Uncovering Hidden Gems: A Guide to Investing in Micro Cap Stocks

Don't Overlook These Tiny Stocks with Huge Potential

Ready to uncover some hidden gems in the stock market?

Look no further than micro cap stocks - the tiny, overlooked companies that could be hiding some big-time potential. These small companies may be under the radar, but they pack a big punch in terms of potential returns.

In this guide, we'll show you how to find the best micro-cap stocks to buy and avoid the common pitfalls that come with investing in them. Get ready to discover a world of untapped opportunities and learn how to invest like a pro.

What Are Micro Cap Stocks?

First things first: what exactly are micro cap stocks? They're companies with a market capitalization of less than $300 million. That might sound like a lot, but when you consider that some of the biggest companies in the world are worth trillions, you start to get a sense of just how small these guys are.

Now, you might be thinking: "Why bother with these little guys? Isn't it better to invest in established companies with a proven track record?"

Here's the thing: micro cap stocks have historically outperformed stocks of larger, more established companies. Because they're so small, even a small uptick in revenue or a successful product launch can have a big impact on their bottom line.

Of course, there are risks to investing in microcap stocks as well. These companies are often unproven and can be volatile. But with a little bit of research and a willingness to take on some risk, you might just find yourself with a big payoff.

So, how do you go about finding these hidden gems? Well, that's the million-dollar question, isn't it? There are plenty of resources out there, but ultimately, long term success comes down to having a proven rules-based approach.

How To Find Microcap Stocks

As with any other group of stocks, you have a few methods at your disposal to find the best stocks to invest in.

Fundamental Analysis

The traditional method for picking stocks, fundamental analysis involves researching a company's financial statements, industry trends, management team, competitive landscape, and other relevant information to determine the value of the company. While it’s true that fundamentals like earnings drive stock prices over time, the problem with fundamental analysis is that it can be very subjective and requires a significant amount of research to accurately analyze a company’s financial statements and competitive position. Fundamental analysis is often wrong, as unexpected events or changes in the market can impact a company’s financial performance in ways that are difficult to predict.

Technical Analysis

Technical analysis involves evaluating securities by analyzing trends gathered from trading activity, such as price and volume. Technical analysts use charts and other tools to identify patterns and trends in the market and individual securities in order to predict future movements in price. While we often use technical analysis to identify trends, it’s impossible to predict the potential of a company on technical analysis alone. Technical analysis is also highly subjective, and analysts can come to very different conclusions by looking at the same data. While technical analysis is a useful tool to identify supply and demand of shares, it’s best used as a tool to validate other strategies of selecting stocks.

Story Stocks

"Story stocks" refer to stocks of companies that have a compelling narrative behind them, often involving a unique or disruptive business model, innovative technology, or a charismatic founder or CEO. In the post-COVID market, they were often referred to as meme stocks. This is probably one of the worst ways to select stocks. The appeal of story stocks is often emotional rather than rational, as investors are drawn to the excitement and potential of these companies, rather than their current fundamentals or valuations. While the media covered many investors who made millions from story stocks like Gamestop, independent research has since shown that thousands of investors lost money on these stocks. It is also nearly impossible to replicate success, because story stocks involve a high degree of speculation and emotion, and the story often creates high expectations that are difficult for companies to live up to.

Factor Investing

Rather than selecting stocks based on a subjective analysis of individual companies, factor investing involves selecting stocks with specific characteristics that have historically outperformed the market. These factors can include things like value, momentum and quality, among others. Because these factors are quantitative, factor investing is an objective rules-based approach to buying and selling stocks, and we believe it offers investors the best opportunity to build wealth with micro cap stocks. And the best part is there’s extensive research that shows applying factor investing

Is the most efficient way to build a micro cap stocks list that consistently beats the market over long periods of time.

The Best Factors to Screen for Micro Cap Stocks

Ken French and Eugene Fama are well-known economists who have conducted extensive research on the behavior of financial markets. Their research suggests that factors like value and momentum are effective in screening for micro cap stocks with potential to outperform the market.

