Interest Rates vs. Sector Performance

How interest rate moves shift sector returns: higher rates often boost financials and energy, while healthcare and consumer staples provide defensive stability during cuts.

When interest rates change, sectors in the stock market react differently. As of December 2025, with rates at 3.75%-4.00%, here are the key takeaways:

Winners in High-Rate Environments: Financials benefit as higher rates increase profit margins. Energy may also perform well if rates signal economic growth.

Sectors Under Pressure: Utilities and real estate struggle due to high borrowing costs. Consumer discretionary businesses often face reduced spending as credit becomes more expensive.

Resilient Sectors: Healthcare and consumer staples remain steady because demand for essentials doesn’t waver with rate changes.

Historical Insights: Rising rates have often coincided with S&P 500 gains, but sector-specific trends vary. For instance, banks thrived during the 2022 rate hikes, while utilities underperformed.

Understanding these patterns can help you align your portfolio with rate-driven trends. Focus on financials and energy during hikes, while healthcare and consumer staples offer stability during cuts.

These sectors could benefit most from a Fed rate cut

How Interest Rate Sensitivity Affects Different Sectors

The way sectors respond to interest rate changes often depends on their debt levels, cash flow stability, and overall business models. Industries that rely heavily on borrowing tend to feel the strain more acutely, while those with minimal debt and steady cash flows are less affected. Let’s explore how various sectors, from utilities to financials, react when interest rates shift.

When the Federal Reserve adjusts rates, the ripple effects can be strikingly different across industries. For instance, during the 2022 rate hike cycle - when the Fed raised rates by 425 basis points at its fastest pace since the early 1980s - banks saw their net interest income grow by 17.9% year-over-year by the first quarter of 2023. Meanwhile, debt-heavy sectors like utilities faced mounting financing costs, showing just how much rate changes can reshape the financial landscape.

Utilities and Interest Rates

Utilities are particularly sensitive to rate changes because they rely heavily on debt to fund massive infrastructure projects, like building power plants or maintaining water systems. When borrowing costs rise, profit margins take a hit. On top of that, utility stocks often serve as bond substitutes for investors. As Treasury yields climb, investors may shift their money away from utilities, putting pressure on stock prices.

The numbers tell the story. Between 1973 and 2024, utilities consistently underperformed the broader market by 7.6 percentage points in the 12 months following the first rate cut in various cycles. This trend reflects how rate cuts often coincide with weakening economic conditions, which can reduce demand for utility services. However, utilities with lower debt or better financing terms may handle rising rates more effectively.

Financials: Winners in a High-Rate Environment

The financial sector often thrives in a high-rate environment. Rising rates widen net interest margins (NIM) - the difference between what banks earn from loans and what they pay depositors. As lending rates climb faster than deposit rates, banks’ profits grow.

Past rate cycles highlight this advantage. During the 2004 rate hike cycle, banks’ median net interest income grew by 6.2%, more than double their usual rate of growth. In the 2022 cycle, this figure soared to 17.9% by early 2023. Higher rates can also encourage borrowers to prioritize repayment, improving loan quality and further boosting profitability. However, falling rates shrink NIM, with banks underperforming by 8.2 percentage points after rate cuts. Additionally, if the yield curve flattens or inverts - where short-term and long-term rates converge - the NIM advantage diminishes.

Telecommunications and Materials

Telecommunications companies also carry significant debt due to their need to invest in infrastructure like cell towers and fiber optic networks. However, they have more pricing flexibility than utilities, allowing them to pass higher costs onto customers through increased service fees. Their diversified revenue streams also help soften the blow of rising rates. Still, historical data shows a 1.9 percentage point underperformance for telecom companies following rate cuts.

Materials companies, which include mining, chemical manufacturing, and construction materials, face a different dynamic. Rising rates increase borrowing costs, but they can also signal strong demand for raw materials. If higher rates reflect an overheating economy with growing inflation, materials companies may benefit from increased demand and pricing power. On the other hand, if rates rise to combat inflation without accompanying economic growth, these companies face challenges. Materials underperformed the broader market by 3.2 percentage points in the year after the first rate cut, reflecting their vulnerability to broader economic shifts.

