7 Financial Milestones for Long-Term Wealth

Explore seven essential financial milestones that pave the way to long-term wealth and financial independence, from emergency funds to retirement readiness.

Building long-term wealth requires setting clear, actionable goals. This roadmap outlines seven key financial milestones to help you achieve financial security and independence:

Emergency Fund: Save 3–6 months of essential expenses to cover unexpected costs like medical bills or job loss.

Pay Off High-Interest Debt: Eliminate debts with rates over 8%, such as credit cards, to free up cash for savings and investments.

Retirement Savings: Start early and prioritize contributions to accounts like 401(k)s and IRAs, especially if employer matching is available.

Diversified Investment Portfolio: Spread investments across stocks, bonds, and other assets to manage risk and grow wealth steadily.

Real Estate: Buy a home or invest in rental properties for equity growth and potential income.

Education Savings: Use tools like 529 plans to prepare for rising college costs while balancing other financial goals.

Retirement Readiness Check: Regularly review your progress, adjust contributions, and plan for future expenses like healthcare.

Wealth Manager Explains Key Financial Milestones for Every Age (0 to 60 years) | Sophia Bhatti

What Are Financial Milestones

Financial milestones are key benchmarks in your journey to building wealth. Think of them as measurable goals that guide your decisions and mark your progress toward achieving financial independence and stability. Each milestone represents a tangible achievement, bringing you one step closer to long-term financial security.

These milestones act as a roadmap, helping you stay focused and ensuring that every dollar you earn serves a greater purpose. They influence how you spend, save, and invest by providing clear targets. For example, whether it's saving for a six-month emergency fund or maximizing your 401(k) contributions, knowing exactly what you're working toward encourages smarter financial choices.

Studies show that acknowledging your progress makes you 30% more likely to stick to your goals. This sense of accomplishment fuels motivation, especially during tough times. Financial milestones also create natural moments to celebrate, which helps maintain the discipline needed for a solid investment strategy.

The Role of Discipline in Wealth Accumulation

Setting long-term financial goals fosters a disciplined mindset, which is crucial for growing wealth efficiently. Discipline becomes especially important in investing, where emotional decisions can disrupt even the best plans. Financial milestones prioritize saving and investing for specific objectives, encouraging you to cut back on unnecessary expenses.

"The most important step is to start. You can always refine your goals, but having a plan and keeping it in motion is what truly matters." - Noah Damsky, founder of Marina Wealth Advisors

A rules-based investing approach perfectly illustrates this discipline. By sticking to established strategies, you can avoid impulsive decisions driven by market ups and downs.

The numbers back this up: delaying your investment start from age 25 to 35 could halve your long-term returns. Additionally, only about 10% of large-cap U.S. funds outperform the S&P 500 over 15 years. This highlights the importance of staying consistent and disciplined rather than trying to beat the market.Discipline not only drives better decision-making but also strengthens your financial safety net.

Building Financial Resilience Through Milestones

Financial milestones do more than track progress - they also help reduce risk and build a safety net for unexpected challenges. By encouraging strong savings and budgeting habits, milestones create the financial stability needed to navigate economic uncertainty.

"It's important to remember that long-term investing strategies are based on sticking to the strategy over the entire period, regardless of how you feel about the economy, fiscal policy or political environment." - Ryan Patterson, Chief Investment Officer at Linscomb Wealth

This stability is invaluable during market downturns or personal financial setbacks. Clear milestones, combined with a rules-based approach, keep you grounded and prevent panic-driven decisions that could derail your long-term goals.

Ultimately, financial milestones turn abstract ideas like "financial security" into actionable, achievable steps, helping you stay on course even when challenges arise. They provide clarity and purpose, ensuring that every effort you make contributes meaningfully to your financial future.

1. Build an Emergency Fund

An emergency fund acts as a financial safety net, helping you avoid debt when life throws unexpected expenses your way - think medical bills, car repairs, or even job loss.

Experts suggest saving enough to cover 3–6 months of essential living expenses. For the average American household, this translates to around $35,000, which is roughly 40% of their annual income. Unfortunately, many fall short: 56% of Americans have less than three months' worth of expenses saved, and 27% have no emergency savings at all.

"Think of an emergency fund as a buffer between you and high-cost debt or forced sale of assets in the event of unplanned expenses or income reduction."– Greg McBride, chief financial analyst at Bankrate

Calculating Your Emergency Fund Target

To determine how much you need, focus on your essential monthly expenses and exclude non-essentials. Essentials typically include rent or mortgage, utilities, groceries, transportation, insurance, and medical costs. For a clearer picture, Investopedia estimates six months of essentials at $11,634 for medical care, $10,621 for transportation, and $9,785 for housing.

"When planning for an emergency fund, it's essential to strike a balance between ambition and practicality... What can make this more achievable - and ultimately more useful - is to think about saving for three months' worth of essential expenses rather than your current lifestyle costs."– Alyson Basso, a certified financial planner with Hayden Wealth Management

Starting Small and Building Momentum

If saving 3–6 months' worth of expenses feels daunting, start with a smaller, more manageable goal - like $500. This can help you build momentum and develop a savings habit. Track your fixed and variable expenses to find areas where you can cut back and save.