In their research paper "Size and Value in the Returns of Individual Stocks," they found that small stocks outperformed large stocks, and value stocks outperformed growth stocks over the long term. Additionally, they found that momentum (the tendency of winning stocks to keep winning and losing stocks to keep losing) was also a significant factor in explaining excess stock returns.

These findings suggest that screening for micro cap stocks with a combination of size, value, and momentum factors is an effective strategy for identifying profitable investments in this asset class.

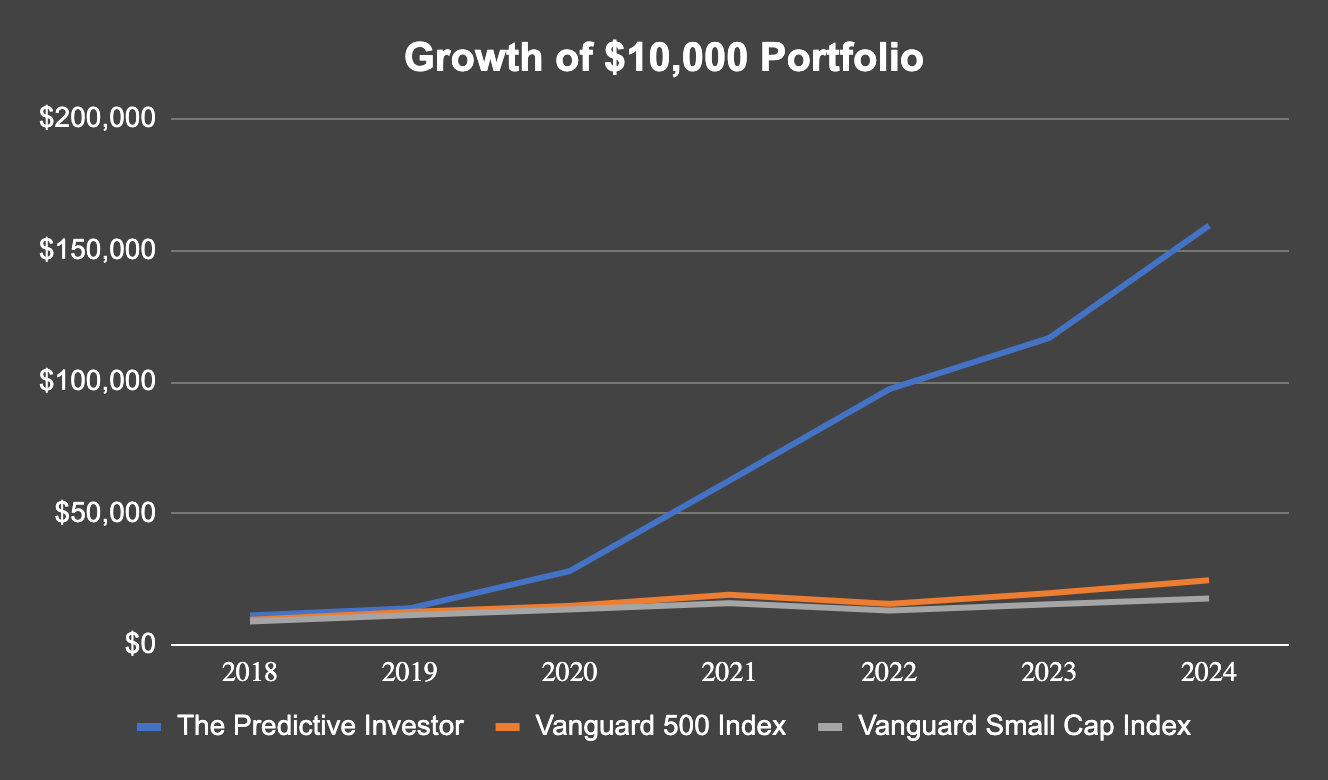

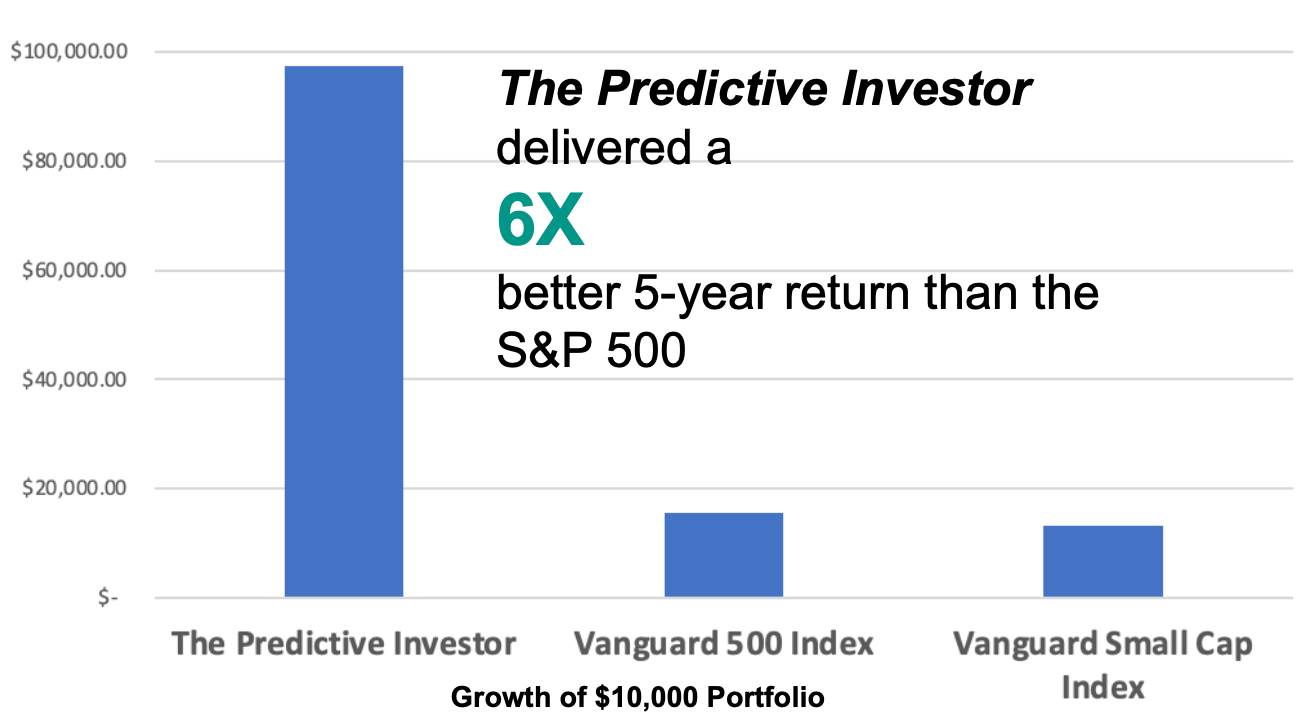

Additionally, our own experience publishing The Predictive Investor newsletter shows the superiority of selecting micro cap stocks based on value and momentum criteria. The chart below shows our 7-year performance against Vanguard’s 500 and small cap index funds. A $10,000 portfolio following The Predictive Investor grew to nearly $160,000 (vs. $25,000 for the S&P 500).

3 Reasons to Invest in Micro Cap Stocks

1. Micro Cap Stocks Are Undervalued

Micro cap stocks are trading at less than half the PE Ratio as the S&P 500. Low PE ratios are correlated with higher future returns, which means micro cap stocks offer significantly better value for your money.

