U.S. growth keeps surprising

Economic momentum is running hotter than nearly anyone expected.

What if the economy isn’t slowing at all, but quietly accelerating while everyone worries about a recession?

That’s the story the latest data are telling. Over the past week, U.S. economic reports have consistently topped expectations, challenging the popular “slowdown” narrative. Second-quarter GDP was revised higher on robust consumer spending, and August personal income and spending both beat forecasts.

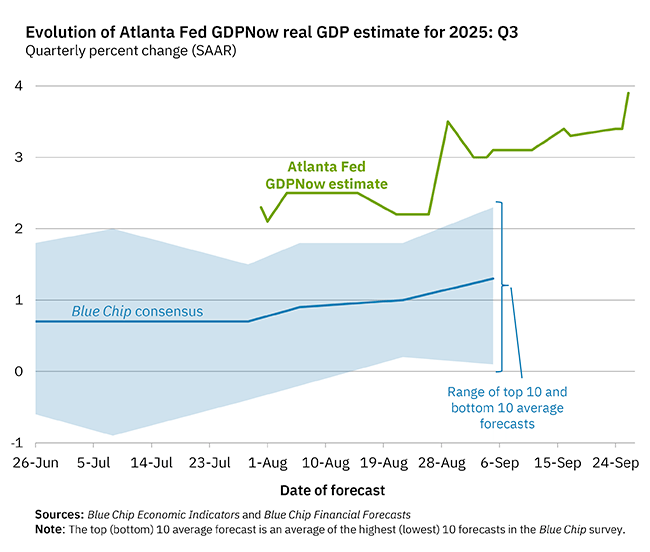

The Atlanta Fed’s GDPNow estimate now calls for 3.9% growth in Q3, up from 3.3% just a week ago and well above the long-term U.S. trend of ~1.5–2.0%. Consumption, which drives roughly 70% of the economy, also accelerated to 3.4%, from 2.7%.

Despite constant chatter about a weakening labor market and a looming recession, the real economy is powering ahead. Don’t let gloomy headlines distract you from the underlying strength.

Macro Focus

Silver’s breakout

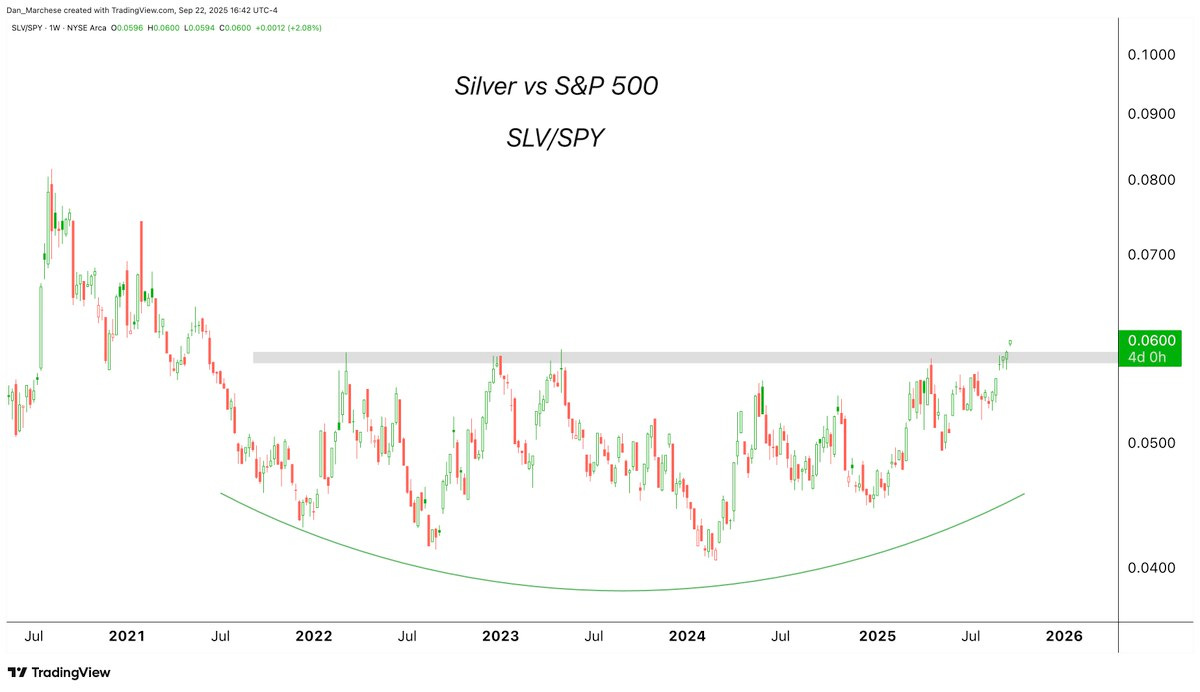

After three-and-a-half years of sideways action, silver has broken out relative to the S&P 500.