Where to Keep Your Emergency Fund

Your emergency fund should be stored in an account that’s both accessible and earns interest. High-yield savings accounts or money market accounts are great options, especially those offered by online banks, which often provide higher interest rates and lower fees. Avoid keeping these funds in checking accounts (low interest), CDs (penalties for early withdrawal), stocks (market volatility), or as cash (no growth and risk of theft). Also, ensure your account is FDIC-insured, which protects up to $250,000 per depositor, per account.

"When you save your emergency funds in a high-yield savings account, the funds are easily accessible when needed."– Ohan Kayikchyan, Money Coach and Certified Financial Planner

To stay consistent, consider setting up automatic transfers to your emergency fund.

"Given the recent increase in economic uncertainty and a realistic calculation of what our 'needs' actually cost on a monthly basis, $35,217 sounds like a lot, and is a lot of money for most households. But having that emergency cushion could help prevent you and your family from falling deep into debt due to unforeseen circumstances."– Caleb Silver, Investopedia Editor-in-Chief

Building an emergency fund is a critical first step toward securing your financial future and preparing for the unexpected.

2. Pay Off High-Interest Debt

Once your emergency fund is in place, it’s time to tackle high-interest debt - one of the biggest obstacles to building long-term wealth. High-interest debt, like credit card balances, can quickly become a financial burden. With average credit card rates exceeding 24%, even small balances can balloon over time. For example, carrying $10,000 in credit card debt at a 20% interest rate could cost you over $16,000 in interest alone before it’s fully paid off. That’s money that could be better used to grow your wealth through investments.

Paying such high interest means your investments would need to earn at least 20% annually just to break even, which is highly unrealistic.

“When looking at this from an interest rate perspective, if you're paying 20% interest on credit card debt, you would need to make at least 20% on your investments to cover that interest cost. No one makes 20% year-over-year.”– Tony Molina, CPA and senior product specialist, Wealthfront

Understanding High-Interest Debt

Debt with interest rates of 8% or more - such as most credit cards and many personal loans - is considered high-interest. The numbers speak for themselves: credit card rates typically range between 15% and 30%, while personal loans often fall between 10% and 29%. These rates far surpass the returns you could reasonably expect from most investments, making paying off this debt a guaranteed way to improve your financial health.

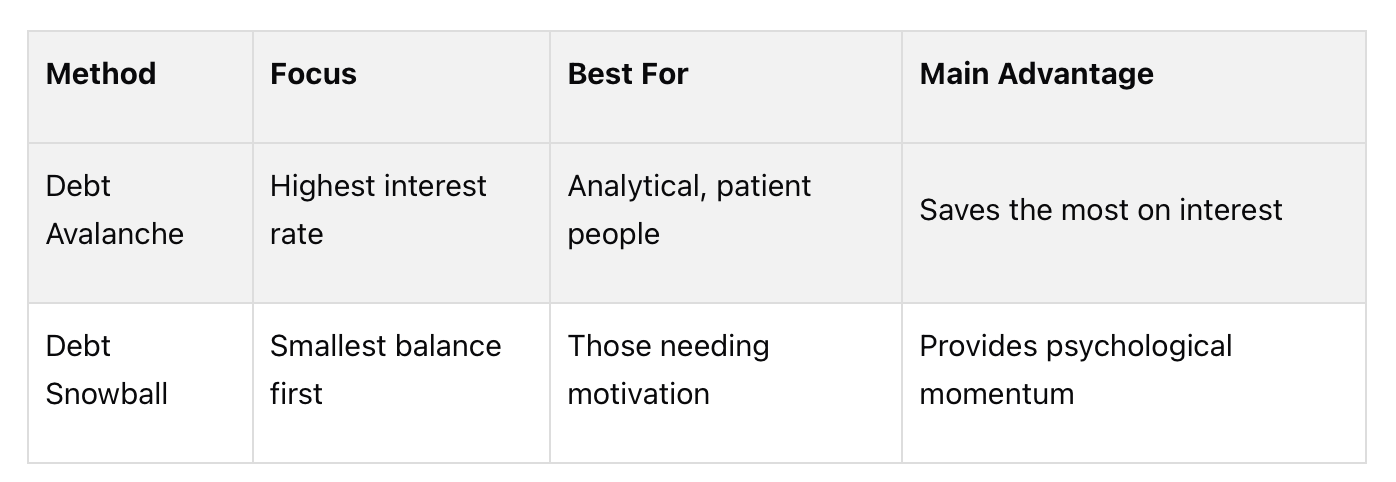

Two Effective Debt-Repayment Strategies

If you’re juggling multiple debts, there are two popular approaches to consider:

Debt Avalanche Method: Focus on paying off the debt with the highest interest rate first. This strategy saves the most money in interest over time and shortens your repayment period.

Debt Snowball Method: Start with the smallest debt balance, regardless of interest rate, and work your way up. While this method may cost more in interest overall, the quick wins can keep you motivated.

“The best debt repayment plan is the one you can stick with until you're debt-free.”– Navy Federal Credit Union

Tips to Speed Up Your Progress

Here are some additional strategies to help you pay off debt faster:

Pay more than the minimum: Minimum payments often cover just the interest, leaving your principal untouched. Paying extra reduces the principal faster and cuts down on overall interest.

