10 Common Mistakes in Stock Market Investing

Want to improve your stock market results? Start by avoiding these 10 common mistakes that derail many investors.

From emotional decision-making to ignoring taxes, these errors can cost you big. Here’s a quick summary of what to look out for:

Emotional Investing: Fear and greed lead to bad timing and impulsive trades.

Poor Diversification: Overloading on one stock, sector, or region increases risk.

Chasing Trends: Buying hot stocks often means overpaying and losing money later.

Skipping Asset Allocation: Misaligned portfolios can expose you to unnecessary risks.

Excessive Trading: Frequent trades rack up fees, taxes, and poor timing.

Overpaying Fees: High costs eat into your returns over time.

Ignoring Taxes: Poor planning leads to higher tax bills and lower profits.

Skipping Rebalancing: Without adjustments, your portfolio drifts into higher risk.

No Investment Plan: Lack of goals and strategy results in inconsistent outcomes.

Skipping Research: Investing without due diligence increases the chance of losses.

10 Worst Investing Mistakes // Avoid At All Cost

1. Making Emotional Investment Decisions

Emotions like fear and greed can wreak havoc on even the most carefully crafted investment plans. When these feelings take over, they can lead to decisions that undo years of preparation and thoughtful strategy.

Fear-driven selling often happens during market downturns. When markets dip, panic can set in, prompting investors to sell at the worst possible time - right at the bottom. A striking example is the March 2020 COVID market crash. Many investors, gripped by fear, sold their holdings and missed out on the strong recovery that followed.

On the flip side, greed-fueled buying can push investors into risky territory. When a stock skyrockets, the fear of missing out (FOMO) can tempt people to buy in at inflated prices. The GameStop craze of early 2021 is a textbook case, where emotions led to impulsive decisions and many investors were left holding the bag.

Confirmation bias adds another layer to emotional investing. After purchasing a stock, some investors focus only on positive news that supports their decision, ignoring warning signs or negative developments. This selective thinking can distort judgment and amplify risks.

Then there’s revenge trading, where investors, after suffering a loss, feel compelled to recover their money quickly. This often results in taking on excessive risks, compounding the initial mistake.

When faced with losses, our natural survival instincts can kick in. The fight-or-flight response, fueled by stress hormones, can cloud judgment and make it even harder to think rationally during tough market conditions.

While emotions are an inevitable part of investing, they can be managed with clear, rule-based strategies. For instance, setting predefined rules for buying and selling, using stop-loss orders to limit potential losses, and applying position sizing rules can help ensure that no single investment jeopardizes your overall financial health.

One effective way to counter emotional decision-making is dollar-cost averaging. By investing a fixed amount at regular intervals, this approach reduces the temptation to time the market and helps smooth out volatility over time.

Another helpful tool is keeping a trading journal. By documenting not just your trades but also the reasons behind them and your emotions at the time, you can uncover patterns in your behavior and work toward more disciplined decision-making. These strategies provide a solid foundation for developing a structured, emotion-free approach to investing.

2. Poor Portfolio Diversification

Putting all your eggs in one basket can lead to unpredictable losses. Many investors make this mistake by focusing their money on just a handful of stocks, a single sector, or one type of asset. This approach leaves their portfolios exposed to significant risks when the market takes an unexpected turn.

Concentration risk can wreak havoc, especially during market downturns. Take the dot-com bubble, for example. Investors who heavily focused on technology stocks faced massive losses when the bubble burst. A similar scenario played out during the financial crisis, where portfolios overly reliant on one sector saw sharp declines. These events highlight the dangers of putting too much weight on a single area of the market. The risk isn't limited to overall concentration - it also applies to specific sectors and regions.

Sector concentration is a common pitfall. For instance, a portfolio heavily invested in the energy industry might take a big hit during an oil price crash. Similarly, geographic concentration can be risky. Relying too much on the performance of one country's market can reduce your portfolio's exposure to global opportunities and make it more vulnerable during regional economic slumps.

Another key risk to watch out for is company-specific risk. Betting heavily on individual stocks, especially those of your employer, can be a recipe for disaster. The collapse of companies like Enron serves as a stark reminder of how overreliance on a single stock can wipe out retirement savings.

