How Unemployment Data Predicts Market Moves

Explore how unemployment data influences market trends, its role as a lagging indicator, and strategies for informed investment decisions.

Unemployment data offers key insights into economic health and market trends. Released monthly by the Bureau of Labor Statistics, this data significantly influences stock market behavior. Here's why it matters:

Market Indicator: Low unemployment often correlates with market growth, while high unemployment can signal economic challenges.

Lagging Nature: Unemployment reflects past conditions, making it more of a confirmation tool than a predictor.

Immediate Impact: Monthly jobs reports, especially unexpected figures, can cause sharp market reactions.

Smart investors use unemployment data alongside other indicators like inflation and GDP for a well-rounded analysis. By understanding its role, you can better navigate market movements and make informed investment decisions.

What the jobs report means for markets

Understanding Unemployment as a Market Indicator

Unemployment data can be a powerful tool for market analysis, but to use it effectively, you need to grasp what these numbers represent and the context behind them. The unemployment rate stands out as one of the most important economic indicators, offering insights that differ from other market signals.

What the Unemployment Rate Measures

The unemployment rate is the percentage of people in the labor force who are actively seeking work but haven’t found employment. This figure, calculated by the Bureau of Labor Statistics (BLS), is determined by dividing the number of unemployed individuals by the total labor force and multiplying by 100.

It’s important to note that this measure includes only those who are available for work and have actively searched for a job within the past four weeks. It excludes several groups, such as discouraged workers who’ve stopped looking for jobs, part-time workers who’d prefer full-time roles, and individuals not actively seeking employment.

To get a broader view of the job market, the labor force participation rate is often evaluated alongside the unemployment rate. When people stop looking for work entirely, they’re no longer counted in the labor force, which can make the unemployment rate seem better than actual job market conditions.

How the Monthly Jobs Report Works

Every month, the Bureau of Labor Statistics releases the Employment Situation Report, a key resource for understanding labor market trends. This report is published on the first Friday of each month at 8:30 AM ET and is based on data collected from roughly 60,000 households and 145,000 businesses.

The data reflects employment conditions during the week that includes the 12th of the previous month, offering a snapshot of the job market about two to three weeks before the report’s release. The report provides both seasonally adjusted and non-seasonally adjusted figures, with most analysts focusing on the seasonally adjusted numbers to account for predictable changes like holiday hiring.

In addition to unemployment figures, the report includes wage growth data, which is a critical measure of inflationary pressures.

Why Unemployment Lags Behind Other Indicators

Unemployment is considered a lagging economic indicator, meaning it reflects past economic conditions rather than predicting future ones. This makes it useful for confirming trends suggested by other data but less effective for identifying real-time turning points.

Businesses typically respond to economic changes with a delay. When times are tough, companies often try to adjust by increasing existing employees’ hours, cutting overtime, or temporarily reducing pay before resorting to layoffs. Similarly, during economic recoveries, employers are cautious about rehiring. They often start by extending hours for current workers or using temporary staff before committing to permanent hires.

There’s also a delay in how unemployment data is collected and reported. By the time the statistics are compiled, analyzed, and released, they’re describing conditions from several weeks earlier. As a result, unemployment data works best when combined with more immediate indicators, such as stock market trends, consumer confidence surveys, and leading economic indicators.

Recognizing unemployment as a lagging indicator helps investors use this information wisely. Rather than viewing it as a predictor of future market movements, it’s better understood as a tool for confirming economic trends that may already be influencing stock prices. This perspective lays the groundwork for examining historical patterns and market reactions in the following sections.

Historical Patterns Between Unemployment and Stock Markets

Looking at the past, unemployment rates and stock market performance often move in opposite directions, though they don’t always align perfectly. Understanding these patterns can give investors a clearer picture of the economic environment and help them anticipate how changes in the job market might influence stocks. These trends form the basis for analyzing how markets behave under different economic conditions.

The Inverse Relationship: Low Unemployment, High Markets

In most cases, when unemployment decreases, stock markets rise. During economic growth, falling unemployment often signals stronger demand for goods and services, which boosts corporate revenues and, in turn, stock prices. A robust job market reflects business confidence, which can drive higher stock valuations. However, when unemployment hits very low levels, it can spark inflation concerns and lead to tighter monetary policies, which might slow market momentum. This push-and-pull dynamic often shapes market trends during economic recoveries.