Consider debt consolidation: Combine multiple debts into one loan with a lower interest rate. This simplifies payments and can save money over time.

Explore balance transfers: Transfer high-interest credit card debt to a card with a lower promotional rate. Be mindful of transfer fees and aim to pay off the balance before the promotional period ends.

Negotiate with creditors: Many lenders are open to creating payment plans or even reducing the amount owed if you’re facing financial difficulties.

Reducing high-interest debt not only frees up cash flow but also sets the stage for future financial milestones.

The Wealth-Building Connection

Eliminating high-interest debt is about more than just escaping the cycle of payments - it’s about creating opportunities for growth. Every dollar saved on credit card interest is a dollar that can be invested in your future. Lowering your credit utilization ratio (ideally below 30%) can also boost your credit score, making it easier to qualify for better loan terms. Beyond the financial perks, being debt-free reduces stress and opens the door to new possibilities you might not have thought possible.

3. Start and Maximize Retirement Savings

Once you've tackled high-interest debt and built an emergency fund, the next step is to focus on a powerful wealth-building tool: retirement savings. Starting early and contributing consistently can make the difference between enjoying a secure retirement and facing financial struggles later in life. This step sets the stage for long-term financial success.

Retirement accounts take advantage of tax benefits and compound growth to help your money grow over time. The two main options are employer-sponsored 401(k) plans and Individual Retirement Accounts (IRAs). Each offers unique advantages, allowing your savings to grow either tax-deferred or tax-free, depending on the type of account.

Understanding Your Options: 401(k) vs. IRA

The key distinction between these two accounts lies in how they’re accessed. A 401(k) is offered through your employer, while an IRA is something you open independently through a financial institution like a bank or brokerage. Both can play an important role in your retirement planning.

401(k) Plans

These accounts come with higher contribution limits. In 2025, you can contribute up to $23,500 if you're under 50, and $31,000 if you're 50 or older. For those aged 60 to 63, the Secure 2.0 Act allows contributions of up to $34,750. Many employers also offer matching contributions, which is essentially free money added to your retirement savings.

IRAs

While IRAs have lower contribution limits - $7,000 in 2025 (or $8,000 if you're 50 or older) - they offer greater investment flexibility. Unlike most 401(k) plans, IRAs provide access to a wider range of investment options, such as individual stocks, ETFs, and mutual funds. However, IRAs don’t include employer matching.

Maximize Employer Contributions

If your employer offers a 401(k) match, prioritize contributing enough to receive the full match. Over 85% of 401(k) plans provide some form of employer contribution, with the average match being 4.6% of income. A common structure matches 100% of the first 3% of your salary and 50% of the next 2%.

To understand the power of matching, consider this example from TIAA: a $2,400 employer match could grow to over $50,000 by age 70, assuming a 7% annual return. Some companies are even more generous. For instance, Wills Group matches $1.17 for every $1 contributed, up to 6% of your salary. Employees contributing at least 6% receive a 7% match.

"With matching contributions and compounding interest, you're literally multiplying your money." – Eric Pullett, Senior Manager of Benefits and Diversity, Equity, & Inclusion at Wills Group

Growing Your Contributions Over Time

Once you've secured the full employer match, focus on gradually increasing your contributions. While many 401(k) providers recommend saving about 10% of your income annually, Fidelity suggests aiming for 15% of your pre-tax salary, including employer contributions.

"If you can't afford to go up to the maximum yet, Fidelity believes in aiming for 15% of your pre-tax salary (including your employer's contributions). If you can't afford the 15%, figure out what you can afford, then you can always increase it whenever you get a raise or promotion."

Here are a few strategies to boost your contributions over time:

Use raises to save more: Increase your contribution rate each time your salary goes up.

Annual adjustments: Many plans offer automatic escalation features, allowing you to raise your contributions by 1% each year.

Review during open enrollment: Take advantage of your company’s annual benefits review to reassess and adjust your retirement savings rate.

