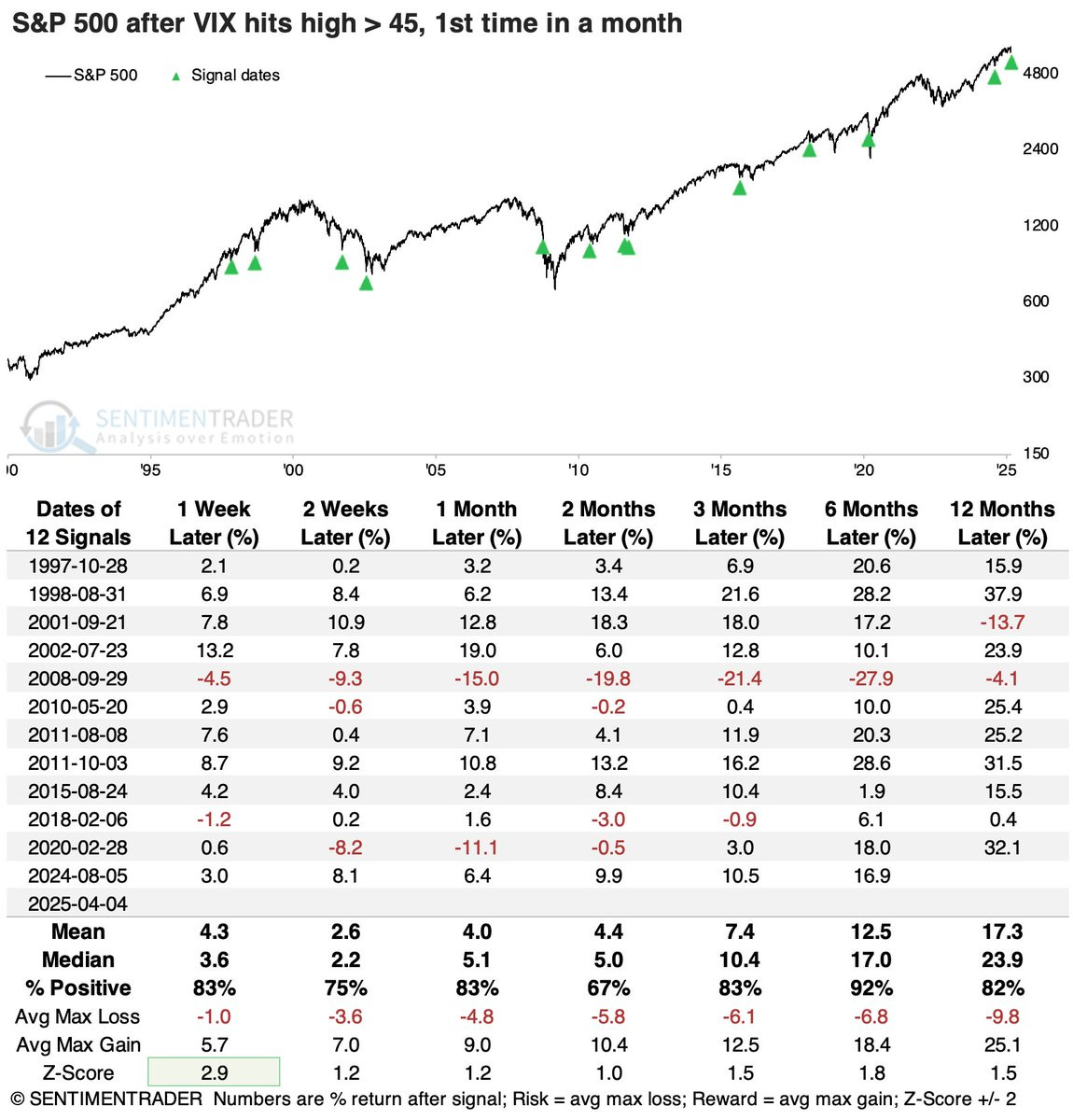

After weeks of extreme bearish sentiment with relatively low volatility, market indicators are now catching up.

The VIX jumped to levels seen during prior market panics. SentimenTrader analyzed forward returns for the S&P 500 after the VIX closed above 45. In most time periods, the index was higher.

Therefore I’m expecting a rebound rally over the next couple of weeks. But it’s important to realize none of these previous panics coincided with an attempt to reorder the global economy.

I don’t believe a V-shaped recovery is in the cards, unless there’s a complete reversal of these tariffs.

If you can’t stomach the volatility, use these snapback rallies as an opportunity to adjust your equity allocation.

Downside targets for the S&P 500

Over the last few weeks I’ve maintained that the S&P 500 will remain in correction until a decisive close above the 2/19 AVWAP (blue line on chart below). Last week I said that the index needs to hold the 10/27/23 AVWAP (red line) or we’ll be in for a more prolonged correction.

I thought the index would start to consolidate around the 10/27 AVWAP, but last week it blew past that line.

It’s important to realize that much of this selling is forced. Many hedge funds are leveraged, and got caught on the wrong side of recent events. They need to sell to meet margin calls. At some point the forced selling will subside, and those who are short will cover to lock in profits.

The next area of interest is 4,800 which coincides with the 2022 top. After that would be the 200-week moving average (currently at 4,674), which has been an area of support multiples times over the last 5 years.

I don’t expect to catch the exact bottom, and therefore for those looking to capitalize on the volatility I’d recommend adding to my holdings slowly going forward until we get more clarity on the policy front.