Confirmation Bias vs. Data-Driven Investing

Explore how confirmation bias undermines investment decisions and why data-driven strategies lead to more consistent, profitable outcomes.

Investing success often comes down to one choice: relying on emotions or following data. Most investors unknowingly fall into confirmation bias, a mental trap where they seek out information that aligns with their beliefs while ignoring contradictory evidence. This bias can lead to poor decisions, like holding onto losing stocks or missing better opportunities.

On the other hand, data-driven investing uses objective rules and analysis to guide decisions, avoiding emotional pitfalls. Studies show that emotion-driven investors underperform the S&P 500 by 4.4% annually, while data-driven strategies can outperform peers by up to 20% yearly.

Here’s the key difference:

Confirmation bias leads to selective information use, overconfidence, and risky decisions.

Data-driven investing ensures consistency, better risk management, and improved returns through predefined rules and systematic analysis.

If you want to improve your investing outcomes, shifting to a disciplined, data-based approach is critical. Below, we’ll explore how confirmation bias impacts decisions, why data-driven methods work better, and actionable steps to implement them.

What is Confirmation Bias?

What is Confirmation Bias in Investing?

Confirmation bias pushes investors to favor information that supports their existing beliefs while ignoring anything that contradicts them. This mental shortcut can derail even the most carefully planned investment strategy, often leading to poor outcomes.

In practice, confirmation bias narrows an investor’s focus. They might cherry-pick news articles, analyst opinions, or market data that align with their views about a particular stock or strategy, while dismissing warning signs that challenge their perspective.

"Confirmation bias is the inclination to seek out, interpret, and recall information in a manner that reinforces one's existing beliefs or assumptions. In investing, this psychological phenomenon can lead investors to make decisions based on inaccurate, misinterpreted, or inappropriate information."

Here’s how it typically plays out: Imagine an investor who is optimistic about a company. They’ll zero in on glowing earnings forecasts, positive industry trends, or upbeat management remarks. But when negative news, like a competitor gaining ground or regulatory risks, surfaces, they might brush it off as temporary or irrelevant.

Take this real-world scenario: An investor firmly believes fixed deposits are better than debt mutual funds. They’ll focus on reports of bond downgrades or rising yields that hurt debt fund performance, reinforcing their preference for fixed deposits. This mindset may cause them to miss out on higher returns or tax benefits offered by debt funds. Similarly, an investor emotionally tied to a company may dismiss poor earnings as "one-time events" or blame falling stock prices on general market volatility, even when broader trends suggest otherwise.

Understanding how this bias works can help uncover its telltale signs.

Common Signs of Confirmation Bias

Spotting confirmation bias in your own investing habits can be tricky because it often feels natural. But there are a few patterns to watch for:

Selective information consumption: If you only follow financial news or sources that align with your views, you may be falling into this trap.

Overconfidence in specific stocks or sectors: Believing you’ve found the "next big thing" can lead you to interpret every piece of news as validation, while ignoring red flags like high valuations or competitive threats.

Dismissing negative data: It’s common to explain away poor results as "temporary" or "one-offs" without considering deeper issues.

Blindly following trends: In bull markets, you might focus only on data supporting the rally, while in bear markets, you could cling to pessimistic outlooks without independent analysis.

Asking biased questions: Instead of probing for risks - like "What could go wrong with this investment?" - you might frame questions to confirm your optimism, such as "Why is this such a great opportunity?"

These behaviors can distort your judgment and lead to poor investment decisions.

Risks of Confirmation Bias in Investing

The financial consequences of confirmation bias can be severe. One major risk is missed opportunities. By sticking to preconceived notions, you might overlook investments outside your comfort zone - like a value investor ignoring growth stocks, or vice versa.

Another issue is poor diversification. Overconfidence in a single stock, sector, or strategy often leads to concentrated portfolios, which are more vulnerable to market swings and specific risks.

Holding onto losing investments is another common pitfall. Instead of reevaluating objectively, investors may cling to underperforming stocks, justifying their decisions even as evidence piles up against them.