Central to the bullish thesis on silver are two trends we’ve been talking about for some time:

Monetary debasement. With global debt high and central banks comfortable with above-trend inflation, hard assets are set to benefit.

Industrial demand. Silver is essential for solar panels, electronics, and electrification, all key to U.S. industrial reshoring.

For direct exposure, the iShares Silver Trust ETF SLV 0.00%↑ offers simple, liquid access. I’m also researching silver mining companies, and will share new ideas with paid members soon.

Labor market stabilizes

Initial jobless claims fell sharply last week, reversing the early-September spike that spooked markets. The October 3rd non-farm payrolls report will be the next big test.

Overall my take here is that the market is starting to decouple from employment data.

Economists who rely on jobs as a recession gauge may be missing a structural shift. AI-driven productivity is driving economic growth even with slower hiring, making traditional labor signals less reliable.

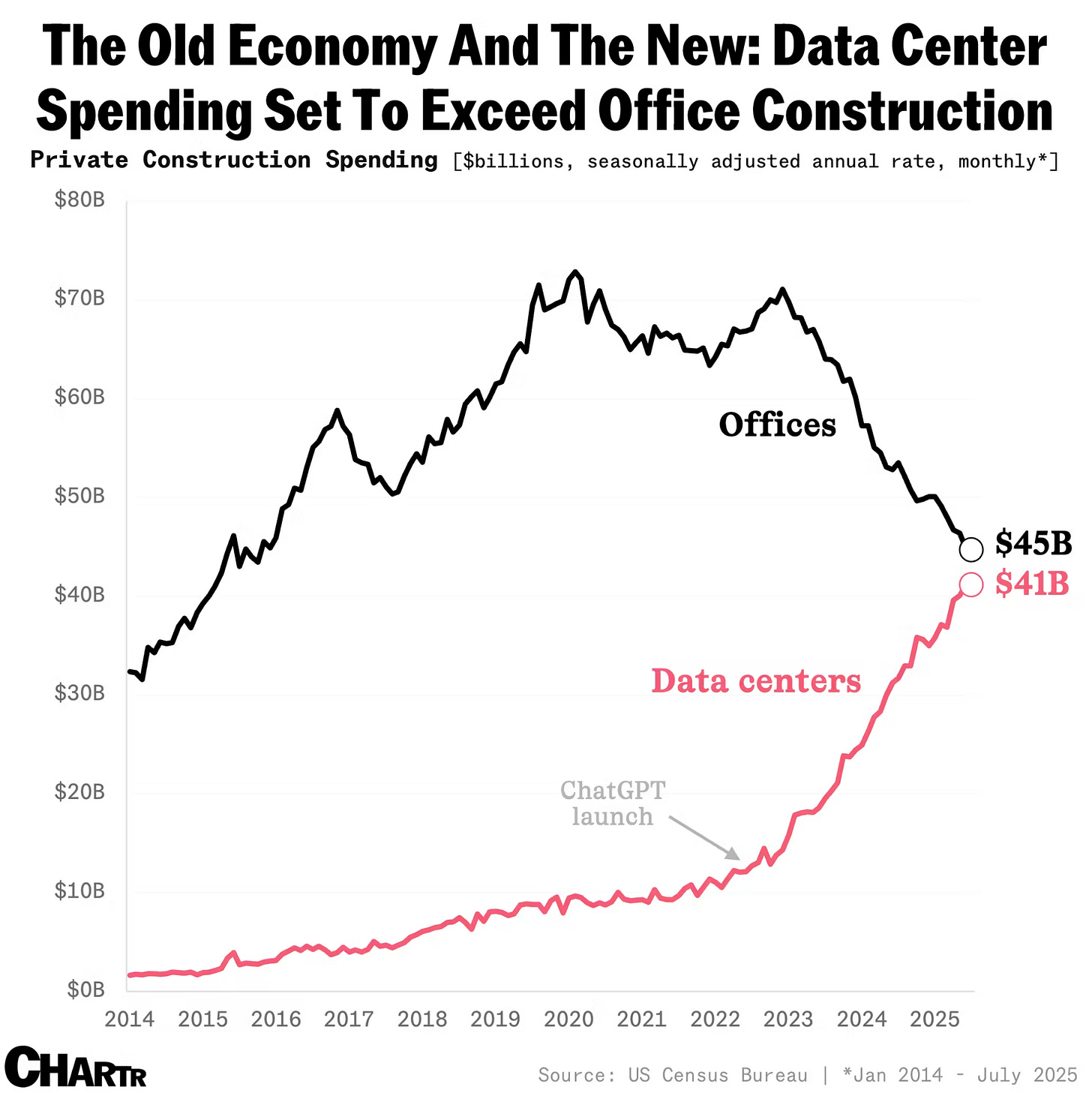

Data center spend to outpace construction

U.S. data-center construction spending (annualized $41 B) is on pace to overtake private-office construction for the first time.

