Buy the dip or brace for more?

The Predictive Investor - 2/23/25

Welcome to The Predictive Investor weekly update for February 23rd, 2025!

The S&P 500 made a new all-time high on Wednesday, but sold off sharply after risks to growth began to pile up.

The Fed meeting minutes revealed officials are nervous about the economic consequences of some of Trump’s policies.

Services PMI fell into contraction territory and consumer sentiment dropped on fears over inflation and potential tariffs.

Walmart WMT 0.00%↑ also lowered guidance, fueling fears of weaker consumer spending.

The S&P 500 closed the week at the YTD AVWAP, an area of support over the last 30 days. So a short term bounce early this week is likely.

Could there be more downside ahead? Of course. On average, there’s a 10% correction in the stock market every 13 months, so we’re overdue.

But I will continue to buy into weakness. Earnings have been good, and this bull market is still young by historical standards.

Here’s my takeaways from the week.

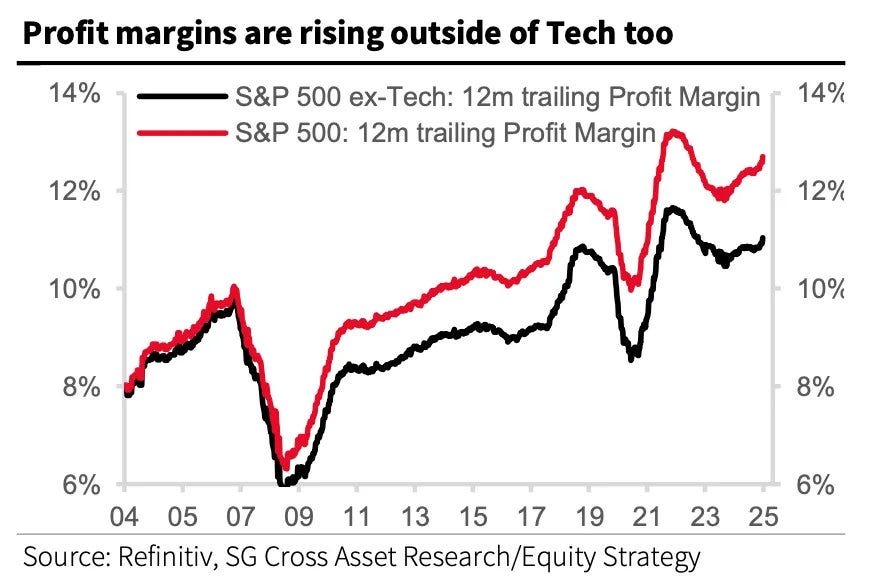

Profits drive prices

Earnings growth remains one of the most predictive factors for stock prices. So far, 73% of S&P 500 companies have exceeded EPS expectations, according to Factset. Additionally, the blended year-over-year earnings growth rate for the index is about 17%. If this holds, it will be the highest YoY earnings growth rate by the index since Q4 2021.

Profit margins also continue to expand, with growth beyond tech and the Mag 7. This is supportive of the continuation of the bull market, despite the uncertainty over tariffs and inflation.

Palantir tumbles

Palantir PLTR 0.00%↑ dropped 15% last week, primarily due to fears over defense spending cuts and CEO Alex Karp selling shares. Neither of these change my investment thesis for the company.

First, 50% of Palantir’s business comes from the private sector. And cuts in defense spending are very unlikely to affect AI - a must-have technology for military superiority.

Second, execs sell shares for all kinds of reasons, but Karp remains very committed to his vision for the company.

Even after last week’s selloff, shares are still up 407% over the last 12 months, vs. 18.2% for the S&P 500.

I’ll be looking to add to my position if shares drop to $75-$80.

