Best Practices for Emergency Fund Liquidity

Learn how to build and manage an emergency fund to enhance financial security and protect long-term investments during unexpected events.

Having an emergency fund is your first line of defense against financial surprises. It ensures you can cover unexpected expenses - like medical bills, car repairs, or job loss - without disrupting your long-term investment goals. Here's what you need to know:

What it is: Emergency fund liquidity means having cash that’s easy to access (within 24-48 hours) without penalties or losses.

Why it matters: It prevents you from selling investments during market downturns, locking in losses, or making impulsive financial decisions.

How much to save: Aim for 3-6 months of essential expenses, adjusting based on income stability, job type, and family needs.

Where to keep it: Use high-yield savings accounts or money market accounts for quick access and modest growth. Avoid risky or illiquid options like stocks, crypto, or retirement accounts.

How to maintain it: Automate contributions, review annually, and test withdrawal methods to ensure funds are accessible when needed.

Mastering Liquidity Management & Emergency Fund Strategy

How to Size Your Emergency Fund

Having an emergency fund that's just the right size does more than give you peace of mind - it protects your financial plans and keeps you from derailing long-term investments during tough times. The amount you need depends on your essential expenses, income stability, and financial responsibilities.

Calculate Your Emergency Fund Needs

Start by listing your essential expenses. These include things like your mortgage or rent, utilities, insurance, minimum debt payments, groceries, and transportation. Skip over discretionary costs like dining out or entertainment for this calculation.

Financial experts generally recommend saving enough to cover three to six months of essential expenses. For instance, if your monthly essentials add up to $4,000, your fund should range from $12,000 to $24,000.

However, the type of emergency you might face also plays a role. A small unexpected expense may not require much, but losing your primary income might call for a larger safety net. While the three-to-six-month guideline is a solid starting point, your personal circumstances might require adjustments.

If you work in an unstable industry, have irregular income, or support several dependents, you might need to aim for six to twelve months of expenses. On the other hand, if your job is secure, you have multiple income streams, or you can lean on family support, three months might be enough.

Use this guideline as your starting point and adjust based on your own financial situation and risk factors.

Adjust for Risk Tolerance and Financial Goals

Your emergency fund should also align with your overall financial approach and risk tolerance. If you’re an investor with a high-risk portfolio, having a larger emergency fund can prevent you from needing to sell investments during a downturn.

Income stability is another critical factor. If you’re a freelancer, work on commission, or own a small business, you’ll likely need a bigger safety net than someone with a steady, salaried job. For those with fluctuating income, base your calculations on your essential expenses during the months when your income is at its lowest - not during peak earnings.

Family dynamics matter too. Single-income households typically need more robust reserves since losing that one income can cause a complete financial disruption. If you have dependents or family members with specific needs, make sure to factor those costs into your emergency fund target.

Don’t forget to consider other financial safety nets you might have. A home equity line of credit, strong disability insurance, or reliable family support could allow you to maintain a slightly smaller fund. That said, external credit sources might not always be accessible during broader economic challenges, which is when an emergency fund becomes most critical.

Even if you can’t save the ideal amount right away, starting small is still a step in the right direction. Building your emergency fund over time - even if it’s modest at first - can provide a much-needed financial cushion when you need it most. A small fund is far better than having no safety net at all.

Where to Keep Your Emergency Fund

Finding the right place to store your emergency fund is just as important as building it. The ideal account offers quick access, protects your money's value, and earns a decent interest rate. In short, you need a balance between easy access, security, and growth potential, all while steering clear of risky market fluctuations.

Your emergency fund should be kept separate from your regular checking account to avoid the temptation of dipping into it for everyday expenses. At the same time, it must be liquid enough for you to access the funds quickly when a crisis arises. Below, we break down some popular options to help you decide where to park your emergency savings.