2. Micro Cap Stocks Increase Your Portfolio’s Risk-Adjusted Return

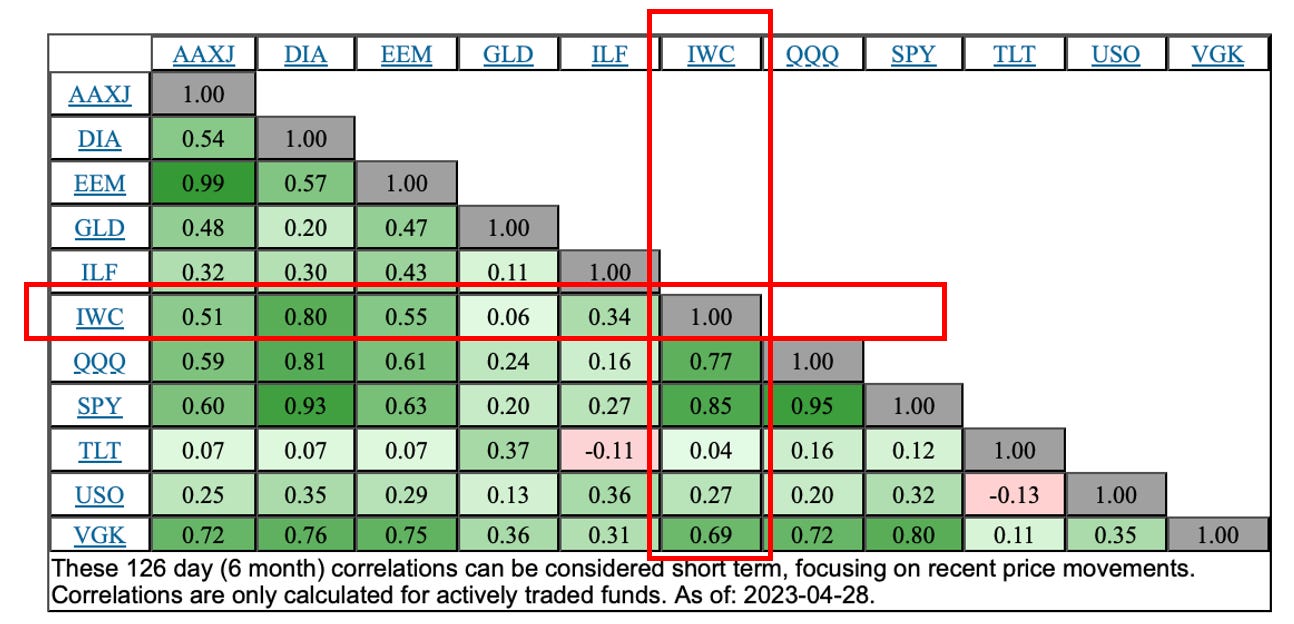

Micro cap stocks, as measured by the iShares Micro-Cap ETF (IWC), increase your portfolio’s risk-adjusted return because they aren’t highly correlated with other asset classes, including other U.S. stocks, foreign stocks, gold and bonds.

This means micro cap stocks tend to move independently of other asset classes and allocating part of your portfolio to smaller company stocks can deliver a more stable return profile with lower volatility.

Source: ETFScreen.com

3. Individual investors have an edge over Wall Street

When it comes to investing in microcap stocks, we believe individual investors have a major edge over Wall Street.

Big institutions simply can't invest effectively in micro cap stocks, because their portfolios are just too darn big.

Think about it - if you're managing billions of dollars, it's not practical to invest in companies with market capitalizations of just a few hundred million dollars. Even if those companies are poised for big growth, the sheer size of the investment required to make a meaningful impact on your portfolio could be too much to justify.

This is why, as Wall Street was flooded with money over the last decade, small cap managers have tilted their portfolios to the larger end of the small company universe. A recent paper published by Oberweis Asset Management showed that the average small cap manager had nearly 53% of their portfolio invested in companies with market caps under $1.5 billion in 2012. That allocation dropped to 24% in 2022.

Because we're investing with much smaller amounts of money, we can be nimble and take advantage of opportunities that bigger players can't touch.

That said, there are many institutional investors with smaller funds that do invest in micro cap stocks. Because micro cap companies have lower average daily volume than large cap companies, this institutional buying is typically visible on a chart, as it typically takes institutional investors several days to complete a purchase, astute individuals can get into the stock just as the big money is positioning itself for a big run up in the stock price.

So if you're looking to beat Wall Street at their own game, consider adding micro cap stocks to your portfolio. With the right factor-based strategy you can easily find the best micro cap stocks to invest in, and you could be well on your way to big returns.

For details on how to implement a factor investing strategy, see our post Factor Investing: The Ultimate Guide for Investors.

Let’s now turn to an example of a recently closed trade from The Predictive Investor newsletter.

