U.S. strikes Iran: what this means for investors

Why disciplined investors shouldn’t flinch, and how to turn volatility into opportunity.

By now you’re likely well aware that the U.S. launched strikes on Iranian nuclear facilities, an escalation that sent headlines into overdrive and markets bracing for potential fallout.

There’s plenty of analysis out there, but if you’re reading this you likely want to know what it means for your investments.

Here’s the bottom line:

Volatility is a given: that’s a gift for traders. but now is not the time to suddenly try your hand at trading if that’s not your edge.

Stick to your plan: investors will be best served by staying disciplined with dollar-cost averaging. Have your buy list ready, especially for stocks you missed on the way up. If markets wobble, you want to act on your terms, not out of fear. Pre-plan the price levels where you’ll deploy extra cash.

No one knows what’s next: anyone who claims to know how this plays out is lying. The latest reports suggest Iran may attempt to close the Strait of Hormuz, a chokepoint for nearly 20% of global oil flows. But markets (including Gulf exchanges) aren’t in freefall. In fact, many regional markets closed in the green. The uncertainty over whether the U.S. would strike is now behind us, removing one major source of risk.

In short, there is certainly a risk the situation gets worse before it gets better. But the key to turning these kinds of situations into an opportunity isn’t guessing the future, it’s having a plan that’s ready for whatever the market does next.

US interest payments a growing burden

Whenever global risks spike, treasuries rally as investors seek out safe havens. We may see the same thing this time around, driving yields lower.

But US interest payments are now nearly 20% of tax revenue, far above the global average. This reflects the fact that the government has to issue more and more debt just to cover interest, creating long-term risks that didn’t exist at past moments of geopolitical stress.

It’s true that markets have shrugged off the rising debt for years. But more recently we’ve started to see a shift in confidence, which suggests long term treasuries may no longer be the unquestioned safe haven many assume.

Betting heavily on long term treasuries overlooks the rising risk that inflation, debt monetization, or loss of fiscal credibility erode the real value of those bonds. We continue to favor short term treasuries and floating rate notes over long term bonds.

P/E multiples: rethinking what’s “expensive”

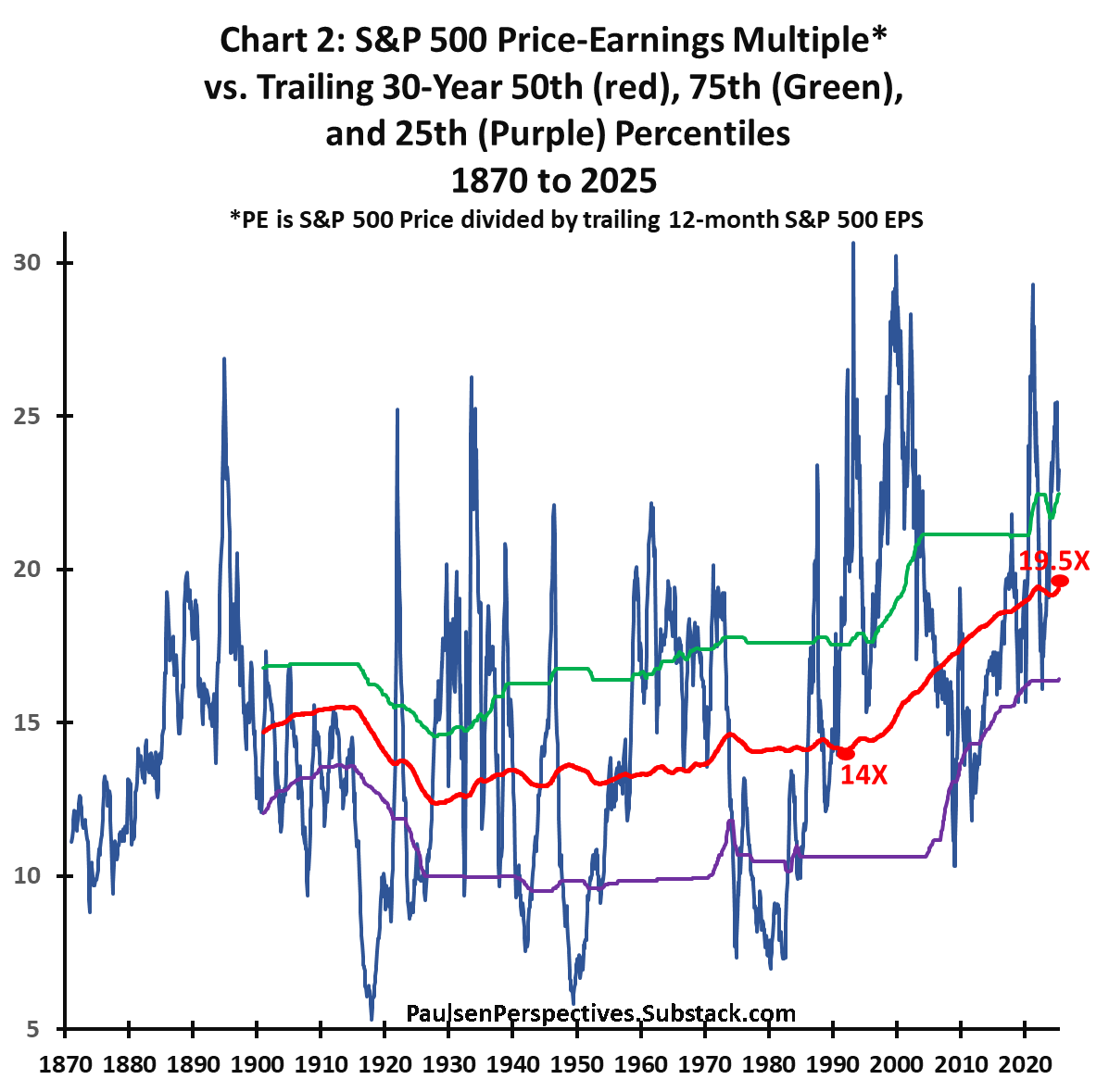

An interesting chart from Jim Paulsen, that reflects what we’ve been saying for a long time.

The S&P 500’s price-to-earnings (P/E) multiple has evolved over the past 150+ years. For most of history (1870 to about 1990) the average P/E ratio hovered around 14X earnings (the red line). But since 1990, that average has climbed significantly, rising to about 19.5X. This represents a 40% upward shift in what the market has considered “normal” valuation.

So, today’s S&P 500 P/E of ~23.5 might look elevated at first glance. But when adjusted for this post-1990 valuation drift, it equates to a historically reasonable 16.7X on a like-for-like basis.

Stronger corporate profitability justifies higher multiples. Today’s valuations aren’t cheap, but they’re not bubble-level either. Adjusted for the higher regime since 1990, the market looks closer to fair value than alarmists might suggest.

May retail sales drop

May retail sales dropped 0.9%, the sharpest monthly decline in four months. (Read)

The drop was driven by a steep pullback in auto purchases (–3.5%), lower gasoline demand (–2%), and declining home-improvement sales, following a tariff-driven sprint earlier in the spring.

Though total sales fell, core retail sales, which exclude autos, gas, building materials, and dining, actually rose 0.4%. This suggests that beneath the big-ticket volatility, everyday consumer spending remains steady.

The overall decline reflects the fact that consumers pulled forward consumption to beat tariffs, and is not a signal of broader consumer retrenchment.

For markets, it's a reminder that headline swings don’t always forecast economic trends, especially amid policy reshuffling. The key takeaway? Core spending matters more than headline shocks.