These examples highlight that interest rate sensitivity isn’t just about debt levels. Factors like global demand, pricing power, and the reasons behind rate changes all play a role in shaping how industries respond.

Sectors with Low Interest Rate Sensitivity

Certain sectors maintain steady performance regardless of interest rate shifts, making them reliable options during periods of market volatility. These industries focus on essential goods and services, which tend to remain in demand regardless of borrowing costs or economic conditions. Let’s explore how healthcare and consumer staples provide this stability.

Healthcare: Resilience in Any Environment

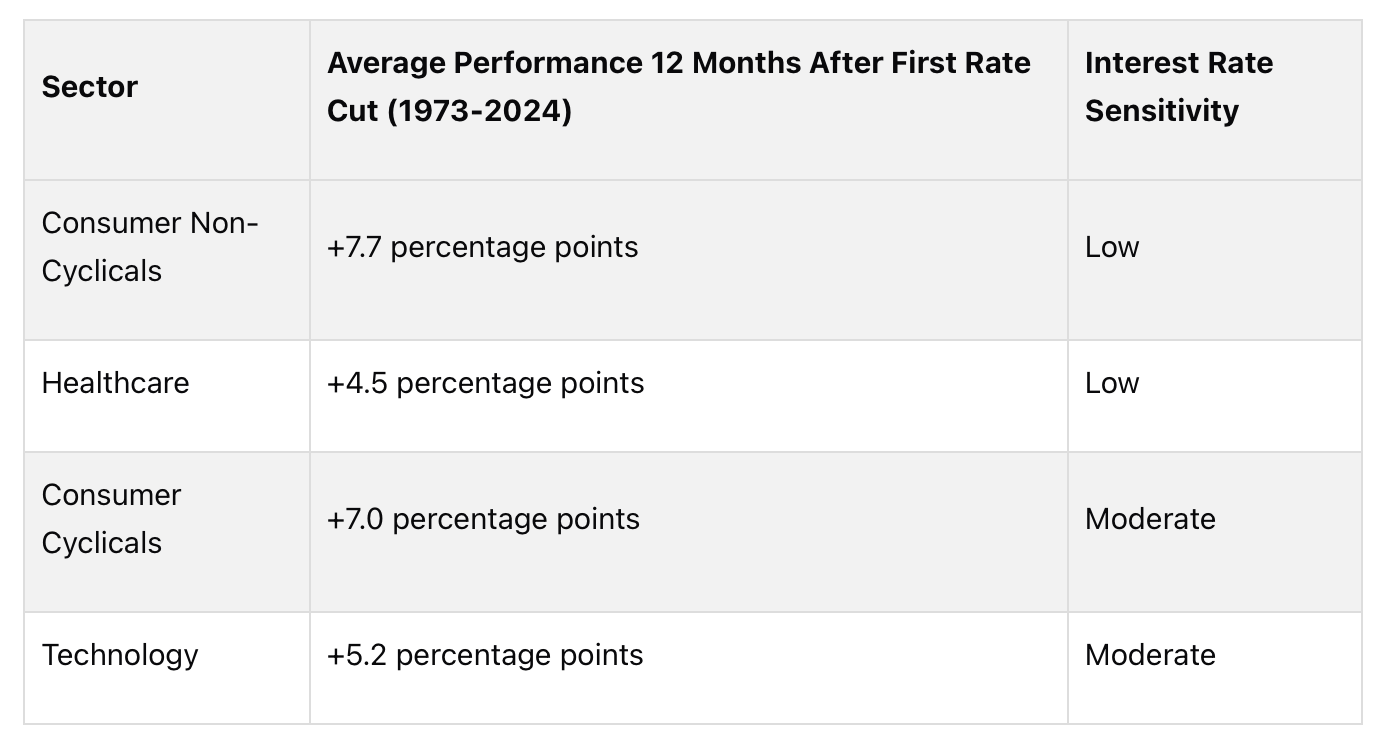

Healthcare is consistently one of the most dependable sectors, performing well across varying interest rate environments. Between 1973 and 2024, healthcare stocks outpaced the broader market by an average of 4.5 percentage points in the 12 months following the first rate cut. This reliability stems from the consistent demand for medical services, which ensures stable cash flows. Hospitals continue treating patients, pharmaceutical companies keep selling medications, and medical device manufacturers supply vital equipment - none of which slows down due to changes in interest rates.