Anatomy of a Successful Micro Cap Trade

1. Hallador Energy Co. (HNRG) qualified for purchase in February 2021 under our factor-based criteria. The stock was both undervalued and had strong 12-month price momentum relative to the market.

2. The potential upside was validated by recent price and volume action. Several months of flat price performance with strong volume indicated an accumulation campaign had begun. We purchased the stock at $1.84.

3. The stock went on to increase 554% over the next 21 months, netting our subscribers a massive gain while the rest of the market was tanking.

Every week we scour the market for undervalued micro cap companies with big upside potential. By sticking with a proven rules-based approach you can position yourself for long-term success in this exciting and potentially lucrative corner of the market.

For real-time trade alerts and market analysis sent to your inbox subscribe to The Predictive Investor today!

Are Micro Cap Stocks Risky?

Wall Street measures risk through volatility, and because micro cap stocks are more volatile than the market cap based indexes, they are considered more risky.

But this may not be the best way to assess risk for the individual investor.

One of the metrics Wall Street portfolio managers are measured by is tracking error, or the difference between the returns of a portfolio and its benchmark. A low tracking error indicates that the portfolio is closely aligned with its benchmark, while a high tracking error indicates that the portfolio is deviating significantly from its benchmark.

Wall Street money managers constantly have to report their performance to clients, partners and bosses, and since institutional investors typically prefer steady returns, they cannot afford a portfolio that deviates too far from the market. This is precisely why micro cap stocks, with lower correlation to the rest of the market and more volatile returns, are often overlooked.

But individual investors do not have to operate under the same constraints as Wall Street portfolio managers. Therefore, using volatility as the only measure of risk can lead to a few problems:

Overemphasizing short-term fluctuations: Volatility is a measure of how much a stock's price varies over time. It can be affected by many short-term factors such as market sentiment, news, or rumors. However, these short-term fluctuations may not necessarily reflect the underlying fundamentals of the company. Focusing only on volatility may cause investors to overreact to short-term fluctuations and ignore the long-term prospects of the company.

Ignoring other types of risks: There are other types of risks that can affect a company's long-term prospects, such as economic, industry, or regulatory risks. These risks may not be reflected in the volatility of the stock. By only looking at volatility, investors may overlook these other risks and make an incomplete assessment of the company's overall risk.

Underestimating the potential of high-volatility stocks: High-volatility stocks may have the potential to generate higher returns in the long run. However, investors who only focus on volatility as a measure of risk may avoid these stocks, thinking that they are too risky. As a result, they may miss out on potentially high returns.

The bigger risk for the individual investor is not having enough money to fund a retirement. And the two questions to ask yourself to assess that risk are:

What return do you need to reach your retirement goal?

How much volatility can you handle?

If the average market return is enough to reach your retirement goal, then there is no reason to take on additional risk beyond an index fund or target date retirement fund. But if you need a higher return to reach your financial goals, then it’s important to assess how much volatility you can handle.

For example, our micro cap portfolio historically has outperformed the S&P 500 by nearly 2 to 1, but has also been twice as volatile. If you’re willing to accept that tradeoff, then allocating part of your portfolio to micro cap stocks could be the best way to reach your financial goals.

Bottom Line: Micro Cap Stocks Offer Individuals the Best Opportunity to Beat The Market and Build Wealth Over The Long Run

Investing in microcap stocks can be a high-risk, high-reward strategy. While there are potential benefits to investing in these stocks, such as their potential for explosive growth and the opportunity to capitalize on emerging trends and innovative companies, there are also significant risks, such as volatility.

That being said, for those who are willing to put in the time and effort to research and analyze potential micro cap investments, there can be significant opportunities for profit.

By using the strategies and techniques outlined in this article, individual investors can gain an edge over Wall Street when it comes to micro cap investing.

If you're interested in exploring micro cap investing further, consider a subscription to The Predictive Investor and paper trade the recommendations to understand how these stocks perform on a deeper level.

Sticking to a proven rules-based approach is critical to getting consistent results.

With the right approach and a bit of luck, investing in microcap stocks can be a rewarding and exciting adventure.