This bias also increases portfolio risk. Believing in their superior insight, investors may take outsized positions that defy sound risk management, resulting in heavy losses when their assumptions prove wrong.

History offers stark examples of confirmation bias at work. During the dot-com bubble, many investors ignored traditional valuation metrics, instead embracing the "new economy" narrative. This selective focus blinded them to clear signs of overvaluation, leading to significant losses when the bubble burst.

Ultimately, confirmation bias fuels emotional decision-making, causing impulsive reactions during volatile markets. Instead of following a disciplined, data-driven approach, investors may let their emotions take the wheel.

Warren Buffett summed up the danger well, quoting Charles Darwin:

"Charles Darwin used to say that whenever he ran into something that contradicted a conclusion he cherished, he was obliged to write the new finding down within 30 minutes. Otherwise his mind would work to reject the discordant information, much as the body rejects transplants. Man's natural inclination is to cling to his beliefs, particularly if they are reinforced by recent experience - a flaw in our makeup that bears on what happens during secular bull markets and extended periods of stagnation."

The Principles of Data-Driven, Rules-Based Investing

Emotions and biases often cloud investment decisions, leading to inconsistent outcomes. Data-driven, rules-based investing flips the script by taking emotions out of the equation. Instead of relying on gut feelings or cherry-picked data, this approach uses predefined, thoroughly back-tested rules to guide every decision.

The key distinction here is objectivity. Traditional investing often leans on subjective judgment, influenced by personal opinions or market speculation. In contrast, data-driven investing adheres to a strict framework, ensuring decisions are consistent and repeatable.

This systematic method removes much of the guesswork that can trip up investors. Unlike discretionary investing - where two analysts might interpret the same stock differently - rules-based investing applies uniform, data-backed logic. It leverages algorithms to analyze fundamentals, technical indicators, and asset allocation while scanning thousands of stocks to identify patterns and manage risk.

These algorithms sift through massive datasets, identifying assets that meet specific criteria and flagging potential risks. This level of analysis, impossible to achieve manually, enables investors to uncover opportunities and avoid pitfalls with precision.

Core Benefits of Data-Driven Investing

The benefits of this systematic approach extend far beyond just removing emotional biases.

One of the standout advantages is consistency. Traditional investing often produces uneven results, swayed by an investor's mood, recent experiences, or market sentiment. Data-driven strategies, on the other hand, follow a structured process that maintains the same analytical rigor, whether markets are booming or crashing.

Another major benefit is better risk management. Rules-based strategies come with built-in safeguards, such as predefined stop-loss orders, position sizing, and portfolio rebalancing. These measures ensure that losses are cut at predetermined thresholds, avoiding the temptation to hold onto losing positions.

Diversification is also enhanced. Instead of over-concentrating on personal preferences or trendy stocks, data-driven methods objectively pinpoint opportunities across various sectors, market caps, and investment styles. This approach consistently delivers more balanced portfolios and superior risk-adjusted returns.

How Rules-Based Strategies Work

Rules-based investing takes these benefits and translates them into actionable strategies. It revolves around quantitative criteria and structured processes to guide stock selection and portfolio management. The foundation is clear entry and exit rules, often based on technical indicators, fundamental metrics, or asset allocation principles.

Take the Coffee Can Rule, for instance. Introduced by Robert Kirby in 1984 and later refined into a structured strategy, it uses metrics like Return on Capital Employed (ROCE) and Net Sales Growth for stock selection. When backtested from 1999 to 2017, this rule achieved a 24% annual return.

Another example is FidelFolio's Rule 13-14-24-20-8-11-C, which targets companies with a 20% Return on Equity (ROE) and 8% Operating Profit Growth in at least 11 of the last 13 years. Backtesting this method from 1999 to 2021 showed a 21% annual return with a 13% standard deviation in risk.

Before implementation, these rules undergo rigorous backtesting using historical data. This step validates their effectiveness and fine-tunes parameters.

Risk management is central to these strategies. Strict stop-loss levels and position sizes are set to protect capital, ensuring that decisions are based on data rather than emotional attachment to specific investments.