Another factor supporting healthcare’s steadiness is innovation. Advances like new drug approvals and breakthroughs in medical technology drive growth on timelines that are mostly unaffected by monetary policy. This allows the sector to remain a strong performer even during periods of economic or financial uncertainty.

Consumer Staples: A Reliable Foundation

Consumer staples are another sector known for their stability, delivering robust performance through all phases of the economic cycle. From 1973 to 2024, this sector outperformed the broader equity market by an average of 7.7 percentage points in the 12 months following the first rate cut - the highest among all sectors. Impressively, consumer staples are the only S&P 500 sector to consistently post positive average returns during recessions since 1960.

The reason is simple: people continue to purchase everyday essentials like food, beverages, and household items, even during economic downturns. This consistent demand makes the sector a dependable choice when rising interest rates or slowing growth create uncertainty. In fact, during economic slowdowns, consumer staples have delivered average returns of 15% over the analyzed period, outperforming most other sectors.

The table below highlights the consistent outperformance of these sectors:

Consumer staples companies also benefit from their pricing power. When inflation rises, they can often pass increased costs on to consumers without significantly impacting demand. Additionally, their moderate debt levels - supported by stable and recurring revenues - help shield them from the challenges faced by more leveraged sectors when borrowing costs climb.

For investors aiming to protect their portfolios during uncertain times, allocating funds to healthcare and consumer staples offers a solid defensive strategy. These sectors’ lower sensitivity to interest rate changes ensures steady returns and dividends, even when other parts of the market are under pressure from shifting monetary policies.

Rate Cuts vs. Rate Increases: How Sectors Respond

Interest rate changes have a major impact on how different sectors perform, making it essential for investors to adjust their strategies based on the environment.