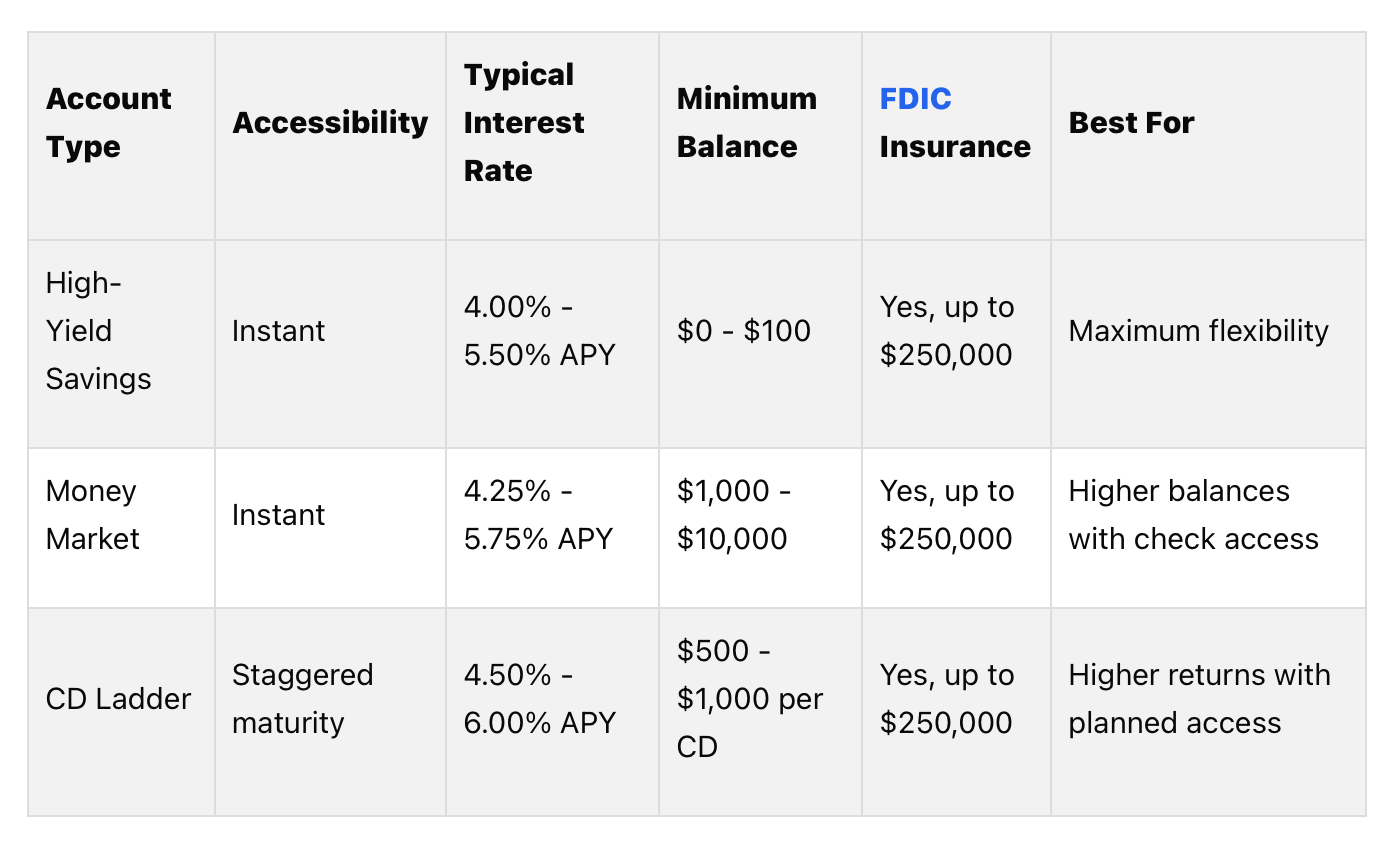

Savings Accounts, Money Market Accounts, and CD Ladders: How They Compare

Each type of account offers a different mix of accessibility, earning potential, and restrictions. Here's a closer look at these options:

High-yield savings accounts: These accounts are simple and effective. They generally offer higher interest rates than standard savings accounts while keeping your funds fully accessible. You can withdraw money via online transfers, ATMs, or checks. However, federal rules limit certain types of withdrawals to six per month.

Money market accounts: These accounts often offer slightly better interest rates than savings accounts and may include check-writing privileges or debit card access. The trade-off? They usually require higher minimum balances - anywhere from $1,000 to $10,000 - to qualify for the best rates or avoid monthly fees.

CD ladders: This strategy involves splitting your emergency fund across multiple certificates of deposit (CDs) with staggered maturity dates. While CDs can yield higher interest rates, they limit your ability to access funds immediately. However, as each CD matures, you can either reinvest the money or use it if needed.

One constant across these options is FDIC insurance, which protects your deposits up to $250,000 per depositor, per institution. This ensures your emergency fund is safe even if the bank faces financial trouble.

Many people opt for online banks, which often provide better interest rates than traditional banks. The downside? Accessing your money might take an extra day or two compared to a local bank account.

While these options strike a balance between accessibility and growth, some financial instruments simply don't fit the bill for emergency savings.

What to Avoid: Risky or Illiquid Options

Chasing higher returns might seem appealing, but certain investments can undermine the purpose of your emergency fund. Here are some options to avoid:

Stocks, bonds, real estate, and cryptocurrencies: These assets are subject to market volatility, and converting them to cash can take time. For example, cryptocurrency values can plummet by 50% or more in just days, making it a poor choice for emergencies. Additionally, cashing out crypto often involves fees, multiple steps, and potential tax implications.