Why Markets Recover Before Unemployment Improves

Interestingly, stock markets tend to bounce back before there’s a noticeable improvement in unemployment rates. This happens because markets are forward-looking - they focus on future profitability rather than current conditions. Investors often bet on recovery well ahead of actual job market improvements, factoring in potential benefits from Federal Reserve policies or operational adjustments by companies. Businesses may begin to see profits rebound even before they ramp up hiring, which explains this early market recovery.

When the Unemployment-Market Relationship Fails

Despite the general trends, there are times when this relationship doesn’t hold up. Events like economic shocks or speculative bubbles can disrupt the usual patterns. In speculative markets, investor behavior might drive stock prices higher, even if economic indicators like unemployment paint a different picture. These exceptions highlight why unemployment data should be just one part of a broader investment strategy, rather than the sole focus.

How to Use Unemployment Data for Market Predictions

Turning unemployment data into actionable investment insights involves understanding how markets react and building a strategy that leverages the strengths of this data while acknowledging its limitations. Investors typically use unemployment figures as part of a broader analytical framework, rather than relying on them alone. This complements earlier discussions on how unemployment trends align with the bigger economic picture.

Market Reactions to Unemployment Surprises

When the Bureau of Labor Statistics releases its monthly employment data - usually on the first Friday of the month - markets can react sharply, especially if the numbers differ significantly from forecasts. These surprise reactions often follow predictable patterns that experienced investors may anticipate.

Markets tend to respond most dramatically when unemployment data contradicts current economic expectations. For instance, an unexpected drop in unemployment during uncertain times can trigger a rally in stock futures, as investors take it as a sign of economic strength. On the flip side, a larger-than-expected rise in unemployment during a recovery can dampen market sentiment quickly.

The scale of the reaction often depends on how much the data deviates from consensus expectations. Minor differences might not move markets much, but significant surprises can lead to heavy trading, particularly in sectors sensitive to economic changes. Initial reactions usually happen right after the release, with further movements unfolding as investors analyze potential Federal Reserve policy shifts and corporate earnings impacts.

Incorporating Unemployment Data into Investment Strategies

To use unemployment data effectively, combine it with other economic indicators - like jobless claims, manufacturing activity, and consumer confidence - to build a more comprehensive analysis.

One approach is to compare unemployment levels to historical averages. For example, when unemployment falls far below its long-term average, it might signal an overheated economy and the likelihood of tighter monetary policy. On the other hand, consistently high unemployment could suggest untapped growth potential and a market primed for recovery.

Sector rotation strategies can also benefit from unemployment trends. When unemployment declines, cyclical sectors such as industrials, materials, and financials often perform well. Conversely, during periods of rising unemployment, defensive sectors like utilities, consumer staples, and healthcare may see stronger performance.

Paying attention to the rate of change in unemployment, rather than just the absolute numbers, can be particularly insightful. A steady decline over several months might indicate a strengthening economy and highlight potential turning points for market trends. Additionally, tracking regional employment patterns can uncover localized opportunities, as areas with faster recoveries may experience stronger market activity.

For rules-based investors, as noted by The Predictive Investor, combining unemployment data with other key indicators can create a more structured and informed decision-making process.

Avoiding Common Pitfalls with Unemployment Data

Using unemployment data effectively requires avoiding common mistakes that can undermine its usefulness. Here are some pitfalls to watch out for:

Treating unemployment as a leading indicator: Unemployment often lags behind broader economic changes. For example, companies may delay rehiring even after conditions improve, waiting for sustained demand before expanding their workforce.

Overreacting to short-term fluctuations: Monthly unemployment numbers can be influenced by seasonal factors, weather, or statistical noise. Focusing on longer-term trends and averages often provides a clearer picture.

Failing to distinguish types of unemployment: Cyclical unemployment, tied to economic downturns, has different implications than structural unemployment, which stems from technological advancements or shifts in industries. Misinterpreting these can lead to flawed conclusions.

Ignoring job quality: Not all job creation is equal. An economy adding mostly part-time or low-wage jobs paints a different picture than one creating high-skilled, well-paid positions. Metrics like the employment-to-population ratio and average hourly earnings can provide crucial context.

