The Predictive Investor - 11/3/24

Jobs confusion right on cue

Welcome to The Predictive Investor weekly update for November 3rd, 2024!

Three weeks ago I told you to expect some disruption in economic data due to the hurricanes. And right on cue, nonfarm payrolls came in at 12k, far below the 125k that was expected.

Some economists think this gives the Fed more room to cut rates. But I’m not so sure.

The ADP report for private payrolls came in at 233k (vs. 115k expected), the largest gain since July 2023. Initial jobless claims were down slightly, and the unemployment rate was also slightly below expectations.

The economy remains strong and resilient. The market was wrong about the number of rate cuts heading into this year, and I think they’re wrong once again on how aggressive rate cuts will be this cycle.

While the market is pricing in another rate cut this week, the current funds rate is only slightly above the long term average. And the bond market has not been affirming economist expectations for much lower rates, something I’ve been saying for some time now.

Here’s my takeaways from the week.

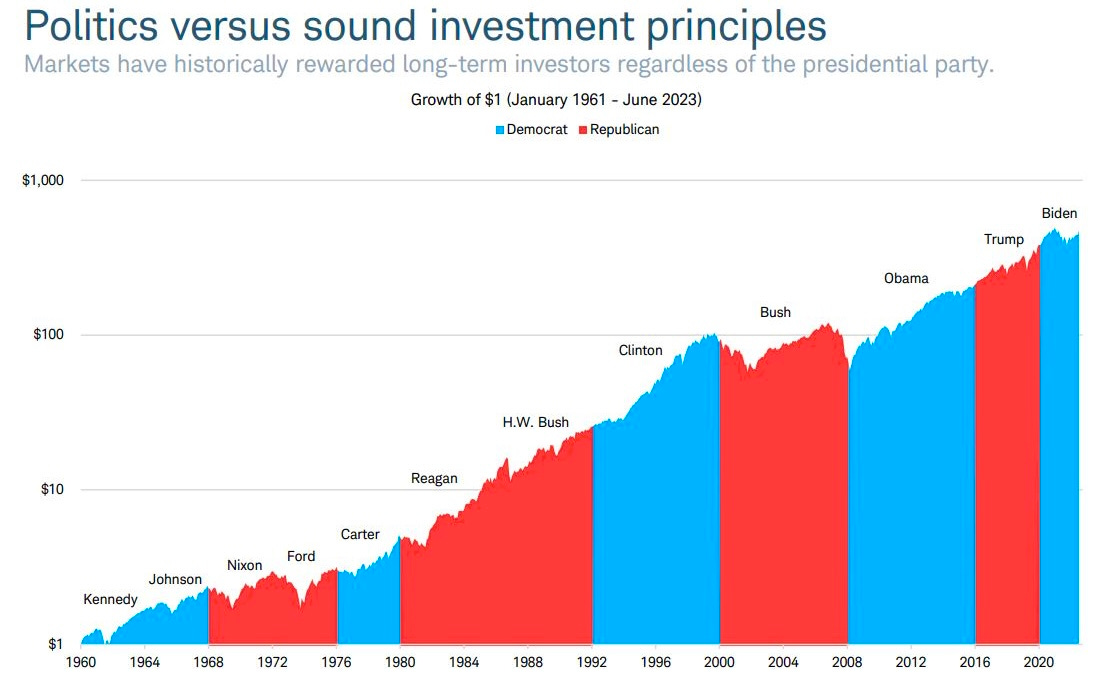

Elections matter less than you think

It’s clear the outcome of the U.S. presidential election is basically a tossup, which means we may not know the winner on Tuesday evening. While that will likely produce some volatility over the short term, don’t let it derail your portfolio.

Volatility is an opportunity. And over the long run, economics matters far more than politics when it comes to stocks.

A rules-based approach, like the one I advocate here, will be your ticket to predictable and repeatable gains in the stock market.

