Volatility Is Rising. So Are Opportunities.

Rate cuts, AI fears, and a rally in value stocks. Here’s what really matters and how to position for it.

It was a volatile week. Tech stocks sold off as media headlines warned of an “AI bubble.” Then on Friday, the market flipped, staging a powerful rally led by value and cyclical sectors after the Fed signaled rate cuts are on the horizon.

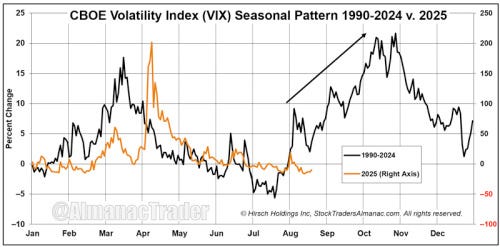

While the media is frantically trying to find a cause for every upswing and downswing, it’s important to realize this kind of back-and-forth is normal. Historically, the VIX tends to hit a seasonal low in July, only to rise through the fall with a peak around October. We’ve been calling this out for weeks.

For long-term investors, the key isn’t avoiding volatility, it’s using it to your advantage. Dollar cost averaging remains one of the best ways individual investors can take advantage of a choppy market. The goal isn’t to avoid discomfort, it’s to stay the course through it, letting volatility work in your favor by accumulating shares at lower prices during pullbacks.

Breadth improves even as sentiment sours

Despite pervasive negative sentiment, the internal strength of the market is improving. This remains one of the most hated bull markets in recent memory, and that’s a bullish sign.

The % of S&P 500 stocks above their 20-day moving average just broke above its downtrend line, while the % of S&P 500 stocks above their 200-day moving average hit a new YTD high.

This kind of underlying strength tends to precede further upside.

Investors have a fundamental reason to be bullish

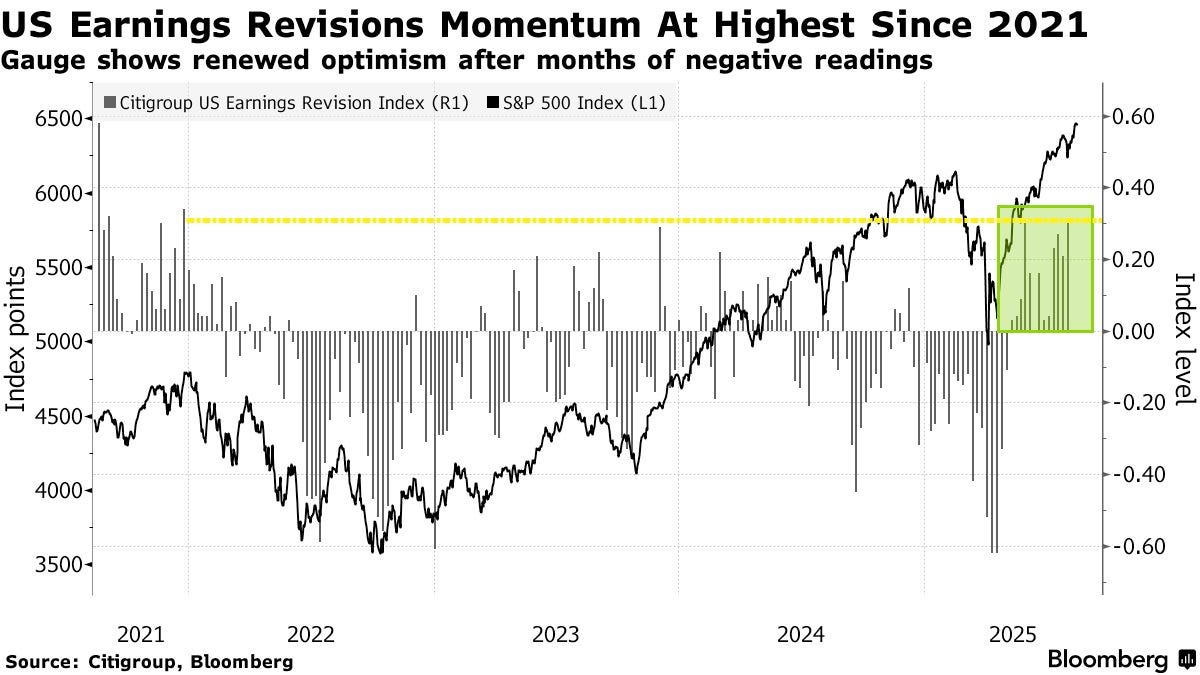

While the pundits are parsing every Fed comment for clues, earnings are telling the real story. Upward earnings revisions are accelerating at the fastest pace in four years.

This matters more than rate cut timelines or headline fears. In the long run, stocks follow earnings. And the earnings trend is bullish.

Our rules-based strategy is designed to keep us invested in companies growing earnings faster than the broader market, and our portfolio is positioned well to lead the next leg higher.

A contrarian bull signal in small caps

Futures positioning in small caps by hedge funds is now more negative than it was at the bear market lows in 2022.

Let that sink in.

When positioning gets this extreme, it often marks a turning point. Add in the likelihood of rate cuts, which historically provide greater benefit to smaller, rate-sensitive companies, and this looks like an opportunity.

Trade idea: consider increasing exposure to small-cap value via the Vanguard S&P Small-Cap 600 Value ETF VIOV 0.00%↑. In small caps, quality matters, and this ETF is a low cost way to capture overall U.S. small-cap value stock returns.

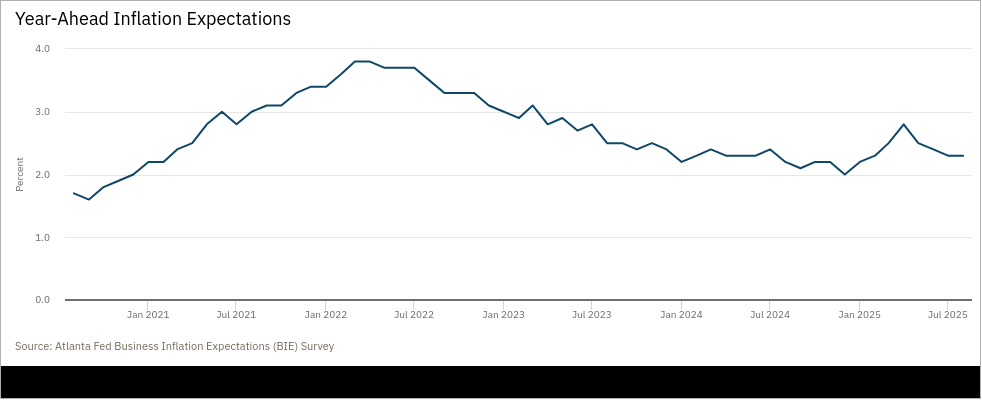

Inflation expectations are falling

According to the Atlanta Fed, firms’ inflation expectations for the year ahead have been trending lower since April. That’s significant, because it indicates tariff policy is not as inflationary as initially feared.

Retail earnings this week reinforced this. Walmart noted it absorbed higher costs on many lower-ticket items, while raising prices selectively on higher-margin goods. The company expects costs to continue rising modestly as inventories adjust to new tariff levels, but not in an overly disruptive way.

This aligns with what we’ve said all along: companies have adapted to shifting policies and pricing pressures. The consumer remains resilient, and that’s good for corporate earnings and the broader economy.

Final thought

Markets are noisy right now. But beneath the headlines, fundamentals are strong and breadth is improving. Stick to your rules, stay invested, and remember: volatility is the price of admission for long-term gains. Don’t let it shake you off course.