Retirement accounts: Accounts like 401(k)s and IRAs aren't suitable for emergency funds. Early withdrawals typically result in a 10% penalty and income taxes, and the process can take weeks. Even though Roth IRA contributions can be withdrawn without penalties, the paperwork and delays make them impractical for emergencies.

Peer-to-peer lending platforms and high-yield corporate bonds: While these might offer attractive returns, they lack the liquidity and security needed for an emergency fund. Selling these investments during economic downturns can be challenging, just when you need the money most.

Although a checking account at your primary bank offers instant access, its low interest rate means your money won't grow. Limit its use to covering one month's worth of expenses.

At the end of the day, your emergency fund's job is to provide stability and quick access, not to generate wealth. Once you've secured this financial safety net, you can focus on long-term investments where market risks and longer time horizons make sense.

Managing and Accessing Your Emergency Fund

Once you've decided where to store your emergency fund, keeping it in good shape and ensuring you can access it quickly requires consistent attention, regular contributions, and occasional testing.

Set Up Automatic Contributions

Automating your savings is one of the easiest ways to grow and maintain your emergency fund. Relying on manual contributions often leads to skipped deposits, but scheduling automatic transfers from your checking account to your emergency fund ensures steady growth without extra effort.

Most banks let you set up recurring transfers on specific dates, often right after your paycheck hits your account. Even small, regular contributions can make a big difference. For example, transferring $200 monthly adds up to $2,400 in just a year. If you're paid bi-weekly, you might opt for smaller transfers that match your pay schedule. Treat your emergency fund contributions like any other fixed expense to stay consistent. And when you receive extra income - like a raise, bonus, or tax refund - consider boosting your contributions to help the fund grow along with your financial situation.

As your life evolves, remember to revisit and adjust your fund as needed.

Review Your Fund Regularly

An emergency fund isn’t something you can set up and forget about. Life is full of changes - new jobs, growing families, or unexpected expenses - and these shifts can impact how much you need in your fund. That’s why it’s important to reassess your savings whenever your financial situation changes.

At a minimum, aim to review your emergency fund once a year. Inflation can erode your savings’ purchasing power, so during your annual check-in, update your monthly expense calculations based on your current spending habits. If your cash flow varies, you might need to review your fund more frequently - monthly or even paycheck-to-paycheck. For those with steady and automated finances, a quarterly review might be enough.

Once your savings are in place, make sure you can access them when it matters most.

Test Your Liquidity Plan

Having an emergency fund is one thing; knowing how to access it quickly is another. The last thing you want during a crisis is to discover that your bank’s system is down or your debit card is outdated. Testing your access options ahead of time can help you avoid surprises.

Explore all the ways you can withdraw money from your fund, whether through online transfers, ATM withdrawals, branch visits, or customer service calls. Document each method, including any daily or monthly withdrawal limits that could affect you in an emergency.

To ensure everything works smoothly, try making a small withdrawal using each method. Take note of how long each process takes and any fees involved. Pay special attention to restrictions that might delay access to your funds when you need them most.

Lastly, clearly define what qualifies as a true emergency - like medical bills, job loss, major car repairs, or urgent home repairs. This helps you avoid dipping into your fund for non-essential expenses. If you do need to use it, make replenishing your fund a priority. Regular testing and careful planning ensure your emergency fund remains a dependable safety net when life throws you a curveball.

Common Emergency Fund Mistakes

Building and maintaining an emergency fund is all about ensuring quick and reliable access to cash when life throws you a curveball. But even with the best intentions, some common mistakes can make your fund less effective. Let’s take a closer look at these pitfalls so you can keep your safety net ready when you need it most.

Fund Allocation Mistakes

Avoid risky investments for emergency funds. Putting your emergency savings into volatile assets like stocks, cryptocurrency, or peer-to-peer lending might seem tempting because of the potential for higher returns. But here’s the problem: these assets can lose value at the worst possible time - like during an economic downturn when you might also be facing a job loss.

Don’t stop saving too soon. Many people set a fixed target for their emergency fund but fail to align it with their real expenses. For instance, if your monthly costs are $4,500, a $5,000 fund barely covers one month of expenses. To truly prepare for the unexpected, aim for three to six months’ worth of expenses.

Keep your emergency fund separate and realistic. Overfunding can tie up money that could be earning better returns elsewhere, while mixing emergency savings with other goals can lead to spending that leaves you unprepared. A clearly labeled, separate account ensures you don’t dip into your safety net for non-emergencies.

Ignoring Withdrawal Limitations

Be mindful of account restrictions. Some savings accounts have withdrawal limits or delays that could slow down access to your funds. This is the last thing you want in an emergency.