Diversification isn't just about owning a lot of stocks. It’s about spreading your investments across different asset classes - like stocks, bonds, real estate, and commodities - as well as across various sectors, company sizes, and regions. Modern portfolio theory supports this approach, showing that diversification can reduce risk without significantly lowering returns.

Fortunately, you don’t need to buy hundreds of individual stocks to diversify effectively. Tools like exchange-traded funds (ETFs) and mutual funds make it easier to achieve broad market coverage. For example, an S&P 500 index fund gives you exposure to 500 of the largest U.S. companies across multiple industries.

Striking the right balance is key. Younger investors might lean toward growth-focused investments, while those closer to retirement often prefer safer options like bonds and dividend stocks. Avoiding the trap of over-concentration is crucial for keeping your portfolio stable and setting yourself up for smarter, long-term investing success.

3. Following Market Trends and Popular Stocks

Jumping on the bandwagon of trending stocks often leads to buying at inflated prices and selling at a loss. Much like making decisions based on emotions, chasing trends can derail a disciplined investment strategy. This reactive behavior stems from emotions overpowering careful analysis.

The psychology behind this is strong. When a stock is climbing fast or everyone is buzzing about the "next big thing", FOMO (fear of missing out) takes over. This fear can push investors to act on impulse, abandoning rational decision-making in favor of chasing the hype.

Take meme stocks as an example. AMC Entertainment skyrocketed from $2 to over $70, only to crash back down. Many retail investors who joined the frenzy at its peak suffered heavy losses when the hype faded, and the stock corrected sharply. These situations highlight the risks of following market buzz instead of sticking to a well-thought-out strategy.

Herding behavior, amplified by social media and constant news coverage, creates a false sense of urgency. Popular stocks often see their prices soar beyond reasonable valuations as attention pushes demand artificially higher.

By the time a stock gains widespread attention, much of the potential upside has already been realized. Latecomers often end up paying a premium, exposing themselves to greater risk.

Another trap is sector rotation. During the pandemic, investors flocked to technology and work-from-home stocks like Zoom and Peloton. While these companies initially thrived, those who bought at their peak in 2020 or 2021 saw significant losses as market priorities shifted to other sectors.

Instead of chasing trends, focus on fundamental analysis to guide your decisions. This involves evaluating a company's financial stability, competitive position, and long-term growth prospects. Look for businesses with strong balance sheets, steady earnings growth, and lasting competitive advantages - regardless of whether they’re currently in the spotlight.

Adopting value investing principles can also help. Seek out quality companies trading below their intrinsic value, even if they aren't making headlines. While this approach requires patience and discipline, it often delivers better long-term results than hopping between trendy stocks.

The secret lies in developing your own investment criteria and staying committed to them. Avoid letting market noise or popular opinions dictate your choices. This disciplined mindset can protect you from the costly mistake of buying during periods of excessive enthusiasm and selling out of fear when the market turns.

4. Ignoring Proper Asset Allocation

Asset allocation might sound complicated, but it’s really just about dividing your investments among stocks, bonds, and cash in a way that aligns with your financial goals and timeline. The mistake many investors make? Either putting all their eggs in one basket or failing to adjust their mix as their circumstances change.

Here’s the thing: how you allocate your assets plays a massive role in your investment outcomes. In fact, research shows that asset allocation is responsible for 100% of return levels, with about 40% of the differences in returns tied directly to allocation choices. That’s huge.

A common misstep is overcommitting to stocks. For example, some investors might pour 90% of their money into individual stocks or stock funds, leaving themselves exposed to significant losses during market downturns. On the flip side, some play it too safe, parking most of their money in low-yield savings accounts or bonds, which can hinder the growth they need to meet long-term goals.

The right asset allocation depends on your unique situation. Take a 25-year-old saving for retirement versus a 55-year-old planning to buy a vacation home in a few years. The younger investor can afford to take on more risk for the potential of higher returns, while the older investor likely needs to prioritize protecting their capital since they’ll need it sooner.

Your time horizon plays a big role here. If you’re investing for something 20 years down the road, you can generally lean more toward stocks, which historically deliver better long-term returns despite short-term ups and downs. But if your goal is just a couple of years away - like saving for a house down payment - sticking with more stable investments is the smarter move. And as your goals and market conditions shift, your asset allocation should evolve too.

