It’s bullish when the Great Depression is trending

Fear returns fast, but opportunity follows even faster

If you’re worried about the market right now, you’re not alone.

Extreme pessimism has taken hold. Andrew Ross Sorkin’s new book about the Great Depression is now the #2 bestseller on Amazon (#1 in the business and money category). And the CNN Fear & Greed index fell from Greed to Extreme Fear in just 11 days.

When investors are reading about breadlines rather than market euphoria, it’s a good sign we’re not at the top.

All this pessimism yet the market hasn’t even corrected that much. What that tells us: volatility shook out some weak hands. Ultimately this is a good thing. Fear presents some of the best opportunities in the market.

Macro Focus

Volatility is fading fast

The VIX has dropped 28% from its recent high. Similar pullbacks in volatility have often marked tradable lows in recent years.

That doesn’t mean we’re immune to further downside, but it does suggest much of the panic has already been priced in. Things simply move faster now in the age of algorithmic trading, and markets reset quickly.

If we do see another leg lower, we continue to view it as an opportunity, not a threat.

Auto loan delinquencies surge

Auto loan delinquencies have hit their highest levels in over a decade as consumers grapple with record-high car prices and elevated borrowing costs. (Read)

It’s hard for me to imagine Carvana keeping its premium valuation in an environment like this.

We flagged the stock’s breakout two years ago at $45. (See our update from July 2023)

The stock rallied nearly 10X since then.

Rate cuts could help. But there are better opportunities elsewhere. Take profits if you haven’t already. Could also be a good short/put option candidate.

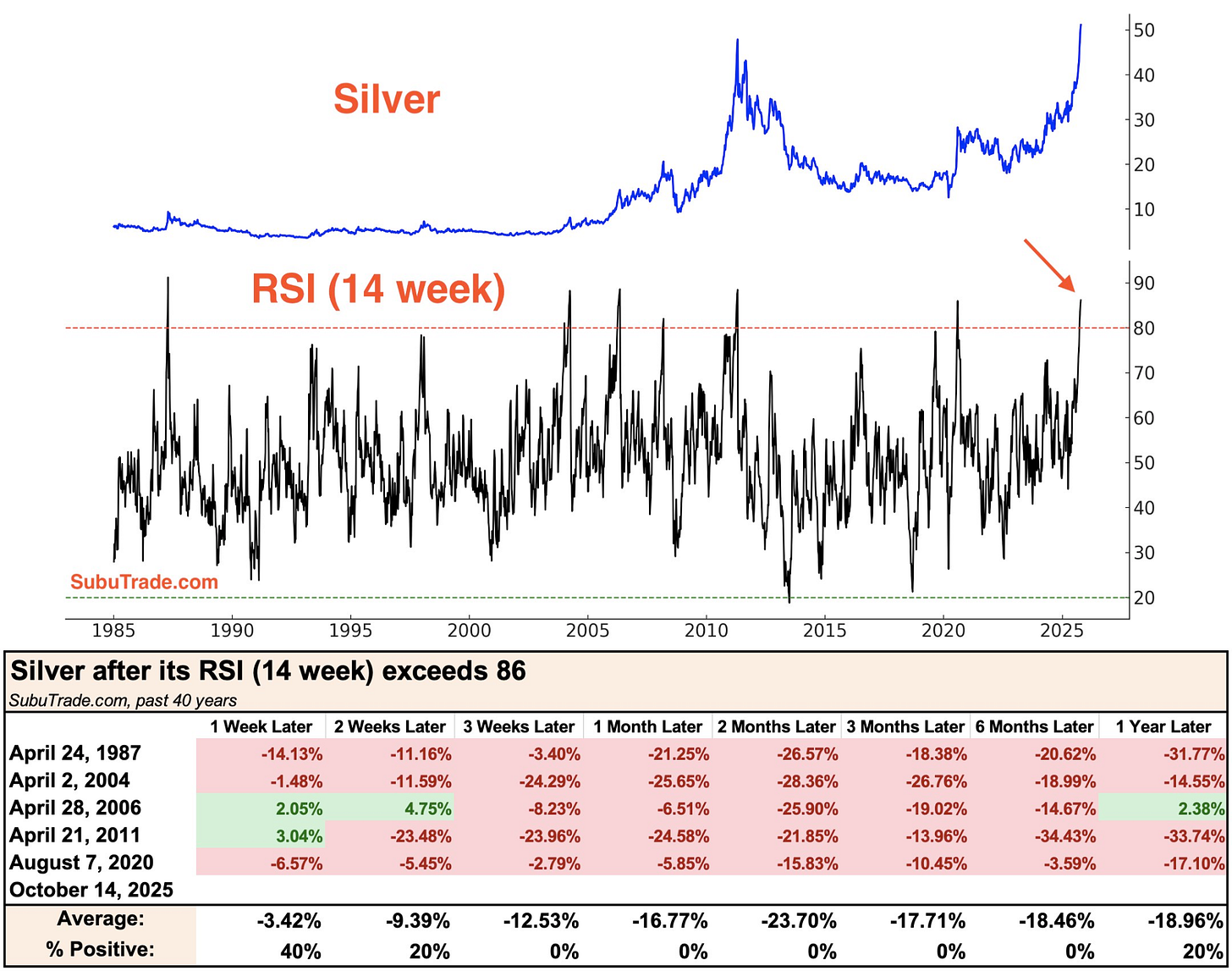

A second chance at silver?

Silver has been on a tear, nearly going parabolic alongside gold. But the metal’s weekly RSI (a momentum measure) is now at one of its highest levels ever, which has historically preceded short-term pullbacks.

That’s good news: we may soon get another opportunity to build exposure.

The long-term thesis remains intact: industrial demand tied to reshoring and electrification, plus the monetary debasement story as deficits grow. If silver cools off, I’ll be ready to pull the trigger, and I’ll share any moves with paid subscribers.

Passive flows still powering the market

Despite short-term volatility, money continues to pour into ETFs. U.S. ETF inflows are on track for a record year, showing that most investors aren’t panicking.

That steady demand provides an important stabilizer beneath the surface, even when headlines scream otherwise.

Portfolio Pulse

As we head into earnings season, there’s very little news on our portfolio companies. Many of you have asked me to track my weekly speculative picks in a portfolio, so I will include that in the next portfolio update.

Final thought

After a strong six-month rally, we’re now seeing short-term challenges, including trade tensions between the U.S. and China, the ongoing government shutdown, and renewed concerns about small regional banks.

But step back and look at the big picture: rate cuts, improving corporate earnings, and fiscal support all remain powerful tailwinds as we head toward 2026.

Our job as investors is to stay focused on companies that can profit regardless of the chaos, and to have a plan ready when volatility gives us another opportunity to buy quality at a discount.