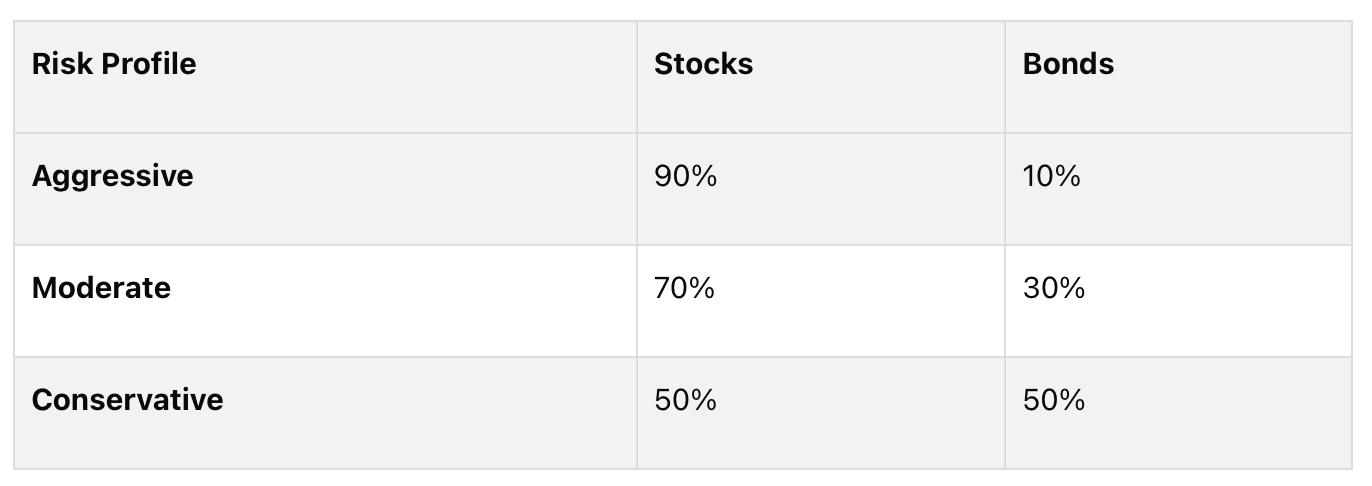

Choosing the Right Investment Strategy

Maximizing your contributions is only part of the equation - how you invest those contributions is equally important. Many 401(k) plans limit your investment options to mutual funds and target-date funds. For those looking to diversify or pursue higher returns, you might consider additional strategies. Resources like The Predictive Investor can help identify lesser-known, high-growth opportunities to complement your portfolio.

A balanced approach that aligns with your risk tolerance and financial goals is essential. By starting early, taking full advantage of employer matches, and increasing contributions over time, you’ll build a strong foundation for a comfortable and secure retirement. This is a key milestone on the journey to financial independence.

4. Build a Diversified Investment Portfolio

Once your retirement savings are on track, the next step is creating a well-rounded investment portfolio. This phase gives you more control over your investments and expands your financial opportunities beyond basic savings.

Diversification is key to managing risk and achieving steady growth over time. By spreading your investments across different asset types, industries, and regions, you can reduce the impact of market downturns and maintain more consistent returns.

The Core Asset Classes

A balanced portfolio typically includes a mix of stocks, bonds, and cash. Each of these asset classes plays a distinct role and reacts differently to market conditions.

Stocks: These often deliver the highest returns but come with greater risk. For instance, large company stocks have historically lost money about one out of every three years. However, over the long term, equities remain a crucial engine for building wealth.

Bonds: While offering lower returns compared to stocks, bonds provide stability and act as a cushion during market downturns.

Cash and Cash Equivalents: These provide maximum safety and liquidity, making them ideal for emergencies or short-term needs, though their growth potential is minimal.

A common starting point for asset allocation is the 60/40 split - 60% stocks and 40% bonds. However, your ideal mix will depend on your risk tolerance, financial goals, and how long you plan to invest.

Going Beyond the Basics: Broader Diversification

After setting up your core stock and bond allocation, you can explore additional investment options like real estate, commodities, and other alternatives [49,50]. For example:

Real Estate Investment Trusts (REITs): These offer exposure to property markets without the challenges of owning physical real estate.

Commodities: Investments such as gold or oil can serve as a hedge against inflation.

Geographic diversification is another layer to consider. Spreading investments across different regions can help protect your portfolio during localized economic downturns.

"Global diversification allows clients to maximize potential returns while minimizing risk, leveraging opportunities across various regions, sectors, and asset classes." – HSBC Private Bank

You can access international markets through mutual funds, ETFs, direct stock purchases, or by investing in multinational companies. Developed markets often provide steady growth, while emerging markets may offer higher growth potential [57,58].

The Power of a Rules-Based Approach

Using a rules-based investment strategy can help identify overlooked opportunities with strong potential. For instance, by the end of 2024, the Russell 1000 Growth Index had become heavily concentrated, with 40% of its weight in just 18 stocks. This highlights the importance of diversifying even within specific asset classes.

Newsletters like The Predictive Investor can help you spot high-growth investments that might not be included in broader market indices.

Keeping Your Portfolio Balanced

Once your portfolio is set, maintaining it is just as important. Regular rebalancing ensures your investments stay aligned with your target allocation. For example, during the 2008–2009 bear market, a diversified portfolio with 70% stocks, 25% bonds, and 5% short-term investments performed better than an all-stock portfolio.

Rebalancing involves selling assets that have grown beyond your desired allocation and reinvesting in underperforming areas. This disciplined approach helps you stick to your investment strategy and may improve long-term results.

Building a diversified portfolio is a crucial step in transitioning from basic savings to advanced wealth-building strategies. It provides a solid foundation for growth while managing risk, setting you up for future financial success.

5. Buy a Home or Invest in Real Estate

Real estate has long been a powerful way to build wealth. Whether you're purchasing your first home or growing a portfolio of rental properties, real estate offers opportunities for both appreciation and income. For example, from 1972 to 2019, REITs delivered an average annual return of 11.8%, edging out the S&P 500's 10.6% performance during the same period. Meanwhile, home values in the U.S. typically rise by 3% to 5% annually. A 2024 Gallup survey even found that Americans consider real estate the best long-term investment option. Beyond potential returns, real estate also adds variety to your investment strategy.

Homeownership vs. Investment Properties

The type of real estate you choose depends on your goals and timeline. Are you planning to live in the property, rent it out for steady income, or flip it for a quick profit? Homeownership provides stability and the chance to build equity over time, while rental properties can generate monthly cash flow. However, managing rental properties requires more effort and comes with risks like vacancies and unexpected maintenance costs.