Transparency and repeatability are other hallmarks of this approach. Every decision can be traced back to clearly defined criteria. Modern technology makes it possible to continuously apply these rules, allowing for incremental portfolio adjustments as market conditions shift. This real-time fine-tuning helps capture opportunities and mitigate risks that might be overlooked with traditional, periodic reviews.

Comparing Confirmation Bias and Data-Driven Investing

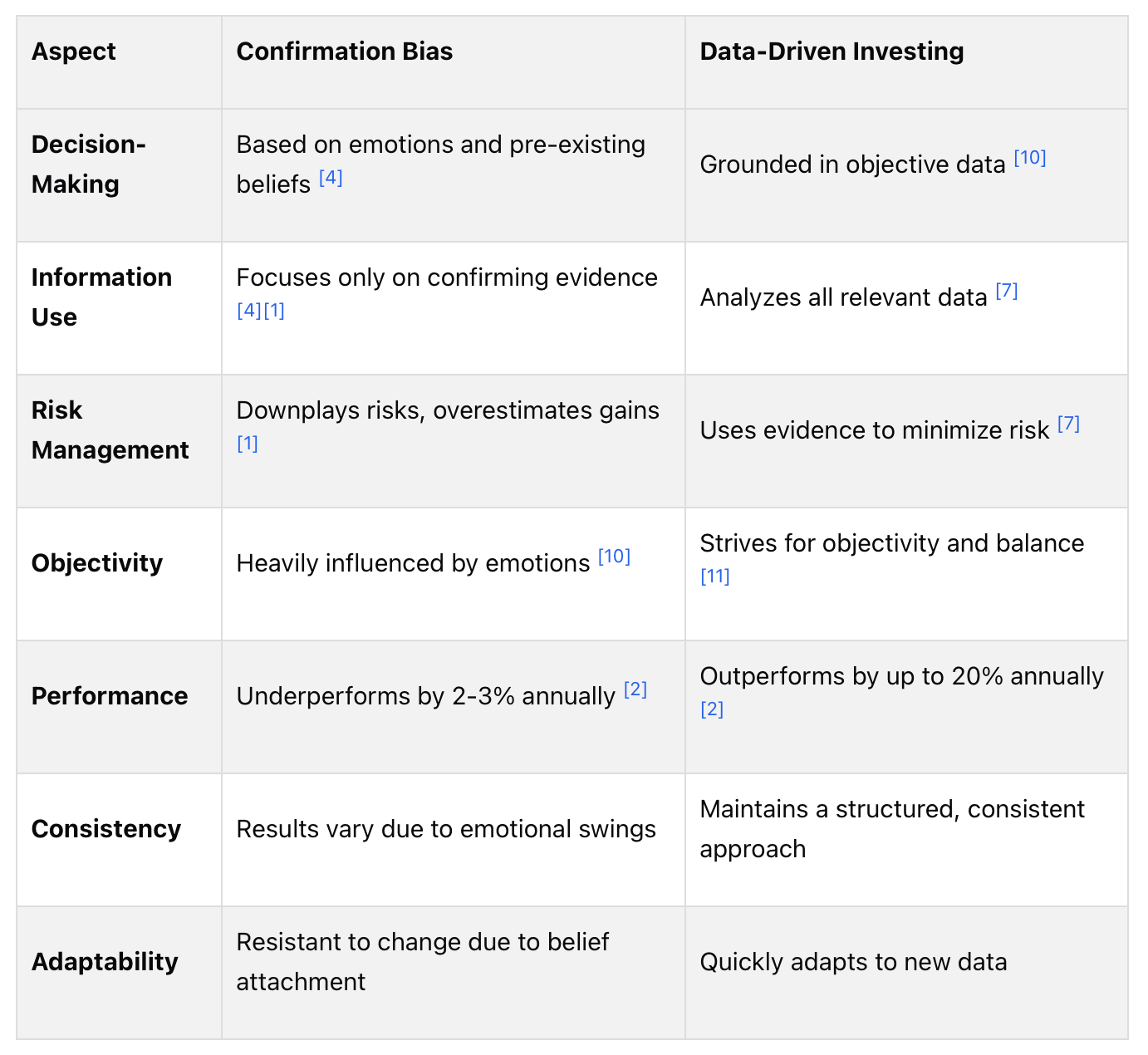

Let’s break down how confirmation bias and data-driven investing stack up when it comes to decision-making, processing information, and portfolio performance. These two approaches couldn’t be more different, and understanding their contrasts highlights their practical impact on investment outcomes.

