📉 Weak Jobs, Strong Earnings – What's the Market Really Telling Us?

Markets digest mixed signals, but earnings and AI spending are proving more important than economic noise.

This week brought conflicting signals for investors. The jobs data was weak, and revisions to past payroll numbers revealed significant overstatements. At the same time, there was some movement on tariff policy, removing a layer of uncertainty that’s lingered since early 2025.

But here’s what matters most right now: Earnings season is off to a strong start.

According to FactSet, 66% of S&P 500 companies have reported, and 82% of them have delivered positive EPS surprises.

In short, despite the headlines, businesses are performing well.

Let’s dive in.

Jobs data revisions more than a blip

The latest jobs report was pretty ugly. Job growth totaled 73k for July (below the estimated 100k), with May and June numbers revised downward by 258k from previously announced levels.

The job market isn’t as strong as many economists believed, which is no surprise to anyone who’s currently job hunting.

But here’s the bigger issue: the Fed is now stuck between its two mandates.

On one hand, price stability is still a concern, with companies raising prices in response to tariffs.

On the other hand, the labor market is showing cracks, and unemployment could rise further if the Fed keeps rates too high for too long.

This puts the Fed in a tough spot. Cut too soon, and inflation could rebound. Cut too late, and the economy risks tipping into a deeper slowdown.

The jobs report raises the probability of a rate cut at the next FOMC meeting. Either way, from an investing standpoint I like to stay macro aware, but micro focused.

It makes no sense to obsess over things we can’t control. Our edge comes from focusing on what we can control, like investing in companies that are structurally positioned to grow regardless of the macro backdrop.

Which is exactly what we’re doing.

Palantir’s $10 billion army deal

One of those companies? Palantir. PLTR 0.00%↑

The U.S. Army just awarded Palantir a $10 billion battlefield software contract, the largest in the company’s history. (Read)

This confirms our thesis when we added it to the portfolio at $25: Palantir is becoming mission-critical infrastructure for the future of defense and intelligence.

If you missed the stock at lower levels, it’s not too late. Wall Street is just now catching on to the opportunity ahead. We remain very bullish.

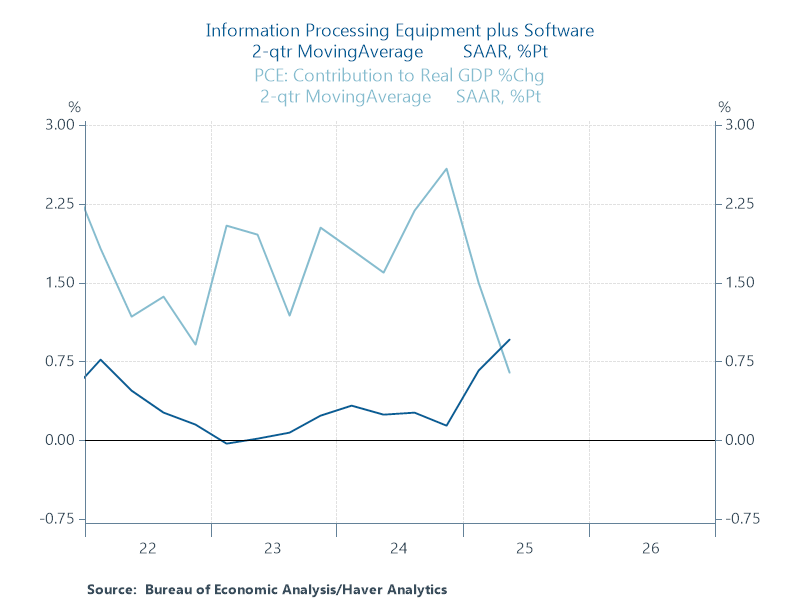

AI capex now driving GDP

So far in 2025, AI-related capital spending has contributed more to GDP growth than U.S. consumer spending. Let that sink in.

Big Tech isn’t just talking about AI, it’s funding it at historic levels:

Meta plans to spend $72 billion on Capex this year

Microsoft will spend $30 billion next quarter alone

And unlike the dot-com era, these companies have the runway to go all the way. They’re using highly profitable core businesses to fund this growth. This isn’t hype. It’s a long-term trend that’s still in the early innings.

We’re positioned well to capitalize on AI and other secular growth trends, including defense and industrial reshoring. If you’re not already a paid member, upgrade today to get immediate access to our portfolio.

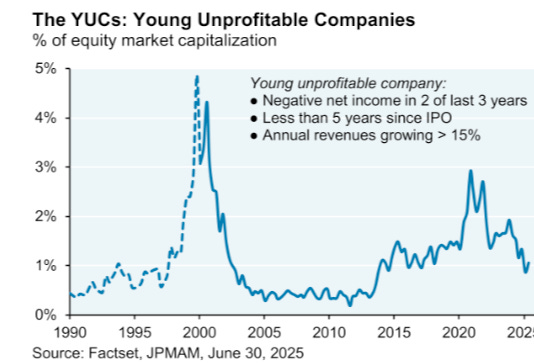

What bubble?

Every week brings another comparison to the dot com bubble. But here’s one key stat that caught my eye:

Young, unprofitable companies account for just 1% of total U.S. market cap.

That’s a fraction of the levels seen in the dot-com era. Today’s market leaders are growing earnings, expanding margins, and generating enormous free cash flow.

At the risk of sounding like a broken record, this is not the same setup as 2000.

Sentiment reset and seasonal weakness

After a red-hot June and July, sentiment is cooling. The percentage of S&P 500 stocks above their 50-day moving average has fallen below 50%, a sign that we could see some near-term consolidation.

This lines up with August seasonality, which historically leans bearish.

If you’ve been waiting for a pullback, get your buy list ready.

Final thought

The job market isn’t as strong as advertised. And August is a historically weak month for stocks. But here’s what’s on the horizon:

Rate cuts are now more likely by year-end

Fiscal stimulus from the new tax bill is coming in 2026

Earnings remain strong, especially in AI and defense

While a pullback would be natural after the strong rally over the last few months, the longer term backdrop looks favorable heading into 2026.