Key Factors for Real Estate Success

When it comes to real estate, location is everything. Katarzyna Zawodna-Bijoch, Business Unit President of Skanska Commercial Development Europe, emphasizes: "Today, it's location, quality and amenities that make a successful project."

When evaluating a property, think about its proximity to schools, shopping, and other amenities, as well as the neighborhood's overall stability. It’s also a good idea to consult local public agencies about zoning regulations and future urban development plans. Adding real estate to your portfolio can provide a tangible asset that complements other investments.

Market timing also plays a role. J.P. Morgan Research predicts a 3% increase in home prices and a slight dip in mortgage rates to 6.7% by 2025. However, John Sim, Head of Securitized Products Research at J.P. Morgan, warns: "The situation is not going to change until we get mortgage rates back down toward 5%, or even lower. And we aren't forecasting mortgage rates to breach 6% in 2025 - they should ease only slightly to 6.7% by the year end."

Evaluating Investment Potential

If you're considering rental properties, calculate cash flow by subtracting monthly expenses - such as mortgage payments, property taxes, insurance, and maintenance - from the rental income. Look for areas with low vacancy rates and rising property values. Staying informed about trends like home price changes, new construction, and inventory levels can also help you identify promising opportunities.

Manage Risks and Costs

Real estate investing comes with its own set of challenges, including market fluctuations, legal considerations, and liquidity issues. Unlike stocks, real estate isn't easily sold and often requires significant time and money to manage. However, it offers the potential for passive income alongside property value appreciation. If you’re hiring a property manager, expect to pay 8% to 12% of the monthly rent. Their expertise can help you avoid common pitfalls, such as unreliable tenants or unplanned maintenance issues. Always set aside funds for unexpected repairs or vacancies.

As Anthony A. Luna puts it: "Real estate investing is not a get-rich-quick scheme; it requires patience, strategic planning, and a long-term vision."

Current Market Outlook

The real estate market typically follows an 18-year cycle with four phases: recovery, expansion, hyper supply, and recession. Understanding where your local market stands in this cycle can guide your decisions. Looking ahead to 2025, experts stress the importance of risk management, resilience, and adaptability. A decrease in new construction is expected to affect most commercial real estate sectors in North America and Europe.

Real estate can be a valuable addition to a diversified portfolio, offering both growth and income potential. But success requires careful research, sufficient funding, and a realistic understanding of the time and effort involved.

6. Save for Children's Education and Other Long-Term Goals

College costs in the U.S. are climbing at an eye-watering pace. On average, a college student spends $38,270 per year on tuition, books, supplies, and living expenses, with private universities averaging an even steeper $58,628 per year. With college costs inflating at about 5% annually, the total price tag for a four-year degree can exceed $500,000 when you include student loan interest and lost income.

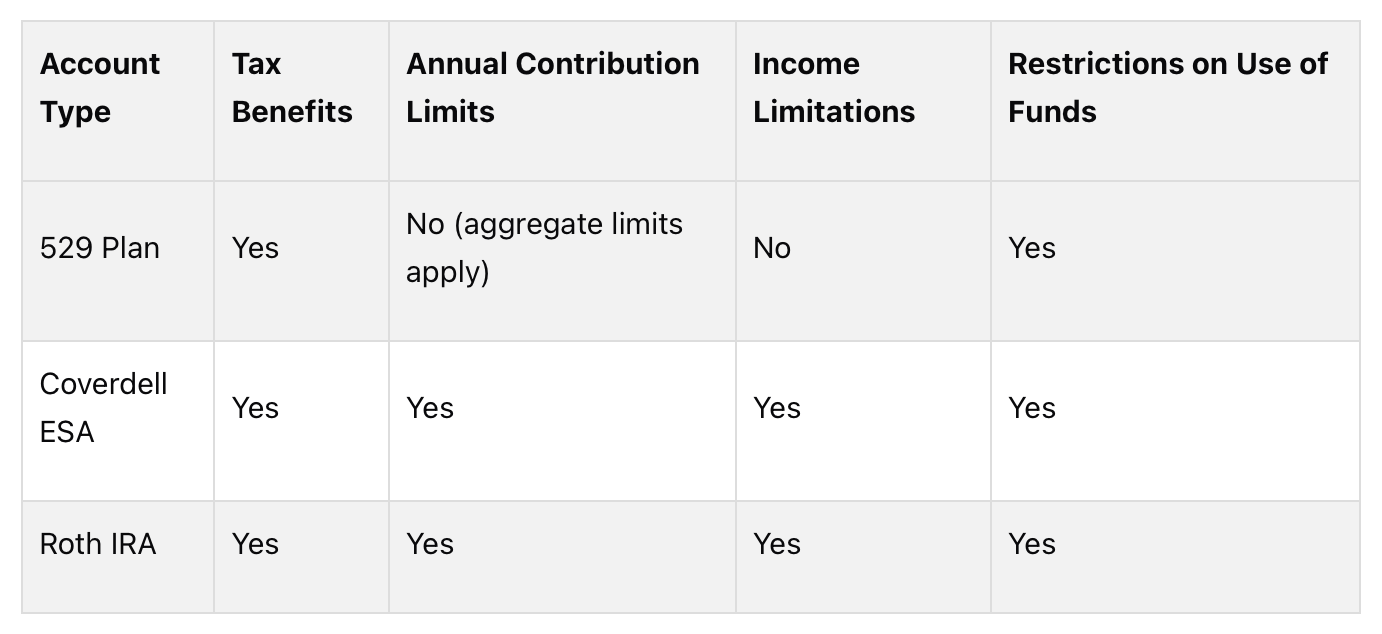

Thankfully, there are tax-advantaged accounts designed to help you prepare for these expenses without compromising your other financial goals. As of December 2022, more than 16 million families were using 529 plans, collectively holding $411 billion in assets. But 529 plans aren’t your only option - there are other tools to help you save for education.