How Decisions Are Made

Confirmation bias leads to decisions rooted in personal beliefs and emotions, often ignoring hard evidence. In contrast, data-driven investing is all about sticking to the facts. Decisions are guided by measurable, objective criteria rather than gut feelings or opinions.

Information Processing: What Gets Considered?

Investors swayed by confirmation bias tend to cherry-pick data that supports their pre-held views, creating blind spots that can lead to poor outcomes. On the flip side, data-driven strategies take a broader approach, analyzing all relevant information to uncover meaningful patterns.

Risk Management: A Key Difference

When it comes to managing risk, the differences are stark. Confirmation bias often causes investors to underestimate risks and overestimate potential returns. This emotional tilt can lead to costly mistakes. Data-driven investing, however, relies on structured analysis and evidence to minimize risk and avoid such pitfalls.

Real-World Performance: The Numbers Don’t Lie

The impact of these approaches becomes clear when looking at portfolio performance. Individual investors, often driven by emotion, underperformed the S&P 500 by an average of 4.4% annually due to poorly timed trades and impulsive decisions. In 2024, the average equity investor fell behind the S&P 500 by a staggering 848 basis points, again highlighting the cost of behavior-driven errors. In contrast, investors leveraging data-driven platforms have been shown to outperform their peers by as much as 20% annually.

A classic example of confirmation bias at work is the dot-com bubble of the late 1990s and early 2000s. Investors became overly optimistic about internet companies, driving stock prices to unsustainable levels without properly evaluating their actual value. Those who relied on data-driven analysis, however, were better equipped to avoid the crash and its devastating financial consequences.

As Warren Buffett famously said, "We don't have to be smarter than the rest. We have to be more disciplined than the rest.". This discipline is at the heart of data-driven investing, and it’s what sets it apart.

A Quick Comparison: Confirmation Bias vs. Data-Driven Investing

The numbers speak for themselves: emotion-driven investing underperforms by an average of 2-3% annually, and fewer than 10% of actively managed funds consistently beat the market. Why? Because traditional strategies often fail to make the most of data.

Strategies to Overcome Confirmation Bias Using Data-Driven Methods

Breaking free from confirmation bias means reshaping how you approach investment decisions. Data-driven strategies offer a clear, structured way to make more objective, disciplined choices. By focusing on measurable evidence and systematic processes, you can move from recognizing bias to making smarter, fact-based decisions.

Practical Steps to Minimize Bias

A well-defined framework can help take the guesswork out of investing. Here are some actionable strategies to keep your decisions grounded in data:

Define Specific, Measurable Goals

Set goals that are clear and quantifiable. For instance, aim for a 12% annual return over five years or save $500,000 for retirement by age 60. These benchmarks keep your focus on the numbers rather than getting swayed by emotions or market chatter.

Actively Challenge Your Assumptions

Seek out viewpoints that differ from your own. Read analyses that contradict your beliefs, and be open to new perspectives during investment discussions. As Charlie Munger famously said: "If you don't change your thinking and ideas 180 degrees at least once a year, you are not thinking enough!" - Charlie Munger

Leverage Stock-Screening Tools

Use tools that filter investments based on strict, predefined criteria. For example, you might screen for companies with a return on equity above 15%, a debt-to-equity ratio under 0.5, and consistent earnings growth. This approach minimizes the risk of favoring stocks that simply align with your existing views.

Set Rules for Entry and Exit

Establish clear guidelines for when to buy or sell. For example, decide to invest 20% of your available cash if the market drops 5%, or use trailing stop-loss orders to automate your exits. These rules help eliminate emotional decision-making.

Review Your Portfolio Regularly

Schedule periodic reviews - such as quarterly check-ins - to reassess your investments using the latest data. Ask yourself what new evidence might prompt you to adjust or sell a position, ensuring your decisions are based on up-to-date information rather than outdated assumptions.