While many have been quick to call this a bubble, AI capex only represents 2-3% of all U.S. capex spend. And these buildouts are driven by mega cap tech companies with immense cash flow.

If this is an AI “bubble,” we’re nowhere near the top. Capex is still ramping, not peaking.

Portfolio Pulse

Kratos KTOS 0.00%↑

Kratos continues to deepen its traction in unmanned systems and hypersonics. The mix of deal flow and defense fundamentals is reshaping sentiment and giving us fresh reasons to lean in.

Kratos landed a five-year exclusive U.S. manufacturing agreement with Elroy Air to produce the Chaparral VTOL cargo drone out of its U.S. facilities.

The Chaparral is a hybrid-electric vertical takeoff and landing (VTOL) drone with a payload of ~300 lbs over ~300 miles. Kratos will handle preproduction in Sacramento before scaling to higher-rate production.

This deal is dual-use by design, targeting both military resupply/logistics needs and commercial middle-mile delivery markets.

Importantly, Kratos already expanded its manufacturing footprint to support next-gen drone production, which gives them a head start in converting this agreement into real production.

The Chaparral manufacturing deal is more than another product line, it’s a scale lever for Kratos. It diversifies revenue streams into autonomous logistics, strengthens Kratos’ role as a manufacturing partner in unmanned systems, and gives tangible near-term optionality beyond just military contracts.

That said, the revenue impact from Chaparral will not be immediate (first units ship in 2026) and execution remains critical. Also, margin pressure from new lines and capital investment will need to be managed carefully. But this week’s announcement shows the setup is now for scale, not just innovation.

SoFi SOFI 0.00%↑

SoFi quietly added a new edge to its “everything app” narrative: a deeper push into alternative investments through a partnership that closes the loop on capital markets access. This is consistent with SoFi’s ambition to own more of the financial stack.

The company announced a collaboration with Templum and Marketplace Partners to integrate top-tier alternative investments (e.g. funds, strategies typically reserved for institutions) into SoFi’s invest ecosystem. The deal enables SoFi users to access alternative assets within SoFi’s interface.

This move not only enriches SoFi’s product mix (beyond stocks, ETFs, crypto) but also raises user stickiness and deepens monetization: high-net-worth users may now see SoFi as a one-stop alternative access point.

Strategically, this is a bridge between retail and institutional investing. SoFi wants to be the on-ramp to more sophisticated assets for its digital-first audience.

Adding alt-investment access can increase the average revenue per user (ARPU) without necessitating a new acquisition engine. Many fintechs provide access to public markets, but few (if any) integrate alternative strategies seamlessly into the same app experience.

As members deepen portfolio complexity within SoFi, the app becomes sticky: users who hold core cash, lending, investing, and alternatives in one place are less likely to migrate.

This also represents a stepping stone toward higher-asset-class offerings: SoFi might later provide white-label closed-end funds, managed alternative strategies, or in-house alternatives.

SoFi continues evolving from digital bank to full-spectrum wealth & capital platform. The Templum partnership cements that trajectory by layering in alternative strategies, territory typically reserved for institutional or high-net-worth clients. As SoFi continues to steal share in lending, deposits, and crypto, this product addition scales monetization and reinforces user lock-in.

Palantir PLTR 0.00%↑

Palantir added two marquee defense wins to its narrative: a massive U.K. military AI contract and a strategic AI partnership with Boeing Defense. These deals validate the company’s positioning as a central AI infrastructure provider to sovereigns and aerospace primes.

The company secured a military AI contract from the U.K. government worth £750 million (over multiple years) to deliver AI infrastructure, mission systems, and data integration capabilities. This deal marks one of Palantir’s largest non-U.S. defense contracts to date, reinforcing its credibility among allied governments.

It also tightens Palantir’s foothold in Europe, which has been a longer-term focus and often seen as a lagging geography for its commercial AI efforts.

The company also announced a partnership with Boeing to adopt Palantir’s AI/ML and operational software tools across Boeing’s defense systems, platforms, and data operations.

The collaboration is set to include joint work on digital twins, AI-driven analytics, predictive maintenance, and mission planning workflows.

Boeing’s scale and embedded defense relationships offer Palantir a pathway into deep systems integration in aerospace, and potentially a channel to embed AI inside Boeing’s portfolio of military platforms (satellites, aircraft, ISR systems).

This partnership also signals confidence from one of the largest defense OEMs in Palantir’s platform and execution capabilities.

Final thought

If you’ve been following the latest political news, near term risks include a possible U.S. government shutdown on Oct 1. While this has the potential to rattle markets, historically shutdowns have short-lived economic impact.

Our job is to focus on owning businesses positioned to thrive despite the chaos. From the seemingly relentless AI infrastructure boom to the global defense buildout, the signals remain clear: focus on the fundamentals, stay diversified, and keep capital in assets that can outgrow the uncertainty.