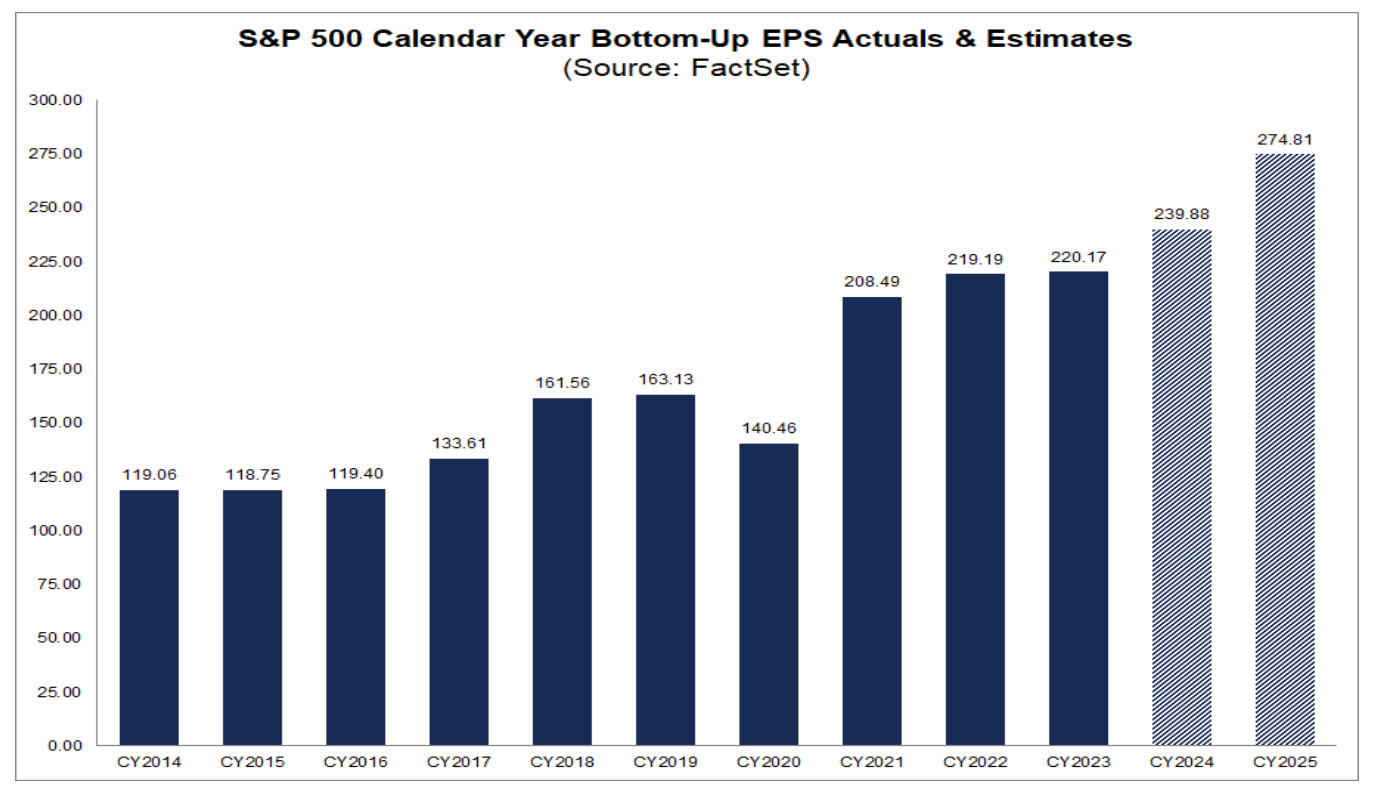

Q3 earnings have been strong

According to Factset, 70% of S&P 500 companies have reported Q3 results, 75% of which have reported a positive EPS surprise and 60% reported a positive revenue surprise.

The blended year-over-year earnings growth rate for the SPX is 5.1%, and if this holds it will be the 5th consecutive quarter of year-over-year earnings growth for the index.

The forward 12-month P/E ratio for the SPX is 21.3 vs. the 5-year average of 19.6. While analysts in the media are harping high valuations, these multiples are justified by actual results.

The rate of earnings growth in 2025 is expected to nearly double that of 2024. Now is not the time to be bearish.