Another factor to consider is your risk tolerance. This isn’t just about how much volatility you think you can handle - it’s about how you’ll actually react if your portfolio takes a hit. Even if you believe you’re okay with market swings, a sharp drop could push you to make emotional decisions, like selling at the worst possible time.

One of the biggest mistakes you can make is setting your allocation and then ignoring it. Over time, market movements can throw your portfolio off balance. For instance, a portfolio that starts as 70% stocks and 30% bonds might drift to a riskier mix if stocks outperform bonds. Regularly reassessing and rebalancing your portfolio ensures you stay aligned with your original plan.

To get started, define your financial goals and when you’ll need the money. Be honest about how much risk you can handle, both emotionally and financially. From there, build an allocation strategy tailored to your needs. And don’t forget to diversify within each asset class - spread your stock investments across different sectors, company sizes, and regions to further protect your portfolio.

5. Excessive Trading Activity

Trading frequently might feel like you're taking control of your investments, but it often does more harm than good. Constantly buying and selling based on short-term market movements can lead to higher transaction costs, added tax burdens, and the nearly impossible task of timing the market correctly.

Even with commission-free trading, hidden costs like bid-ask spreads can chip away at your returns. For taxable accounts, frequent trading can also trigger short-term capital gains taxes, which are typically higher than long-term rates, further eating into your profits. When trades are driven by impulse rather than strategy, these costs stack up quickly.

Impulse is often the culprit behind excessive trading. For instance, an investor might panic-sell a stock after bad news, only to see it bounce back later. Or they might chase a stock that's surging, buying at its peak and losing out when it falls. This "buy high, sell low" cycle can severely damage long-term wealth.

Frequent trading can also become a distraction - or even an addiction - pulling focus away from your bigger financial goals. Even seasoned professionals struggle to predict short-term market movements consistently, so reactive trading strategies are inherently risky.

The solution? Stick to a disciplined, long-term investment approach. A well-thought-out strategy, like setting clear rules for when to buy, sell, or rebalance, helps counter impulsive decisions. Automating your investments with methods like dollar-cost averaging can also take emotions out of the equation. Building a diversified portfolio of quality investments allows you to benefit from compounding growth over time, without getting caught up in the daily noise of the markets.

For those who enjoy active trading, consider designating just 5%–10% of your portfolio as "play money." This way, you can satisfy your trading urges while keeping the bulk of your investments focused on long-term growth.

6. Paying Unnecessary Fees and Commissions

When it comes to a rules-based investing strategy, keeping costs in check is just as crucial as managing risk. Investment fees might seem minor at first glance, but over time, they can quietly chip away at your portfolio's growth. Even a seemingly modest 1% annual fee can cost you tens of thousands of dollars over the years, significantly reducing your ability to build wealth.

Many investors underestimate how much fees can eat into their returns. Expense ratios, management fees, advisory fees, and transaction costs all take a bite out of your earnings. For instance, if your portfolio achieves an 8% annual return but you're paying 2% in fees, your actual return drops to just 6%. That difference might not feel dramatic in the short term, but over decades, it can have a massive impact.

Mutual funds often come with some of the steepest fees in the investment world. Actively managed funds typically charge expense ratios ranging from 0.5% to 2.0% annually, and niche or specialty funds can be even pricier. These fees are automatically deducted from your account, making them easy to overlook - until you calculate their long-term cost.

Here’s a clear example: If you invest $10,000 annually for 30 years at a 7% return with a minimal 0.1% fee, your portfolio could grow to around $909,000. However, with a 2% fee, that same investment would only reach about $566,000. That’s more than half your potential gains lost to fees.

Exchange-traded funds (ETFs) offer a much more affordable alternative to traditional mutual funds. Broad-market ETFs often have expense ratios as low as 0.03% to 0.20%, which is significantly lower than actively managed funds. Similarly, index funds are another low-cost option, as they simply track a market benchmark rather than relying on expensive fund managers to make stock picks. Choosing these low-cost options can make a substantial difference in your portfolio’s performance while also encouraging you to keep an eye on other hidden costs.