529 Plans: A Flexible and Tax-Friendly Option

529 plans are one of the most popular ways to save for education, offering tax-deferred growth and tax-free withdrawals for qualified expenses. These accounts allow lifetime contributions of up to $500,000 or more per beneficiary, depending on your state. Funds can be used for tuition, fees, and other costs at any eligible U.S. college or apprenticeship program. You can even use up to $10,000 annually for K-12 tuition or apply the money toward student loan repayment. Some states provide an extra incentive by offering tax deductions for contributions made to their own 529 plans.

Anyone can open a 529 account, and family and friends can contribute, regardless of where they live relative to the sponsoring state. For those with significant resources, "superfunding" allows you to contribute five years’ worth of gifts in one go.

Other Ways to Save for Education

While 529 plans are a standout option, other accounts may also work for your situation:

Coverdell Education Savings Accounts (ESAs): These accounts function similarly to 529 plans but come with income limits, lower contribution caps, and more investment choices.

Roth IRAs: Primarily designed for retirement, Roth IRAs can also be tapped for education expenses if needed, though there may be tax implications. For 2025, individuals under 50 can contribute up to $7,000 annually to a Roth IRA.

Here’s a quick comparison of these options:

Planning for Rising Costs

To budget for future college expenses, account for both direct costs like tuition and textbooks and indirect costs such as housing and transportation. By 2025, the average annual cost for a public four-year in-state education is projected to reach $25,668, while private institutions will average $60,358 per year. Tools like College Cost Projectors and Net Price Calculators can help create tailored estimates. On the bright side, nearly 75% of undergraduate students receive some form of financial aid, which can significantly offset costs.

Balancing Education and Retirement Goals

When saving for college, don’t lose sight of your retirement. Experts recommend prioritizing retirement accounts while leveraging tax-advantaged education savings tools. Integrating your education savings with your overall financial plan ensures that both short-term and long-term goals remain on track.

Juggling Multiple Long-Term Goals

Education isn’t the only major expense you may need to plan for. Whether it’s buying a second home, launching a business, or supporting aging parents, having separate accounts for each goal can help you stay organized and avoid misallocating funds. Since retirement and college savings often have stricter timelines, they should take precedence over more flexible goals like purchasing a car. For families with multiple children, consider setting up individual funds tailored to each child’s timeline and needs.

Starting early is key to building long-term savings. Noah Damsky, founder of Marina Wealth Advisors, highlights the importance of time: "Time is your biggest advantage when it comes to long-term financial planning. The earlier you start saving for retirement, the less financial stress you'll face later."

This advice applies equally to education and other big-ticket goals. A consistent and early savings strategy can make all the difference. For a personalized approach, consult a tax advisor who can help you balance your priorities effectively.

7. Check Your Retirement Readiness

Heading into retirement without sufficient savings is like embarking on a road trip without checking the gas gauge - it’s risky. A survey by AARP in April 2024 revealed that 31% of adults saving for retirement are unsure if they’ll have enough, while 33% are convinced they won’t. The silver lining? Regularly assessing your progress can help you adjust before it’s too late.

Use Benchmarks to Track Your Progress

Fidelity offers savings benchmarks that can help you gauge if you’re on the right track. According to their guidelines, you should aim to save:

1x your salary by age 30

3x by age 40

6x by age 50

8x by age 60

10x by age 67

Fidelity estimates that saving 10 times your pre-retirement income by age 67 can help maintain your current lifestyle during retirement. However, your target may differ based on your lifestyle goals. For example, if you plan for a more modest retirement, you might need only 8 times your income; for a more luxurious retirement, you might aim for 12 times. Many financial experts recommend setting aside 10% to 15% of your income for retirement as a general rule.

Understand Your Future Expenses

Knowing how much you’ll spend in retirement is key to determining if your savings are sufficient. For example, in 2025, an individual retiree might spend about $172,500 on healthcare, while couples could face expenses of $330,000 in today’s dollars.

"Each family's retirement situation is different. The amount of time until you retire, spending habits, travel plans, health conditions, and unexpected costs can all vary dramatically. That is why it is important to adjust the spending guidelines based on your own needs and wants." – Beau Zhao, director of Financial Solutions at Fidelity

Healthcare alone could consume about 15% of your budget by age 65, even with Medicare. Beyond medical costs, think about how your spending might shift - you might spend more on hobbies and travel but less on work-related expenses and savings contributions. If your savings don’t meet these anticipated expenses, there are steps you can take to close the gap.