Control Emotional Reactions

Avoid obsessively monitoring the markets or consuming excessive financial news. Set realistic expectations and stick to your plan. By managing your emotions, you can make more thoughtful, data-backed decisions.

Each of these steps encourages a shift from subjective thinking to a more disciplined, evidence-based approach.

How The Predictive Investor Avoids Confirmation Bias

Taking these strategies a step further, our strategy at The Predictive Investor is designed to help investors avoid emotional pitfalls. Our rules-based approach focuses on quantifiable data and predefined criteria to guide investment decisions, removing much of the guesswork and bias.

For example, The Predictive Investor uses factor-based research to ground stock recommendations in objective metrics like earnings growth, revenue trends, and market positioning. Instead of chasing market hype or gut instincts, this approach ensures every decision follows a logical, consistent framework. In short, we treat investing as a disciplined process, helping subscribers develop the mindset needed for long-term success.

Conclusion: Choosing a Smarter Path to Investing Success

The way you approach investing directly shapes your financial future. Time and again, data-driven investors prove they can outperform those who rely on emotions.

Research shows that emotion-driven investors underperform the S&P 500 by several percentage points annually, which can snowball into significant long-term losses . Over time, this gap can translate into hundreds of thousands of dollars left on the table.

Data-driven strategies offer a clear way to avoid these costly mistakes. Studies reveal that organizations focused on data are three times more likely to achieve measurable results. In the world of investing, those who leverage data-driven platforms can outperform their peers by as much as 20% annually.

Making the shift from emotional to systematic investing takes discipline. The most successful investors stick to predefined rules, rely on objective criteria, and execute their strategies consistently. By removing subjectivity, they set themselves up for better long-term outcomes.

The Predictive Investor demonstrates how a rules-based, data-driven approach can replace emotion-fueled decision-making. With insights grounded in quantifiable data, it helps investors steer clear of the emotional traps that often derail portfolios. Its factor-based research and systematic framework ensure every recommendation is built on logic and consistency, addressing common biases like confirmation bias. This structured approach not only eliminates rash, emotion-driven trades but also lays the foundation for steady, long-term growth.

Ultimately, success in investing comes down to challenging your assumptions, trusting the data, and following proven strategies. The choice is clear: stick with emotion-driven decisions, or embrace a disciplined, data-backed method that delivers consistent results.

FAQs

What is confirmation bias in investing, and how can investors avoid it?

Confirmation bias happens when investors gravitate toward information that aligns with their existing beliefs while dismissing evidence that challenges them. This mindset can result in poor choices and overlooked opportunities.

To counter this bias, it’s crucial to intentionally explore opposing viewpoints, rely on diverse information sources, and critically assess investment strategies on a regular basis. Adopting a data-focused, rules-based investing approach can help ground decisions in facts rather than emotions or assumptions. Additionally, staying receptive to fresh ideas and keeping a long-term outlook are essential steps in overcoming this widespread bias.

How can I shift from emotional investing to a data-driven strategy?

To shift from emotional investing to a more data-driven approach, start by establishing specific, rules-based criteria for your investment decisions. This approach helps you stay consistent and avoid making impulsive choices. Before implementing these rules in actual markets, use historical data to test their reliability and effectiveness.

Leverage automation and quantitative tools to minimize emotional bias and focus on objective analysis. Make it a habit to regularly evaluate and refine your strategy, guided by measurable performance metrics. Staying disciplined and committed to long-term goals will help you make rational, well-informed decisions and steer clear of the traps set by emotional investing.

How does a data-driven approach improve risk management in investing?

A data-driven approach takes risk management to the next level by offering clear, actionable insights grounded in objective analysis rather than relying on subjective judgment. With the power of data, investors can spot potential risks early, identify hidden weaknesses, and make smarter decisions to address them effectively.

Traditional methods often lean on intuition or incomplete information, leaving gaps in understanding. In contrast, a data-driven strategy provides a broader, more proactive perspective, minimizing the likelihood of unexpected setbacks and improving overall investment outcomes.