Advisory fees are another area where expenses can pile up. Financial advisors can provide valuable guidance, but paying 1% to 2% annually for basic portfolio management may not be worth it - especially if you're comfortable managing a straightforward, diversified portfolio on your own.

Hidden fees can be even more damaging than the ones you see upfront. Some brokerages charge account maintenance fees, inactivity fees, or transfer fees, while certain investment products tack on 12b-1 fees for marketing and distribution costs that offer no direct benefit to you. Always read the fine print and take the time to understand exactly what you're being charged.

To minimize costs, adopt a fee-conscious mindset. Compare expense ratios before selecting funds, favor low-cost index funds and ETFs whenever possible, and regularly review your account statements for unexpected charges. Many brokerages now offer commission-free trading for stocks and ETFs, which can eliminate another potential drain on your portfolio.

If you prefer professional advice, consider working with fee-only financial advisors who charge flat rates or hourly fees instead of percentage-based annual fees. This approach can help you save a significant amount of money, especially as your portfolio grows in size.

7. Ignoring Tax Consequences

Taxes can quietly chip away at your investment returns, often more than fees or frequent trading. Many investors overlook how their trading decisions trigger tax events that can significantly reduce their portfolio's growth. Every time you sell a stock for a profit, you create a taxable event, and if you’re not careful, those taxes can add up quickly. Knowing how taxes affect your investments isn’t just useful - it’s critical for building long-term wealth.

One of the most important distinctions to understand is the difference between short-term and long-term capital gains. If you sell a stock you’ve held for less than a year, your profit is taxed as ordinary income, which can climb as high as 37% for top earners. On the other hand, holding that same stock for more than a year qualifies you for long-term capital gains rates, which are capped at 0%, 15%, or 20%, depending on your income.

Here’s an example: Let’s say you invest $10,000 in a stock and sell it six months later for $12,000, earning a $2,000 profit. If you’re in the 24% tax bracket, you’ll owe $480 in taxes. But if you’d waited just a few more months to qualify for the long-term rate of 15%, your tax bill would drop to $300 - saving you $180. That’s a meaningful difference that directly impacts your returns.

Another overlooked strategy is tax-loss harvesting. This involves selling underperforming investments to offset gains from your winners, reducing your overall tax burden. You can also use up to $3,000 in capital losses annually to offset ordinary income, with any excess losses carried forward to future years. Be cautious of the wash-sale rule, though - repurchasing a “substantially identical” security within 30 days will disqualify the loss for tax purposes.

Where you hold your investments matters, too. Tax-advantaged accounts like 401(k)s and IRAs can shield your investments from annual taxes, allowing them to grow more efficiently. For taxable accounts, it’s smart to be selective about what you hold there. Investments like bond funds and REITs, which generate regular income distributions, are better suited for tax-sheltered accounts. Meanwhile, growth stocks that don’t pay dividends are ideal for taxable accounts since you control when to realize gains.

Dividend taxes also add another layer of complexity. Qualified dividends from U.S. companies enjoy the same favorable tax treatment as long-term capital gains, but non-qualified dividends - such as those from certain foreign companies or REITs - are taxed as ordinary income. This difference can significantly affect your after-tax returns, especially for higher-income investors.

Frequent trading only compounds tax liabilities. This is why a buy-and-hold approach isn’t just cost-effective - it’s also tax-efficient. By holding investments longer, you not only reduce trading fees but also benefit from lower tax rates on long-term gains.

To stay ahead, keep detailed records of your trades, including dates, purchase prices, and reinvested dividends. Use this information to plan trades strategically, whether it’s waiting to qualify for long-term capital gains rates or harvesting losses to offset gains. Many brokerages now offer tools to track your cost basis, but it’s still important to understand how your gains and losses are calculated.

Tax rules are always evolving. For instance, the Tax Cuts and Jobs Act of 2017 introduced several changes to investment-related taxes, and future legislation could bring more updates. Staying informed about current tax laws and factoring taxes into every investment decision will help you keep more of your returns. This underscores the importance of a disciplined, rules-based investing strategy that accounts for both market performance and tax efficiency.

8. Skipping Portfolio Rebalancing

Keeping your portfolio balanced isn’t something that happens automatically - it requires regular attention and action. Over time, some investments will grow faster than others, shifting your portfolio's allocation away from its original target. Without rebalancing, you might unknowingly take on more risk than you intended, leaving your investments vulnerable.