Watch out for penalties with certificates of deposit (CDs). While CD ladders can work as part of your strategy, putting all your emergency money in CDs can backfire. Early withdrawals often come with penalties that could cost you several months of interest, reducing the funds available when you need them most.

Plan around ATM withdrawal limits. Most banks cap daily ATM withdrawals between $300 and $1,500. If you suddenly need $3,000 for an emergency home repair, you might have to make multiple trips or visit a branch during business hours. Knowing these limits in advance can help you plan better.

Failing to Update After Life Changes

Life changes demand an updated emergency fund. Major milestones like marriage, divorce, buying a home, or having children can drastically alter your financial needs.

Marriage or divorce can change your income stability. For example, a newly married couple with variable incomes might need a larger fund, while dual stable incomes could reduce the required amount.

Buying a home brings new expenses, from property taxes to maintenance costs, often adding $500 to $1,500 to your monthly obligations.

Job changes can also shift your financial picture. Moving from a stable job to a commission-based role increases income volatility, requiring a larger cushion.

Health changes - like developing a chronic condition - might increase medical expenses and make job loss even more financially challenging.

The key is to reassess your emergency fund regularly. Annual reviews tied to life events are a simple yet effective way to keep your fund aligned with your evolving responsibilities. Set a reminder each January to calculate your current monthly expenses and adjust your savings target. This proactive habit ensures your safety net keeps pace with your life.

Build Financial Resilience Through Liquidity

An emergency fund is the cornerstone of any solid financial plan. By keeping three to six months' worth of expenses in an easily accessible account, you create a safety net that protects your long-term investments from sudden financial disruptions. This kind of liquidity ensures you're prepared for the unexpected while staying committed to your broader financial goals.

To strike the right balance between accessibility and earning potential, consider high-yield savings accounts or money market accounts. These options provide quick access to your funds, offer competitive interest rates, and are insured by the FDIC for up to $250,000, giving you peace of mind. With this secure foundation, you can confidently focus on growing your investments without worrying about emergencies derailing your plans.

Maintaining your emergency fund requires consistency and discipline. Automate your savings contributions, review the fund periodically, and stick to a rules-based approach to investing, as recommended by The Predictive Investor. This disciplined strategy ensures you're always prepared and making decisions based on clear, well-thought-out criteria.

Your emergency fund also plays a critical role in supporting your investment strategy. It provides stability during market volatility, allowing you to stay patient and avoid rash decisions. This patience can often be the key to achieving better investment returns over time.

Having a well-funded emergency account sets you apart from the nearly 40% of Americans who struggle to cover a $400 emergency. By building and maintaining this financial buffer, you position yourself among those who can handle life's surprises while staying focused on growing long-term wealth. This strong foundation is essential for consistent and repeatable investment success.

FAQs

What’s the best way to balance liquidity and growth for my emergency fund?

Finding the right balance between having quick access to your emergency fund and allowing it to grow is all about focusing on accessibility and security. The best approach is to keep your savings in highly liquid accounts, such as high-yield savings accounts or money market accounts. These options not only let you access cash quickly when needed but also provide a modest amount of interest to help your money grow.

A good rule of thumb is to save enough to cover three to six months of essential expenses, but this can vary depending on your personal financial situation and how much risk you’re comfortable with. If you’re looking to grow your fund a bit more, you might explore low-risk investments. Just make sure you don’t compromise on liquidity - your emergency fund should always be ready to step in when life takes an unexpected turn.

How should I adjust my emergency fund if my financial situation changes, like losing a job or experiencing a major life event?

If your financial circumstances shift - whether it’s losing a job, getting married, welcoming a child, or dealing with unexpected expenses - it’s crucial to revisit your emergency fund. Begin by reassessing your monthly expenses and adjusting your savings to cover at least 3 to 6 months of your updated costs. For significant milestones, like buying a house or growing your family, you might want to set aside additional funds to address these new financial commitments.

Regular check-ins with your emergency fund help ensure it keeps pace with your evolving needs. Since life often throws curveballs, keeping your savings readily accessible and easy to tap into is essential for staying financially secure when the unexpected happens.

Why should I test my emergency fund's accessibility, and how can I do it effectively?

Testing how easily you can access your emergency fund is crucial for ensuring you're prepared to handle unexpected expenses without added stress. If you don't test this ahead of time, you might face delays or complications just when you need the money most.

A good way to test is by simulating real-life situations. For example, try withdrawing a small amount to see if the process is quick and straightforward. Make it a habit to review your account setup regularly - this includes checking your login credentials and transfer options to ensure everything is current. It’s also smart to identify potential hurdles, like withdrawal limits or processing delays, so you can resolve them before they turn into bigger problems.