Performance During Rate Cuts

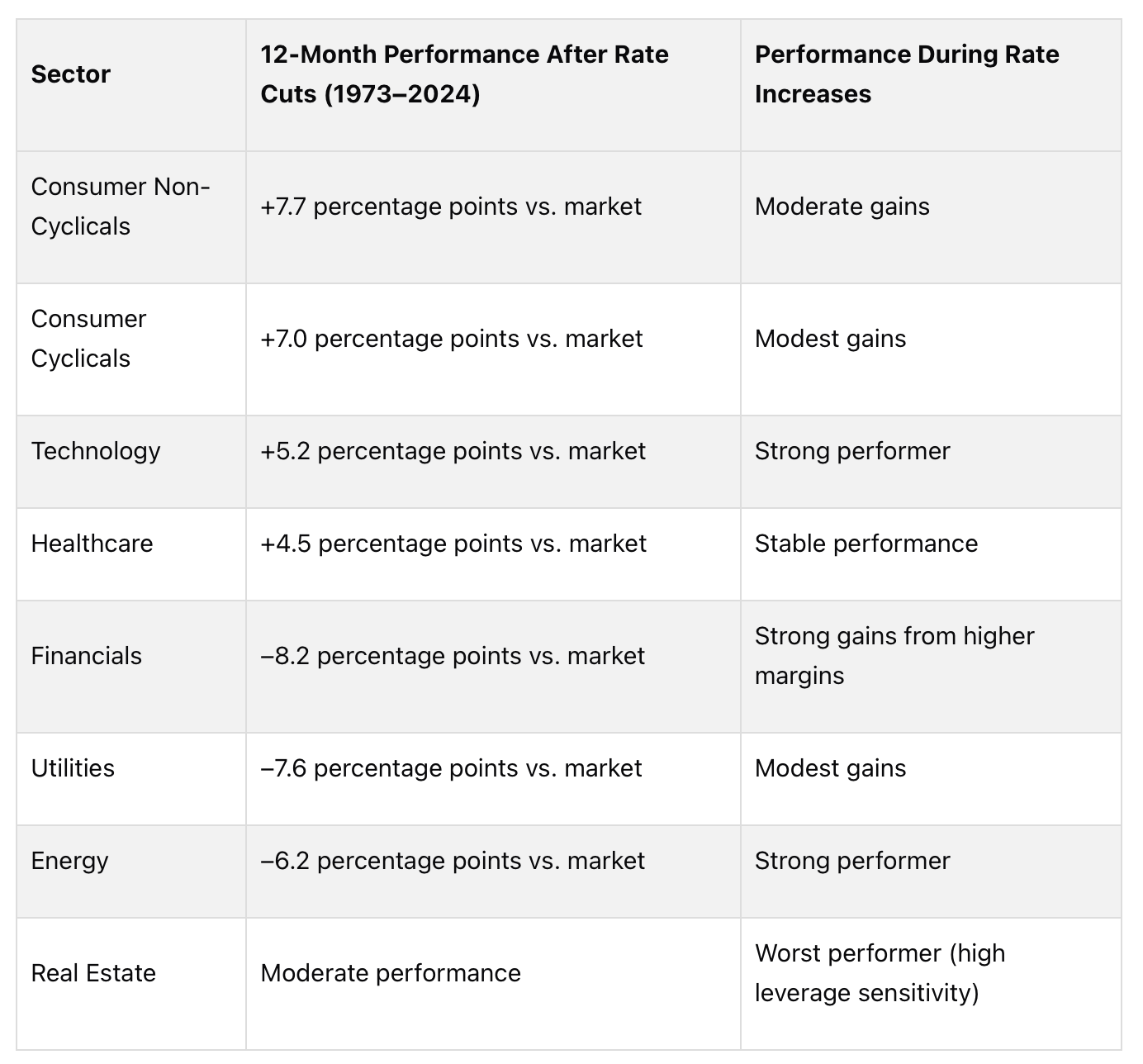

When the Federal Reserve lowers interest rates, growth-focused sectors tend to thrive. Between 1973 and 2024, consumer non-cyclicals outperformed the market by 7.7 percentage points, while consumer cyclicals gained 7.0 points. Even technology stocks, which often stumble initially, saw an average increase of 5.2 percentage points within a year of rate cuts. Why? Lower borrowing costs reduce expenses for companies and increase the value of future earnings, which encourages consumer spending and drives growth. A great example of this was the 2009–2015 period, where aggressive rate cuts and quantitative easing fueled a rally in technology and discretionary stocks.

However, not all sectors benefit. Financials lagged significantly, underperforming by 8.2 percentage points during these periods. Lower rates squeeze net interest margins, raising concerns about loan growth and credit quality. Similarly, utilities and energy sectors trailed the market by 7.6 and 6.2 percentage points, respectively.

These patterns stand in stark contrast to how sectors perform during rate hikes.

Performance During Rate Increases

When rates rise, the spotlight shifts to other sectors. Historically, rising interest rates have been linked to periods of economic growth, with the S&P 500 averaging a 20% gain during such times since 1971. For example, during the 2022 rate hike cycle, banks saw a 17.9% increase in net interest income as a result of a 425 basis point rise in rates, while real estate struggled due to higher financing costs.

Rapid rate hikes - those exceeding 60 basis points in a month - can lead to swift sector repricing, hitting growth and rate-sensitive areas the hardest. The reasons behind rate changes also matter. If rising bond yields are tied to stronger economic growth expectations, stocks across sectors often climb. On the other hand, when rates rise due to inflation concerns or fiscal issues, sectors may face more challenges. For instance, in April and early May 2024, improved growth expectations lifted stocks and bond yields simultaneously, showing how sector responses can vary based on context.

In 2024–2025, sectors like communication services, IT, and utilities posted year-to-date gains exceeding 20%. Interestingly, utilities benefited from increased power demand tied to data center expansion, rather than traditional rate-related factors. Meanwhile, healthcare and consumer staples lagged behind.

Here’s a breakdown of how sectors have historically performed in these two rate environments:

These trends highlight the importance of adjusting investment portfolios ahead of monetary policy shifts. During rate cuts, focusing on consumer-facing and technology sectors can position portfolios for growth as borrowing costs decline. On the other hand, rising rates often favor sectors like financials and energy, while highly leveraged areas like real estate may require extra caution. Knowing how sectors react to rate changes can help investors stay ahead of the curve and make more informed allocation decisions.