For example, imagine starting with a portfolio that’s 60% stocks and 40% bonds. After a strong year for stocks, that mix could shift to 75% stocks and just 25% bonds. Suddenly, your portfolio is far riskier than you planned, with greater exposure to potential market downturns.

Rebalancing is essentially a way to "sell high and buy low." By trimming back investments that have grown too much and reinvesting in areas that have underperformed, you bring your portfolio back in line with your risk tolerance. This approach isn’t just about maintaining balance - it’s about protecting your investments from the unexpected.

Take the dot-com bubble of the late 1990s, for instance. As tech stocks soared, many investors saw their portfolios become heavily weighted toward this one sector. When the bubble burst in 2000, these portfolios took massive hits. On the other hand, those who rebalanced regularly had already taken profits from their tech holdings and shifted into bonds or other sectors, softening their losses. A similar story played out during the 2008 financial crisis - investors who neglected rebalancing often ended up with portfolios overloaded with stocks just as the market crashed. Those who had been systematically rebalancing were better positioned, having shifted some of their gains into safer assets like bonds.

So, how often should you rebalance? Most experts suggest doing it at least once a year, though some recommend quarterly rebalancing or whenever an asset class drifts more than 5% from its target. The right frequency depends on your risk tolerance and how hands-on you want to be. While more frequent rebalancing can help reduce volatility, it may also increase transaction costs and trigger taxes in taxable accounts.

There are two main strategies for rebalancing:

Threshold rebalancing: This method kicks in when your allocations drift beyond set limits, like rebalancing when stocks are 5% above or below their target.

Calendar rebalancing: This follows a set schedule, such as every six months, regardless of how much the allocations have changed.

Both approaches are effective, but threshold rebalancing tends to be more responsive to market changes.

To reduce the costs and tax implications of rebalancing, focus on tax-advantaged accounts like 401(k)s and IRAs, where trades won’t trigger immediate taxes. For taxable accounts, you might use new contributions to adjust your portfolio instead of selling existing positions. Alternatively, you can limit rebalancing to when allocations have drifted significantly.

Thanks to modern tools, rebalancing has never been easier. Many brokerages offer automatic rebalancing services, adjusting your portfolio based on your chosen schedule and parameters. Target-date funds and robo-advisors also handle rebalancing for you, though they may give you less control over the process.

Treat rebalancing as a core part of your investment routine, just like filing taxes or reviewing your insurance. Set a plan, stick to it, and don’t let emotions get in the way. By keeping your portfolio aligned with your original goals, you’ll not only manage risk but also position yourself to capture gains over time.

9. Investing Without a Clear Plan

Stepping into the stock market without a plan is like setting off on a road trip with no destination in mind - you’re likely to end up lost and far from your financial goals. Too often, investors dive into buying stocks based on hot tips, sensational headlines, or gut instincts. Unfortunately, these impulsive moves can lead to decisions that derail long-term success.

Having a clear investment plan is essential. It acts as your financial roadmap, outlining your goals, risk tolerance, time horizon, and the steps you’ll take to achieve them. Without this structure, investing can feel more like gambling, leaving you vulnerable to emotional and reactive decisions.

Take market downturns during crises, for example. Investors without a plan often panic and sell off their holdings at rock-bottom prices, locking in losses. On the other hand, those with a well-thought-out strategy are better equipped to weather the storm and even capitalize on the eventual recovery. A clear plan keeps you grounded, helping you make rational choices during unpredictable times.

Your plan should address key elements like financial goals, your timeline, how much risk you’re willing to take, and how you’ll allocate your assets. It also needs to outline how you’ll respond to market volatility. These guidelines act as guardrails, steering you away from costly, emotionally charged decisions. This disciplined approach ties back to the rules-based strategies we discussed earlier.

Matching your asset allocation to your life stage is a crucial part of this process. For example, a younger investor with decades ahead might lean toward a more aggressive portfolio, while someone nearing retirement may opt for a more balanced or conservative mix. The key is to align your investments with your personal circumstances and long-term goals.