Confusing correlation with causation: While unemployment and stock prices often show an inverse relationship, this pattern isn’t guaranteed to hold under all circumstances - especially during periods of unconventional monetary policy or economic disruption.

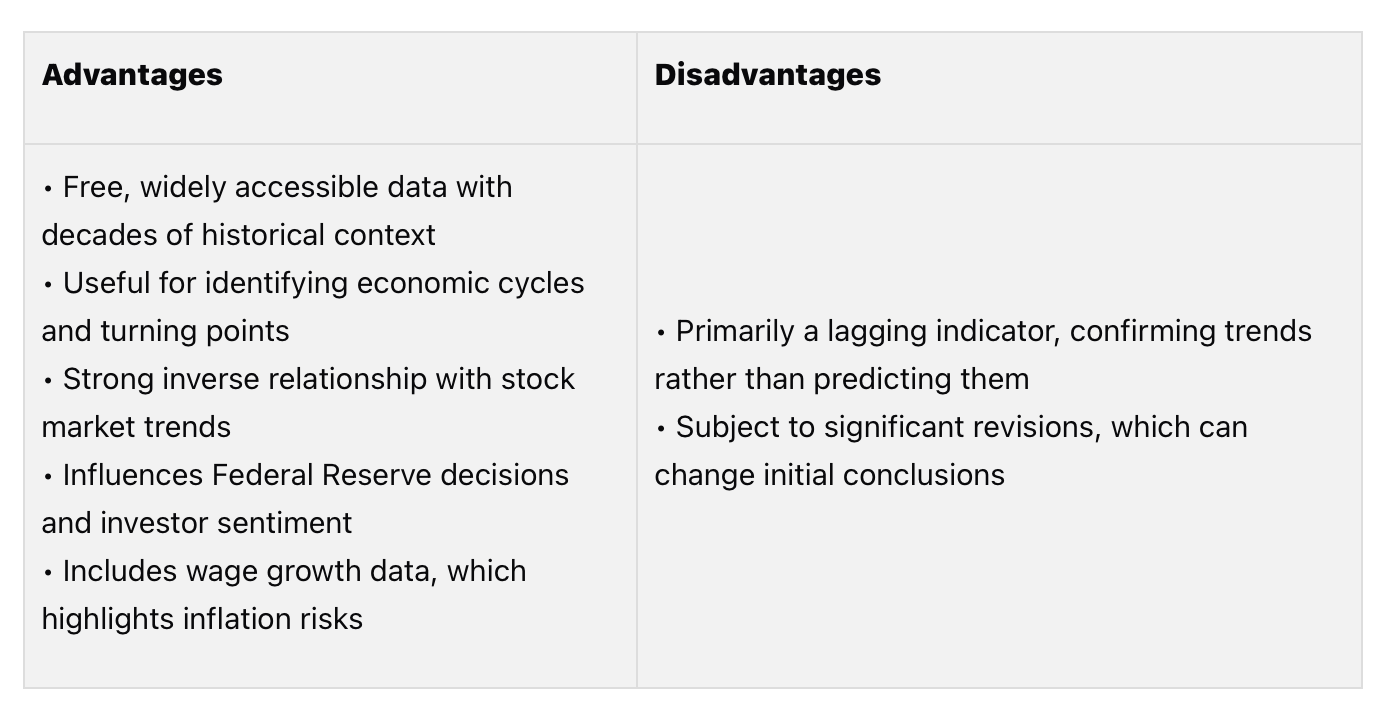

Pros and Cons of Using Unemployment Data

Unemployment data, like any economic indicator, comes with its strengths and limitations. Knowing these trade-offs can help you decide how to use employment statistics effectively in your investment strategy.

Benefits of Unemployment Data for Investors

Unemployment data offers critical insights for market analysis. The Bureau of Labor Statistics provides monthly, government-verified reports with decades of historical information, all freely accessible.

"The jobs report is one of the best insights into the health of the U.S. economy, so it's important investors understand what the report says and how it can impact the markets."Charles Schwab

A declining unemployment rate often aligns with rising stock prices, giving investors a sense of broader market trends. These trends can also hint at Federal Reserve policy shifts. For instance, lower unemployment might signal tighter monetary policies, while higher rates could suggest a more accommodative approach. Additionally, wage growth - such as the 3.9% year-over-year increase reported in July 2025 - can alert investors to potential inflationary pressures.

