Market Brief - August 4, 2024

Bad news is now bad news

Welcome to The Predictive Investor Market Brief for August 4th, 2024!

For a long time bad news was good news because it represented downward pressure on inflation. Last week that narrative shifted. Bad news is now bad news.

Last week’s selloff was the result of two things:

Mega cap earnings falling short of the high expectations heading into earnings season. When stocks are priced for perfection, even good news is sometimes not enough to sustain high valuations.

Rebalancing of portfolios into bonds. The market is now pricing in more aggressive rate cuts in the wake of higher unemployment.

For our portfolio these two things matter less than the earnings our stocks deliver. But we should expect heightened volatility over the next few months as this plays out.

Here’s our takeaways from the week.

Fed makes another mistake

The Fed was late to raise rates despite bonds selling off because they thought inflation was “transitory”. They are now playing Follow the Leader once again.

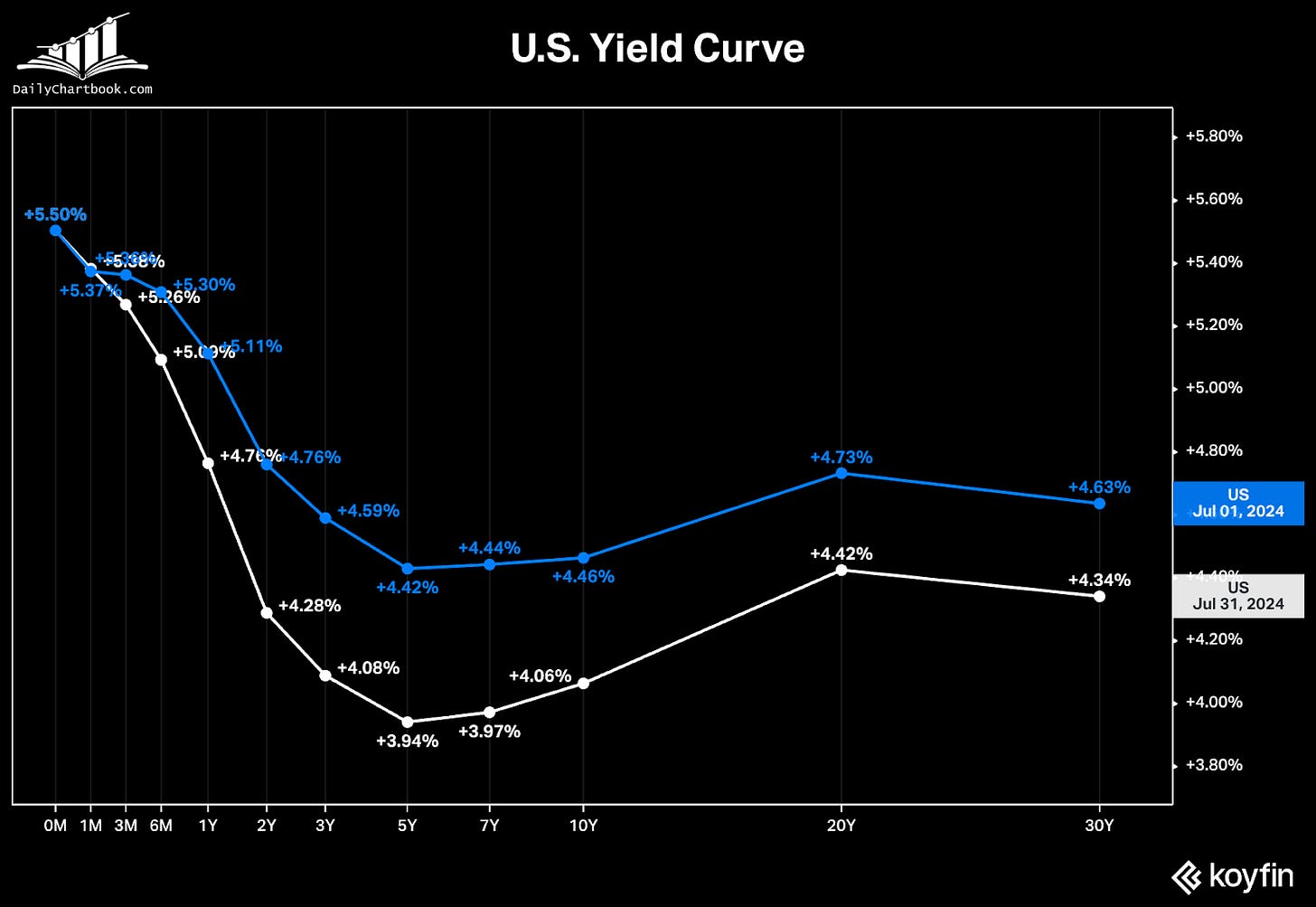

Rates across the yield curve have been falling throughout July.