Successful investors don’t just create a plan - they stick to it. They document their strategy, regularly review it, and follow it even during turbulent markets. Including predetermined rules in your plan can help take emotions out of the equation. For instance, you might decide in advance to rebalance your portfolio if it drifts too far from your target allocation. This way, your decisions are based on logic, not impulse.

It’s also important to revisit and update your plan as your life evolves. Major life events - getting married, having children, changing careers, or nearing retirement - can all warrant adjustments to your strategy. Think of your plan as a living document that adapts to your circumstances while staying rooted in your core investment principles.

A well-crafted plan simplifies every decision. When faced with a buzzworthy stock or a “can’t-miss” opportunity, you can measure it against your established criteria instead of acting on impulse. This systematic, disciplined approach sets successful, wealth-building investors apart from those who struggle to find their footing in the stock market.

10. Skipping Research and Due Diligence

Neglecting proper research before making an investment can lead to unexpected and often expensive mistakes. Many investors get swept up in the buzz of a trending stock or a glowing recommendation, skipping the crucial step of due diligence. This step is vital for uncovering risks that may not be immediately apparent.

So, what is due diligence? It's essentially the process of verifying and investigating all relevant facts about a potential investment before committing your money. Think of it as doing your homework before making a financial decision. Unfortunately, many investors rely on shallow sources like social media hype, flashy headlines, or casual advice from friends, rather than conducting their own in-depth analysis.

"Due diligence is about protecting your interests before you're committed. It allows investors to uncover hidden risks, verify the information they've been given, and ultimately reduce uncertainty. A thorough process can be the difference between a sound investment and a costly mistake." - Walter Soriano, Founder and CEO, USG Security

Skipping this step can leave you vulnerable to investing in companies with hidden liabilities, regulatory violations, or shaky financial foundations. Worse, you could fall prey to fraud or deceptive practices that thorough research might have exposed. For example, a 2022 survey of nearly 1,500 CEOs found that 58% admitted to greenwashing, while two-thirds expressed doubts about their sustainability efforts. Without proper due diligence, you might unknowingly back companies whose environmental claims are misleading.

To avoid such pitfalls, rely on credible sources like SEC filings - specifically Form 10-K and 10-Q. These documents provide detailed financial and operational insights, far more reliable than press releases or marketing materials. Additionally, tools like FINRA's BrokerCheck and the SEC's PAUSE site can help you verify the credentials of investment professionals and identify unregistered solicitors. BrokerCheck lets you research brokers and firms, while the PAUSE site flags intermediaries who may be operating without proper registration.

"No investment is entirely risk-free, but with proper risk assessment, you can position yourself to maximize returns while managing the downsides. It's about knowing what you're getting into and preparing accordingly." - Walter Soriano, Founder and CEO, USG Security

Before diving into specific investments, take a step back and evaluate your financial readiness. Do you have sufficient emergency savings? Have you set clear investment goals? Knowing your risk tolerance is also key - it helps you determine whether an investment aligns with your comfort level, especially during market fluctuations. This systematic, research-first approach ensures your investment strategy is both disciplined and aligned with your financial objectives.

Effective due diligence goes beyond crunching numbers. Investigate the company's leadership, its competitive standing, and the broader industry landscape. Be alert for red flags like unstable management, a declining market position, or legal troubles that could harm the company’s future performance. Regulatory changes are another factor that could significantly impact a company’s prospects.

Taking the time to thoroughly research investments not only helps you avoid costly mistakes but also positions you to spot promising opportunities. While it may require more effort than chasing popular stock tips, this disciplined approach is what sets successful long-term investors apart from those who face disappointing returns and unexpected challenges.