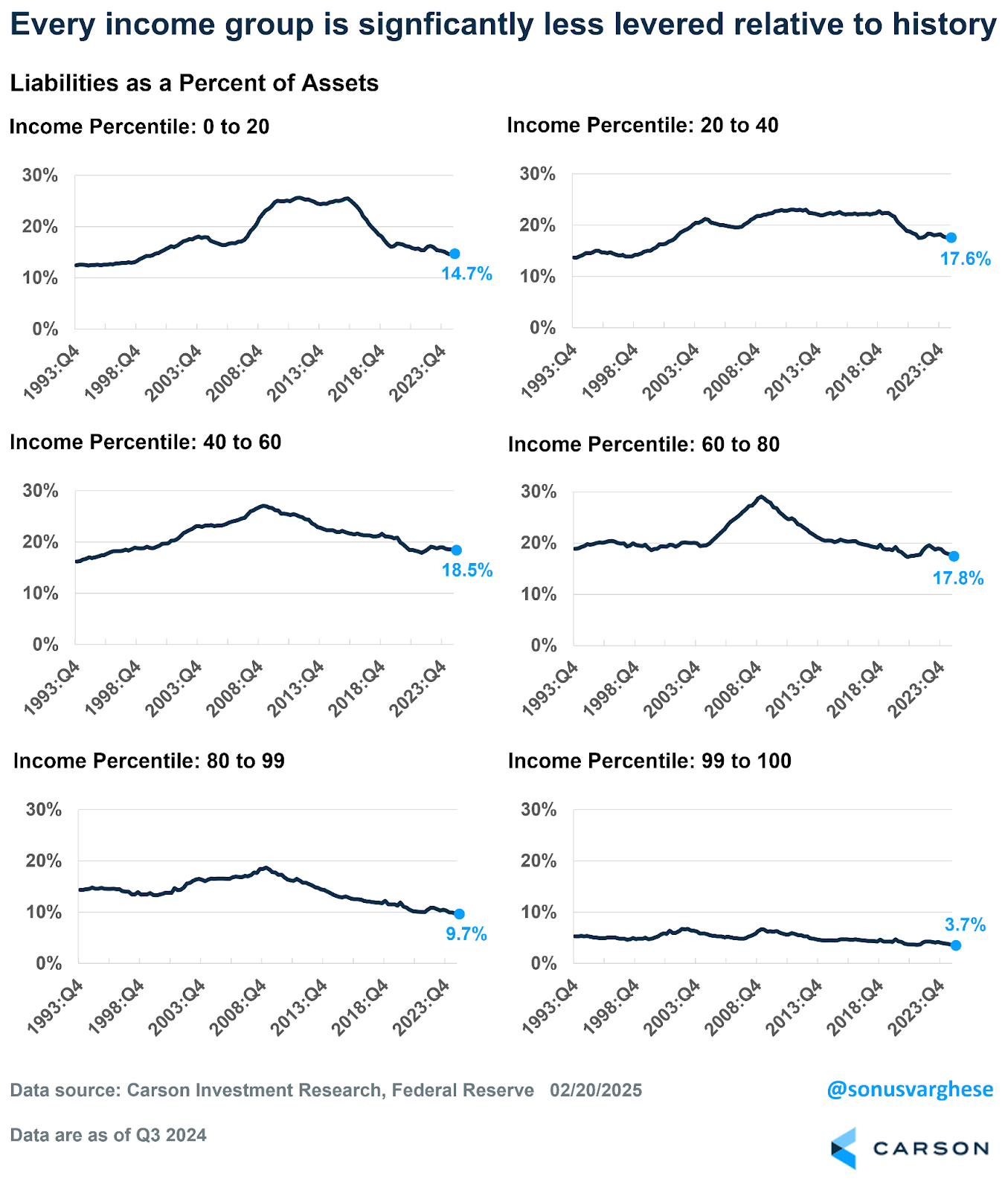

The consumer remains strong

Despite the drop in consumer sentiment and all the talk of stimulus money running out, consumers remain less leveraged across all income groups than before the pandemic.

Unemployment remains below the long term average, and there are still more job openings than unemployed workers.

The biggest outstanding question is whether the private sector can absorb all the roles eliminated by the DOGE effort. I’ll be paying close attention to the March unemployment report, to be released on April 4th, for this reason.

Trump’s agenda still includes tax cuts and deregulation, which will spur growth. But he’s cutting spending first. This is the right order of operations, but until the pro-growth policies are enacted, the spending cuts could pose a headwind to growth in the meantime.