Using Macroeconomic Indicators to Anticipate Sector Trends

Understanding how interest rates influence different sectors is just one piece of the puzzle. To stay ahead, it’s crucial to track key macroeconomic indicators. These indicators work hand-in-hand with earlier insights into sector sensitivities, offering a broader perspective.

Key Indicators: Bond Yields, Inflation, and Treasury Rates

The 10-year Treasury yield serves as a critical benchmark for assessing sector performance. When this yield rises above historical norms, sectors like financials tend to benefit, while rate-sensitive areas like utilities and real estate investment trusts (REITs) often feel the squeeze. On the flip side, a sharp drop in yields often signals potential rate cuts, creating favorable conditions for growth stocks, technology, and consumer discretionary sectors.

The yield curve provides additional clues. It reflects the relationship between short-term and long-term Treasury rates and reveals market expectations. A steepening yield curve - where long-term rates rise faster than short-term ones - usually benefits cyclical sectors like financials and industrials. Banks, in particular, thrive in this environment as they borrow at lower short-term rates and lend at higher long-term rates, increasing their profit margins. However, when the curve flattens or inverts (short-term rates exceed long-term rates), it often signals an impending economic slowdown. For instance, the 2022 yield curve inversion, where the two-year yield surpassed the ten-year yield by the widest margin since 1981, foreshadowed the uncertainty that followed. When this pattern appears, defensive sectors like consumer staples and healthcare often become more attractive.

Inflation data also plays a pivotal role in shaping Federal Reserve policy. The Fed aims for 2% inflation, so when measures like the Consumer Price Index (CPI) or Producer Price Index (PPI) show inflation climbing above this target, rate hikes typically follow. During the 2022 rate-hiking cycle, the Fed raised rates by 425 basis points - the fastest pace since the early 1980s - in response to high inflation. This aggressive approach pushed the 10-year Treasury yield from 1.63% to 3.88%, driving a 17.9% year-over-year increase in median net interest income for banks by early 2023.

Lower inflation, however, signals a potential reversal. Falling inflation often prompts rate cuts, benefiting growth-focused sectors like technology and consumer discretionary. Energy stocks are also sensitive to inflation trends, as higher inflation often aligns with rising oil prices, boosting valuations in the energy sector.

Practical thresholds can help guide decisions. For example:

When the 10-year Treasury yield climbs above 3.5%–4.0%, consider reducing exposure to utilities and REITs.

When yields drop below 2.5%, these sectors may regain appeal as bonds offer less competition for income-seeking investors.

The dividend yield spread between stocks and bonds also provides valuable insights. When utility stock dividend yields dip below Treasury yields, utilities become less appealing compared to bonds. Conversely, when stock dividend yields significantly outpace Treasury yields, it may indicate that bonds are undervalued and stocks could face challenges.

These indicators are directly tied to the sector-specific strategies discussed earlier.

Practical Tools for Monitoring Sector Trends

Several free resources make it easier to track these macroeconomic indicators. For instance:

The U.S. Treasury Department website provides real-time data on 10-year and 2-year Treasury yields.

The Bureau of Labor Statistics releases monthly CPI and PPI data, usually mid-month for the prior month.

The Federal Reserve’s website offers FOMC statements, economic projections, and policy updates that are invaluable for timing sector rotations.

Financial platforms like Bloomberg, Yahoo Finance, and MarketWatch also offer sector performance dashboards, allowing you to compare sector returns against interest rate trends. These tools help identify patterns as they emerge rather than after the fact.

Establishing a regular monitoring routine is key. Check Treasury yields weekly to spot early trends. Review inflation data monthly when new figures are released. Pay close attention to Federal Reserve communications immediately following FOMC meetings, as these often provide early signals for sector adjustments months before rate changes take effect.

The Fed’s “dot plot”, which shows individual policymakers’ rate expectations, and forward guidance are particularly useful. Dovish guidance (indicating lower rates ahead) supports sectors like technology and consumer discretionary, while hawkish guidance (suggesting higher rates) favors financials and energy. For example, when the Fed signals rate hikes, financials tend to benefit from higher lending rates, while utilities and REITs face challenges due to increased refinancing costs. Conversely, when rate cuts are on the horizon, growth stocks and emerging markets often see gains as lower borrowing costs encourage investment and risk-taking.