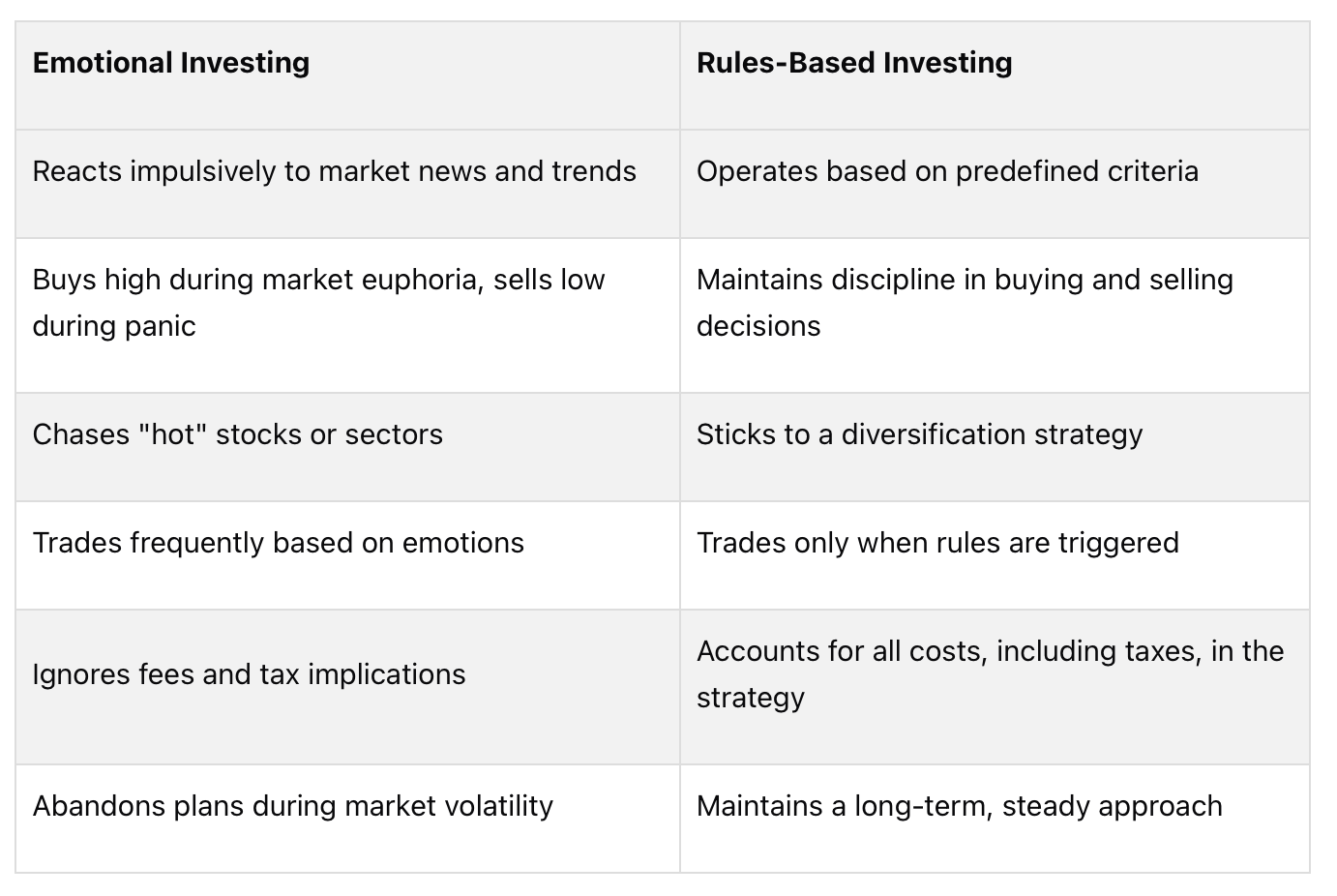

Rules-Based vs. Emotional Investing Comparison

The gap between successful and struggling investors often boils down to one key factor: rules-based investing versus emotional decision-making. As mentioned earlier, emotional decisions can lead to costly errors, while rules-based strategies provide a structured way to avoid such pitfalls. This distinction lays the foundation for a disciplined approach that minimizes bias and promotes consistency.

Emotional investors tend to react impulsively to market movements, chasing trends and making decisions driven by fear or excitement. On the other hand, disciplined, rules-based investors stick to pre-established strategies that eliminate personal bias. Instead of being swayed by market sentiment, they rely on clear, objective criteria for buying, selling, and managing their portfolios.

Rules-based investing operates on a simple principle: every decision must meet specific, predefined criteria. Whether those criteria are tied to financial metrics, technical indicators, or other benchmarks, actions are only taken when the rules are satisfied - ignoring the noise of market fluctuations.