Drawbacks of Unemployment Data

Despite its usefulness, unemployment data has some notable limitations. One issue is its lagging nature - unemployment figures often improve only after the economy has already begun to recover.

Another challenge is the data's volatility and frequent revisions. For example, the July 2025 report revealed that only 73,000 jobs were added, falling short of expectations. Moreover, previous months’ figures were significantly revised downward, complicating initial interpretations.

Comparison Table: Advantages vs. Disadvantages

Balancing these pros and cons is essential for refining your investment strategy when using unemployment data.

"Understanding how the unemployment rate affects markets and trade is essential to making sound investment decisions. Keeping an eye on the unemployment rate and labor market data can help investors identify opportunities and manage risk." SimpleFX Blog

The real value of unemployment data lies in acknowledging both its strengths and its limitations. While it offers important economic context and correlates with market behavior, it works best as part of a broader, more comprehensive analytical approach rather than being relied on as a single indicator.

Conclusion: Making Better Investment Decisions with Data

Unemployment data plays a significant role in shaping smart investment strategies. Savvy investors know that relying on a single metric won’t reveal the full picture of market trends or the economy’s health.

To gain a clearer market outlook, it’s essential to combine unemployment data with other key indicators like GDP, inflation rates, consumer spending, and signals from the Federal Reserve. This broader perspective allows investors to better anticipate market movements and make well-informed portfolio decisions.

Discipline is crucial in any investment process. It’s important to recognize that unemployment is a lagging indicator - it reflects economic changes rather than predicting them. By integrating it with other metrics, you can manage risks more effectively and identify potential opportunities for growth.

Investors who follow structured, rules-based strategies, such as those advocated by The Predictive Investor, benefit from aligning multiple data points. This approach helps uncover promising growth opportunities while minimizing potential losses.

The aim isn’t to achieve perfect predictions - it’s to make better-informed decisions that increase your chances of long-term success. By understanding the role unemployment data plays within the larger economic framework, you can create a more resilient investment strategy. This approach ensures you’re prepared for market fluctuations while keeping your focus on achieving your long-term financial goals.

FAQs

How can investors use unemployment data and other economic indicators to make smarter investment decisions?

Unemployment data, when viewed alongside other major economic indicators like GDP growth, inflation, and consumer spending, offers a clearer picture of market trends. For example, an uptick in unemployment often points to an economic slowdown, which could prompt investors to shift their attention to more stable sectors such as utilities or healthcare. On the flip side, low unemployment combined with strong GDP growth signals a robust economy, potentially opening doors to investments in growth-focused stocks.

By examining these indicators together, investors can gain a better grasp of economic cycles, validate broader trends, and pinpoint sectors that are likely to offer growth or stability. This integrated approach allows for a more strategic and well-informed investment plan that aligns with the current state of the economy.

Why is unemployment data called a lagging indicator, and how does it influence market predictions?

Unemployment data is known as a lagging indicator because it shows the effects of economic changes that have already taken place. For instance, unemployment rates tend to increase after an economic slowdown has begun and decrease only once a recovery is firmly in progress. This delay makes unemployment figures better suited for confirming existing trends rather than forecasting future market changes.

Although unemployment data on its own isn't the best tool for early warnings, it becomes much more insightful when paired with other indicators. By analyzing how unemployment trends fit into the bigger picture of economic activity, investors can gain a clearer perspective and make smarter decisions about potential market developments.

What mistakes should investors avoid when using unemployment data to predict market trends?

Investors should be cautious about focusing only on headline unemployment figures without factoring in seasonal adjustments. These adjustments are crucial because they can mask underlying trends that offer a clearer view of the job market. It's also essential to differentiate between metrics like U-3 (the official unemployment rate) and broader measures that include underemployment or discouraged workers. These additional metrics give a fuller understanding of the economy's overall health.

Another pitfall is overlooking the fact that unemployment data is a lagging indicator. In other words, it reflects past economic conditions rather than what’s happening now or what’s likely to happen next. Relying on it alone can lead to inaccurate conclusions. To make more informed market predictions, pair unemployment data with other forward-looking indicators and always consider its inherent limitations.