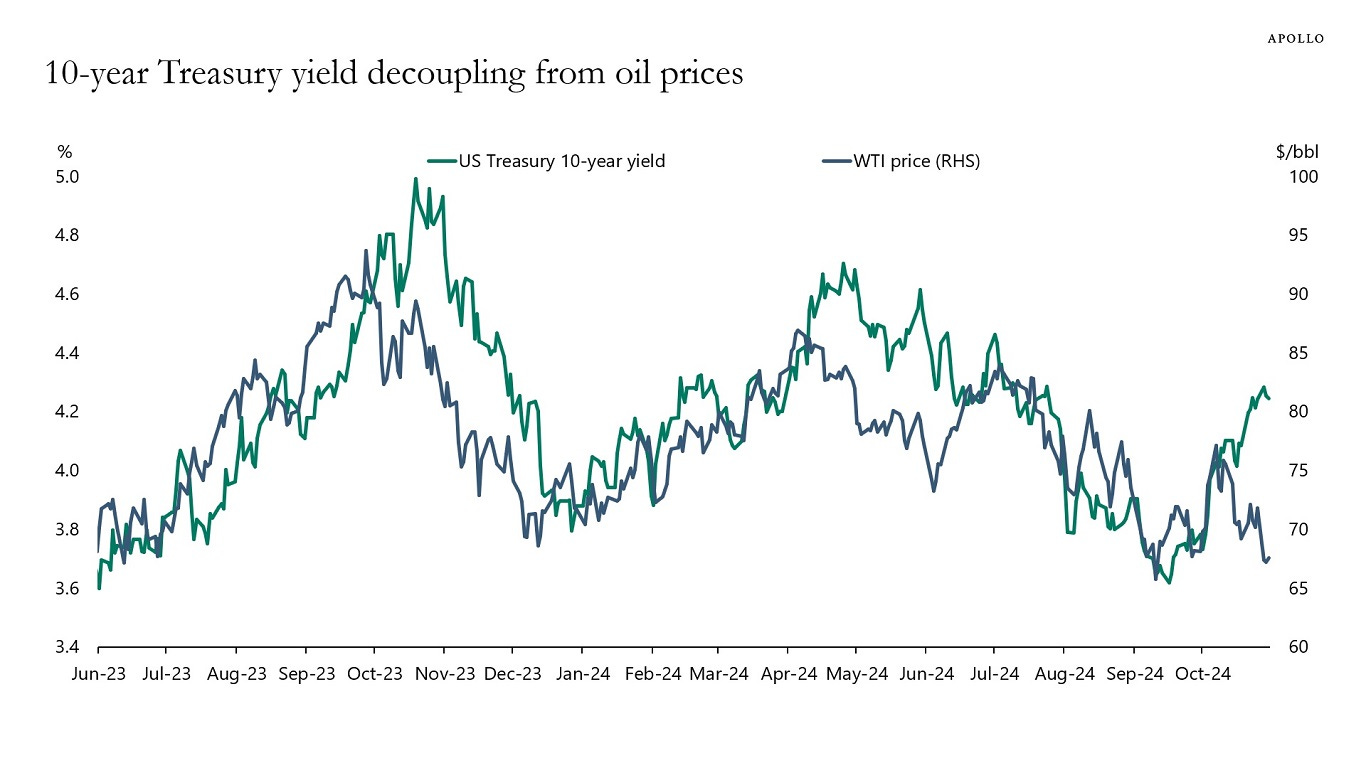

US fiscal nightmare getting harder to ignore

There’s been a divergence between oil and the 10-year yield since the Fed cut rates back in September. Historically yields and oil are positively correlated, since falling oil prices are disinflationary, which is bullish for bonds (and vice versa).

The last two times this happened, yields eventually followed oil. But I don’t think that’s a slam dunk this time around.

Conventional wisdom dictates that a Fed easing cycle is bullish for bonds. But ever since the Fed’s jumbo rate cut, long term interest rates have moved higher. And this is happening globally.

I believe investors are anticipating a continuation of the buildup of government debt, and expect higher rates of return to compensate for a deteriorating fiscal situation.

Does this mean the debt crisis I’ve been warning about is here? Not necessarily. The US can keep this going for much longer than other countries, because the dollar is the world’s reserve currency. When we start to see signs of a debt crisis in other countries (currency devaluations, high interest rates, and spending cuts) we’ll know the day of reckoning is getting closer.

Longtime readers know I’ve been bearish on bonds for some time now. And I’ve been surprised at the amount of pushback I’ve received. But the evidence continues to pile up to support my original thesis.

Zombie apocalypse

TGI Fridays finally filed for bankruptcy protection over the weekend. (Read)

The company has closed more than 100 restaurants over the last year, as they cited fallout from the pandemic as the main factor behind their financial challenges.

The company is privately held, but I would guess the business was close to zombie status, and interest rates were a larger factor than the pandemic.

A zombie company is a business that generates only enough revenue to cover its interest payments. As a result, there’s no cash left over to pay down debt or fund growth.

Near-zero interest rates throughout the 2010s and post-pandemic incentivized companies to defer their financial problems by borrowing money. These companies are now facing a reckoning with the normalization of interest rates.

According to S&P Global, global debt maturities will peak in 2026, with speculative-grade maturities increasing by 4X between 2024 and 2028. Even if rates come down a bit, many of these companies will be forced to restructure.

Unlike the S&P 500, there is no earnings requirement for inclusion in the Russell 2000. As a result 10%-15% of the Russell 2000 are zombie companies, which is why I prefer to select individual stocks over ETFs when it comes to investing in small companies.

Stock Ratings

Every month we highlight some of the top small company stocks outperforming the market. We update buy/sell ratings on previously profiled companies weekly. See the How-To Guide for a complete summary of buy/sell criteria, portfolio management rules, and terms of service.

Rating changes

I changed the rating on TISI 0.00%↑ and GCT 0.00%↑ to Hold. Both report earnings on Thursday, so will assess the results and adjust my rating accordingly next week.