Emotional investors often make decisions at the worst possible moments. For example, they might abandon diversification when a particular sector is booming, neglect asset allocation during market momentum, or skip regular portfolio rebalancing altogether. In contrast, rules-based investors stay the course. They stick to their diversification plans, rebalance their portfolios consistently, and make decisions grounded in research rather than fleeting emotions.

One of the key advantages of a rules-based strategy is its tax efficiency. Frequent, reactive trading often triggers higher short-term capital gains taxes, while a systematic approach minimizes unnecessary transactions and associated tax burdens. Additionally, rules-based investors often favor low-cost index funds, further reducing fees.

While no strategy can completely eliminate the risk of losing money, rules-based investing significantly improves the odds of long-term success by reducing the impact of psychological biases. It fosters consistency and repeatability in the investment process, which are essential for building wealth over time.

To implement this approach, develop rules tailored to your financial goals, risk tolerance, and investment horizon. Then, stick to those rules no matter how tempting it may be to act on market sentiment. By doing so, you can transform investing from an emotional rollercoaster into a steady, methodical process that compounds wealth over the years.

Conclusion

Investing successfully isn’t about chasing the latest stock trend or trying to time the market just right. Instead, it’s about steering clear of the common mistakes that can derail your long-term growth. Emotional decisions, poor diversification, overtrading, and skipping proper research are some of the biggest culprits that can undermine a disciplined approach to building wealth.

The key to long-term financial growth lies in adopting a rules-based, systematic strategy. By sticking to clear investment criteria and staying disciplined - no matter how noisy or volatile the market gets - you can turn short-term fluctuations into opportunities for steady progress. This method not only helps you stay focused but also improves your chances of achieving consistent success.

At the heart of this approach is a commitment to continuous learning and disciplined execution. These principles are the foundation of every recommendation shared here and align with the methodology of The Predictive Investor. By leveraging research-driven insights and factor-based analysis, this disciplined strategy has historically delivered results that outperform the S&P 500.

Avoiding mistakes is just the start of your investing journey. The real progress begins when you commit to ongoing education and stick to a methodical, systematic plan. Markets will always present new challenges, but with the right knowledge and a disciplined approach, you’ll be better equipped to navigate them and achieve your financial goals.

Start applying these strategies today to set yourself up for long-term success.

FAQs

How can I control my emotions to avoid making impulsive investment decisions?

Controlling your emotions while investing in the stock market begins with crafting a solid financial plan. This plan serves as your anchor during market ups and downs, keeping your focus on long-term objectives instead of letting short-term volatility dictate your decisions.

One way to maintain discipline is to automate your investments. This approach minimizes the urge to time the market and helps you stick to your strategy. Setting realistic, long-term goals also provides clarity and helps you avoid getting swept up in day-to-day market noise. Speaking of noise, try to limit your exposure to sensationalized financial news and social media chatter, as these can often provoke unnecessary emotional responses. Finally, practicing mindfulness and taking a breather during stressful moments can help you approach decisions with a calm, rational mindset rather than acting on impulse.

What are some effective ways to diversify my investment portfolio and reduce risk?

Diversifying your investment portfolio is a smart way to manage risk and aim for long-term stability. The idea is simple: don’t put all your eggs in one basket. Start by spreading your investments across different asset classes - like stocks, bonds, and cash. If one of these takes a hit, the others might help offset the loss.

Another effective strategy is geographic diversification. By investing in markets from various countries and regions, you reduce your dependency on the performance of a single economy. On top of that, think about sector diversification. For instance, you could allocate funds to industries like technology, healthcare, and energy, ensuring you’re not overly tied to the ups and downs of one market segment.

Combining these approaches can help you create a balanced portfolio that’s better prepared to weather market swings while increasing your chances of steady growth over time.

What is a rules-based investing strategy, and how can it help me achieve long-term financial success?

A rules-based investing strategy revolves around setting clear, predefined guidelines to manage your investments. These rules typically address key aspects like how to allocate assets, when to buy or sell, and managing risk effectively. The goal? To take emotions out of the equation and avoid impulsive decisions that could lead to financial missteps.

This method promotes discipline and consistency, as it relies on a well-thought-out strategy rather than reacting to short-term market swings. Another advantage is that you can test your approach against historical data to ensure it aligns with your financial objectives. By adhering to your established rules, you’re better positioned to make informed decisions and enhance your long-term investment performance.