Take Action If You’re Falling Behind

If your calculations reveal a shortfall, don’t worry - there are ways to catch up. Workers over 50 can make catch-up contributions, adding an extra $7,500 to their 401(k) and $1,000 to their IRA in 2025.

Starting in 2025, the SECURE 2.0 Act provides additional help for individuals aged 60 to 63. This group can contribute the greater of $10,000 or 150% of the standard catch-up limit, adjusted annually for inflation.

Other strategies include paying down debt, increasing savings, taking full advantage of employer matching contributions, investing unexpected windfalls like bonuses or tax refunds, or even delaying retirement by a year or two to allow your investments more time to grow.

Regularly Review and Adjust Your Plan

Make it a habit to review your retirement plan annually to ensure you’re staying on track. During these checkups, review your 401(k) statements, monitor balances and account changes, and assess your investment options and performance. Update personal details, like beneficiary information, and use online tools or retirement calculators to explore how different scenarios or retirement dates could impact your finances.

For more tailored advice, consider consulting a financial planner, accountant, or attorney. These professionals can help you consolidate accounts, optimize tax strategies, and develop a retirement income plan that addresses potential risks and opportunities.

The earlier you start evaluating your retirement readiness, the better positioned you’ll be to make adjustments. Time is one of your greatest assets in retirement planning, and regular reviews ensure you’re using it wisely to meet your long-term financial goals.

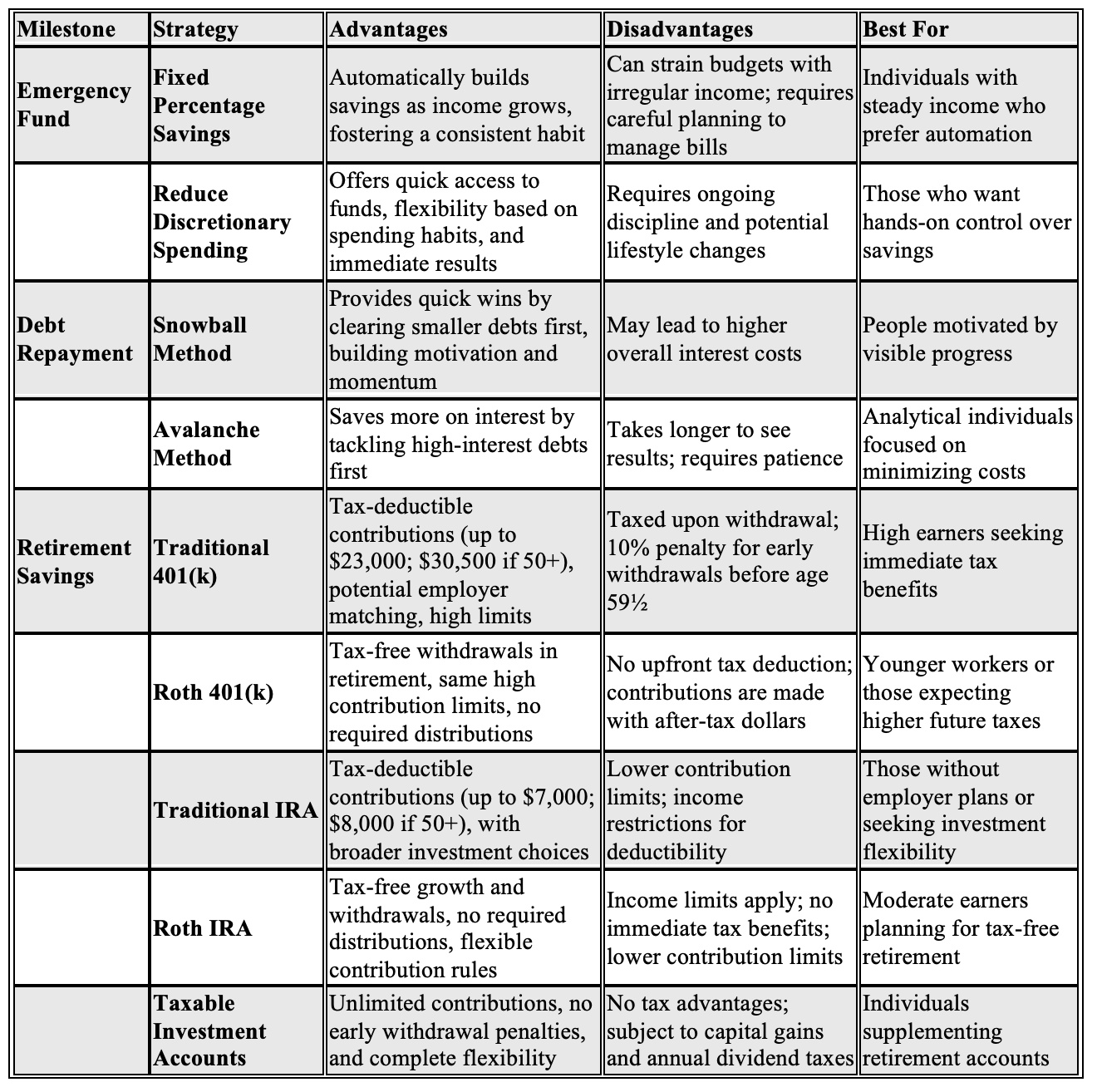

Comparison Table

The table below provides a clear breakdown of strategies for different financial milestones, helping you weigh the pros and cons of each approach.