Evidence of the economy slowing down has been visible for weeks, from real-time inflation data to increasing unemployment, which we highlighted back in June.

Rate cuts have already been priced into stocks. Which means when the Fed finally does cut rates it will be because they see the need to stimulate a weak economy. The current volatility is just a preview of what to expect when that happens.

Interest rate manipulation exposed

A research paper published by Hudson Bay Capital documents how the Treasury has been changing the mix of short-term bills and longer term notes that it issues in order to blunt the effect of interest rate hikes. (Read)

The authors conclude that this activity had the same effect as a one-point cut in the Fed Funds rate. Which explains why so many people who predicted a recession last year were wrong.

Macro forecasting is hard enough, but with increasing government intervention in the economy it has become near impossible. A rules-based approach is critical for active investors.

If you haven’t yet upgraded to paid, it’s not too late. There are plenty of opportunities in this market.

Fear hits an extreme

It was only two weeks ago that we cautioned you to prepare for higher volatility.

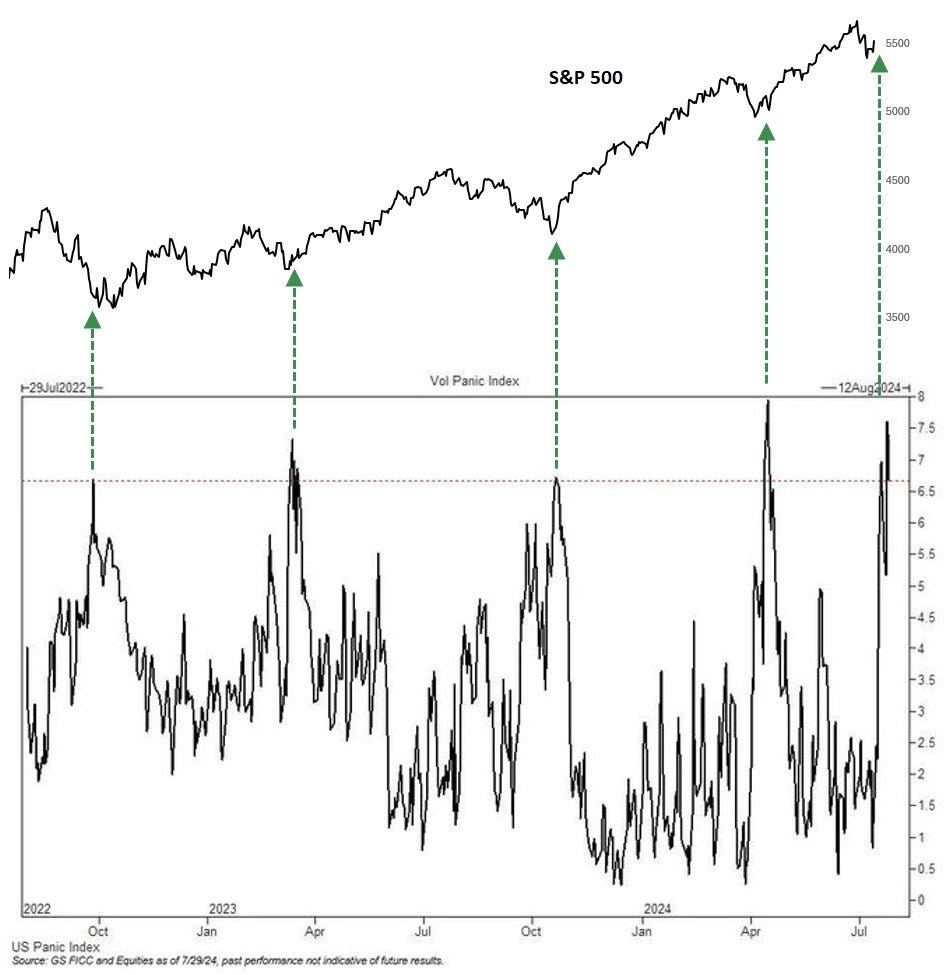

But the fear associated with this selloff seems overdone. The SPX is only down 6% - pretty standard for a pullback.

The Goldman Sachs US Panic Index, which tracks four equity volatility metrics, hit one of the highest levels in the last two years. Spikes of this degree have been previously indicated short-term bottoms in stocks.

We still view this as a short-term correction, but expect higher volatility heading into the Fall.

Downside targets

The last time we had a pullback of this magnitude was in April. The SPX closed the week just between the volume weighted average price from the March high and April low (blue and green lines). This seems like a reasonable level for the market to stabilize. There is also price support at 5260 (March high), about 2% below last week’s close.

If some of the downside momentum wanes next week we will use the opportunity to add to the portfolio. The near-term uptrend will resume when the index trades above the 7/16 AVWAP (red line), currently at 5500.