Short squeeze unfolding in China

In my update to you on February 2nd, I flagged the potential for a short squeeze on Chinese equities. It appears that trade is now unfolding.

Alibaba BABA 0.00%↑, one of China’s largest companies, surged 15% on an earnings beat. The news brought continued momentum into Chinese equities.

The iShares MSCI China ETF MCHI 0.00%↑ is up 21% year-to-date, vs. 1.8% for SPY 0.00%↑.

I don’t own any Chinese stocks, but if that were to change Alibaba would be my first choice. The stock broke above long term resistance at $120, and appears ready to continue higher.

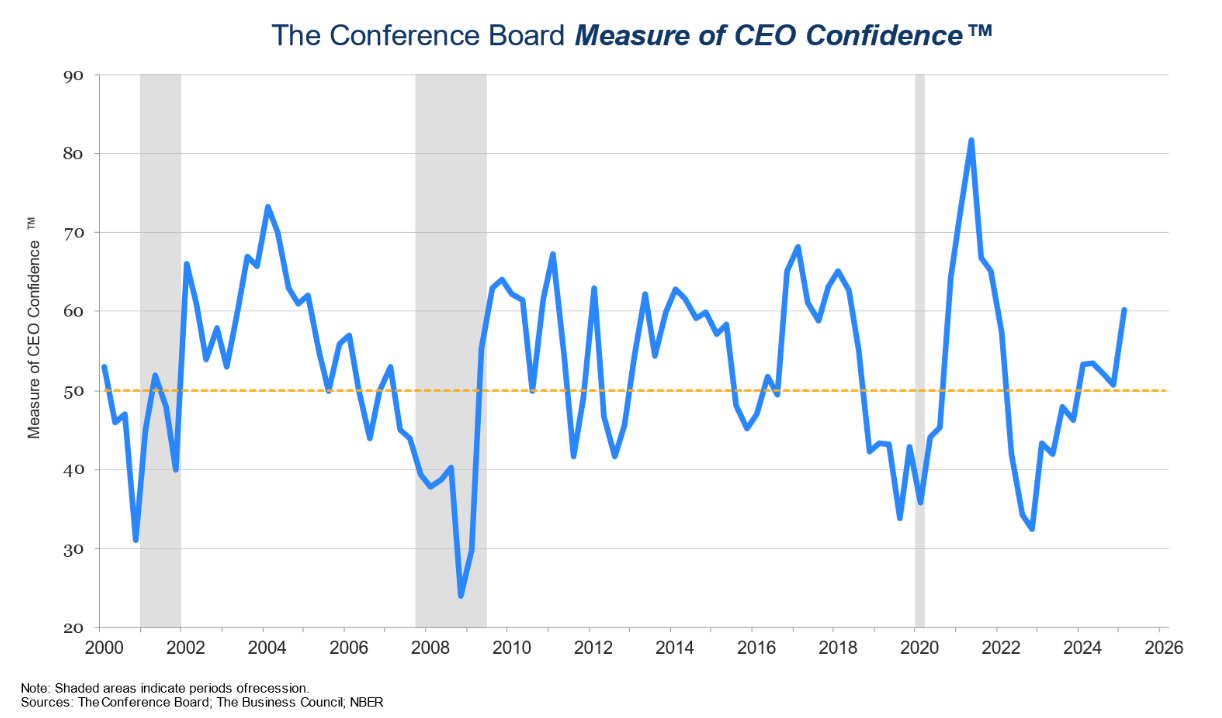

CEO confidence surges

The Conference Board’s measure of CEO confidence increased by 9 points, the highest level in three years, indicating a shift from a more cautious to confident outlook by America’s chief executives.

Some highlights include:

73% of CEOs plan to grow or maintain the size of their workforce over the next 12 months.

44% of CEOs indicated economic conditions were better now than 6 months ago. This is up from 20% last quarter.

56% of CEOs expect economic conditions to improve in the next 6 months, up from 33% in Q4.

Additionally, there were some data points showing that the policy uncertainty has not impacted spending plans. 56% of CEOs indicated no desire to change capital spending this year, and there was an increase in the number of CEOs revising spending up.