For a more in-depth approach, consider specialized resources. The Predictive Investor (https://thepredictiveinvestor.com) is a newsletter that combines macroeconomic analysis with sector-specific recommendations. Written by a Silicon Valley veteran, it focuses on identifying high-growth, lesser-known stocks while factoring in macroeconomic conditions. With a track record of outperforming the S&P 500, it offers disciplined, actionable insights for investors seeking clarity and long-term success.

The secret to successful sector rotation lies in acting before the broader market catches on. By the time headlines highlight sector shifts, much of the opportunity has already passed. Regularly monitoring Treasury yields, inflation data, and Fed communications can help you position your portfolio ahead of the curve.

Conclusion

Interest rates consistently impact how different sectors perform, and historical data spanning 1973 to 2024 highlights patterns that investors can leverage to refine their strategies. For instance, rising rates often boost financials and energy, while sectors like utilities, REITs, and consumer discretionary tend to struggle. On the flip side, falling rates typically favor consumer non-cyclicals and consumer cyclicals, driving their market leadership.

Understanding these trends allows investors to make timely portfolio adjustments in anticipation of sector shifts. To do this effectively, it’s essential to combine macroeconomic insights with solid fundamental analysis. Keeping an eye on Treasury yields and inflation, as discussed earlier, can help investors predict changes and align their portfolios accordingly. Companies with strong balance sheets and competitive advantages are particularly well-suited to weather varied rate environments.

A diversified strategy remains key to managing rate-driven market fluctuations. Defensive sectors like consumer staples and healthcare have historically provided stability during economic slowdowns. For example, consumer staples delivered an average return of 15% during slowdown phases and stand out as the only S&P 500 sector to consistently post positive returns during recessions since 1960. Meanwhile, technology has shown resilience, supported by large cash reserves and growing interest in AI-related investments. By spreading investments across sectors with varying sensitivities to interest rates, investors can build a portfolio capable of navigating diverse economic conditions without needing to perfectly time rate changes.

Rather than attempting to predict precise rate movements, investors should focus on creating adaptable portfolios that respond to evolving conditions. By tracking key indicators, recognizing historical sector trends, and making data-driven decisions, investors can better navigate market cycles and seize opportunities through thoughtful sector positioning.

FAQs

How do rising interest rates affect the financial sector compared to others?

Rising interest rates often bring a boost to the financial sector, particularly banks. Why? Higher rates allow them to charge more on loans, which directly widens their profit margins. On the flip side, sectors like real estate and utilities can feel the pinch. With borrowing costs climbing, growth may slow, and profitability can take a hit.

Take banks, for instance - they usually enjoy increased revenue from loans during these times. Meanwhile, industries that rely heavily on debt, such as construction or utilities, might face headwinds, as higher rates make financing more expensive. Recognizing these trends can help investors spot both opportunities and potential risks in various sectors when interest rates shift.

Why do the consumer staples and healthcare sectors tend to remain steady during interest rate changes?

Consumer staples and healthcare are often labeled as defensive sectors because they provide products and services people rely on no matter the state of the economy or shifts in interest rates. Essentials like food, household items, and medical care remain in demand, whether times are tough or thriving.

What sets these sectors apart is their steady and predictable revenue. This consistency makes them less vulnerable to the ups and downs of economic cycles. For investors, this reliability can offer a sense of security, especially during periods of market turbulence driven by fluctuating interest rates.

What economic indicators can help investors predict how interest rate changes might impact different sectors?

Investors aiming to predict how different sectors might perform during shifts in interest rates should pay close attention to several key economic indicators. These include inflation rates, employment figures, and GDP growth - all of which play a role in shaping the Federal Reserve’s interest rate decisions. Additionally, keeping an eye on bond yields and credit market trends can offer valuable clues about how industries like financials, real estate, and technology might react to rate changes.

For instance, when interest rates rise, banks and other financial institutions often benefit because they can earn higher margins on loans. On the other hand, sectors like utilities and real estate may struggle due to the increased cost of borrowing. Technology stocks, too, have historically shown sensitivity to rate hikes, as higher rates tend to lower the present value of their future earnings. By staying updated on these economic signals, investors can position themselves more effectively to handle market fluctuations and make informed decisions.