These strategies underscore the importance of aligning your financial approach with your personal goals and circumstances. By understanding the trade-offs, you can make informed decisions that support your progress across all milestones.

Michael Conticelli, a financial advisor at Solutions Advisory Services, highlights the importance of prioritizing savings: "Paying ourselves first is important because it's too easy for our bills and expenses to expand to the amount of money we have, often not leaving anything leftover for savings. We often find ways to spend what's available."

When planning for retirement savings, consider how your current tax situation compares to your expected future tax bracket. Robert R. Johnson explains the value of automatic savings plans: "The biggest advantage of automatic plans is the behavioral underpinnings. Inertia and the inherent laziness of people tend to work in our favor. Once enrolled in an automatic savings plan, people tend to stay enrolled."

As your income and financial needs evolve, adjust your strategy by integrating options like employer 401(k) matches, Roth IRAs, and taxable investments to maximize your long-term results.

Conclusion

The seven milestones discussed lay the groundwork for turning basic financial stability into lasting wealth. They act as a roadmap, guiding you from one level of security to the next.

Consider this: the average American saves just 5% of their income, and only 6.5% of households reach millionaire status. These figures highlight why having a structured plan is so important. Research shows that people who celebrate their progress are 30% more likely to stay committed to their goals. Each milestone serves as a stepping stone, making the journey toward financial success both manageable and motivating.

Discipline is what separates dreamers from doers. Northwestern Mutual's 2024 Planning & Progress Study found that the percentage of Americans identifying as disciplined financial planners dropped from 65% in 2020 to just 45% in 2024. Yet, those who embrace structured planning are twice as satisfied with their financial life, twice as confident about retirement, and five times better prepared for unexpected challenges. This makes sticking to a solid plan even more critical.

Sustained effort over time is the key to success. Strategies like compounding returns, tax-efficient planning, and strategic investing only work when applied consistently. Automating your savings and investments can help you stay on track even when motivation dips. As Sam Dogen of Financial Samurai aptly puts it: "If the amount of money you're saving and investing each month doesn't hurt, you're not saving and investing enough."

As you advance through the milestones, building a diversified investment portfolio becomes increasingly important. Tools like The Predictive Investor can provide a rules-based approach to uncovering high-growth opportunities. With a proven track record of outperforming the S&P 500, it offers valuable insights to help you navigate milestone four and beyond.

Your financial future doesn't hinge on perfect timing or market conditions - it depends on your commitment to these steps. Start where you are, use the resources at your disposal, and let time and consistency work in your favor. Wealth-building isn't complicated; it just demands dedication to the process.

FAQs

How can I save for retirement while also planning for my children's education expenses?

Balancing retirement savings with education expenses takes thoughtful planning and a clear strategy. First and foremost, focus on consistently contributing to tax-advantaged retirement accounts like a 401(k) or IRA. These accounts not only grow over time but also serve as a cornerstone for your financial stability in the future.

At the same time, explore setting up a 529 college savings plan for your children. The earlier you start, the more you can benefit from the power of compound growth. If finances get tight during your child’s college years, it’s okay to temporarily adjust contributions to the 529 plan. However, try to avoid cutting back on your retirement savings - your long-term financial well-being should always take precedence.

The secret lies in starting early, saving steadily, and adapting as your circumstances change. This balanced approach can help you work toward both your retirement and education funding goals without creating unnecessary financial stress.

What are the pros and cons of using a rules-based investment strategy to build a diversified portfolio?

A rules-based investment strategy brings a lot to the table when it comes to building a well-rounded portfolio. By following a structured plan for asset allocation, it ensures your decisions stay in line with your goals and risk tolerance. This method helps cut down on emotional decision-making, encourages discipline, and even allows for automation and backtesting to improve long-term outcomes. Plus, it can support a balanced portfolio aimed at steady growth over time.

That said, it’s not without its challenges. Strict rules can sometimes make it hard to take advantage of unexpected market opportunities, which might limit the potential for higher returns. For those just starting out, setting up and managing such a system can feel overwhelming. There’s also the risk of over-diversification - spreading your investments too thin could water down returns, leading to average or even below-average performance. Finding the sweet spot is crucial to making this strategy work effectively.

How can I choose the right mix of investments to match my financial goals and risk tolerance?

Understanding the right mix of investments begins with evaluating your risk tolerance - essentially, how much market ups and downs you can handle - and your financial goals. Key factors to weigh include your age, how much income you'll need, and the time horizon for your investments. For instance, younger investors often favor stocks because of their growth potential, while those approaching retirement might opt for a more cautious mix of bonds and cash.

A popular rule of thumb is the "100 minus your age" guideline. According to this, your age corresponds to the percentage of your portfolio allocated to safer investments like bonds, with the rest going into stocks. Diversifying your investments - spreading them across stocks, bonds, and cash - can help strike a balance between risk and reward. It's also important to regularly review and adjust your portfolio to ensure it aligns with your evolving financial goals and life circumstances.

By customizing your asset allocation to fit your unique situation, you can build a portfolio designed to weather market changes and support your long-term financial success.